The coronavirus induced volatility has really brought the importance of portfolio diversification to the forefront of investors’ minds. Now is the perfect time to assess both the make-up of your portfolio and risk exposure within the portfolio.

This document has been prepared by FIIG Investment Strategy Group. Opinions expressed may differ from those of FIIG Credit Research.

Background

Simply put, the aim of diversification is to avoid putting all your eggs in the same basket. In the case of investing it means optimising the mix of assets in a portfolio to minimise risk and maximise returns.

Government bonds, investment grade (IG) bonds, high yield (HY) bonds, shares, hybrids, property, commodities and cash are all examples of different asset classes. Each of these assets has a varying degree of volatility, which means their price movement (the quantum and direction) in reaction to an event is different.

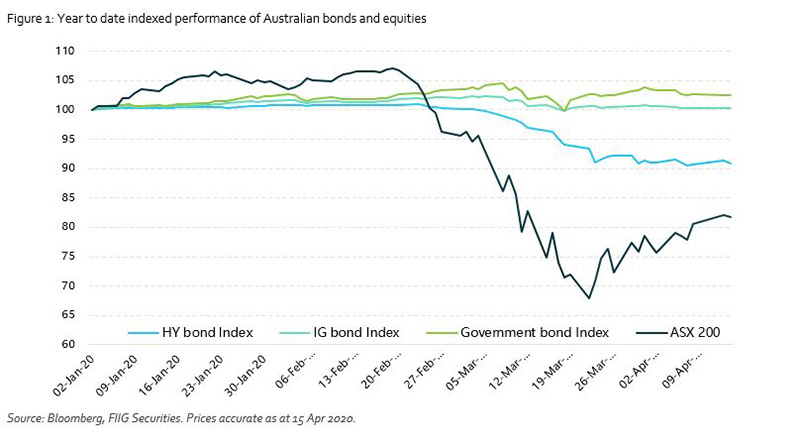

The chart below illustrates the year to date indexed performance of the first four asset classes mentioned above in the Australian context. Whilst the general directional movement of these asset classes has been similar, the quantum of price falls and hence volatility varies quite significantly.

Performance of equities until mid-February was stellar, however this asset class has been hit very hard due to the widespread economic slowdown. This downturn is even more pronounced when we look at this performance over a longer horizon.

Diversification in practice

Many investors would be familiar with the concept of an efficient frontier, which shows the relationship between incremental risk and return. Below is an illustration of this relationship.

Investing in a 100% equity portfolio offers high return but also has high risk associated with it. This risk reduces as you start to add bonds to this portfolio, and this incremental reduction in risk outweighs the reduction in return.

According to the latest OECD data most countries have a greater preference for bonds over equities in pension portfolios, with Australia being one of the exceptions, where equities (43.7% of overall allocation) outweigh bond investments (16.4% of overall allocation) in pension funds.

For years we have been advocating the inclusion of various asset classes in investment portfolios. The risk of investing primarily in one asset class such as shares for capital gains, high dividend income and the associated franking credits has been exposed again over recent weeks as numerous companies, including banks, reassess their earnings outlook and dividend policies. Dividends are discretionary, unlike coupons paid on bonds.

Similarly, investing primarily in high yield bonds for their higher coupons is also not appropriate given the risk associated with these issuers.

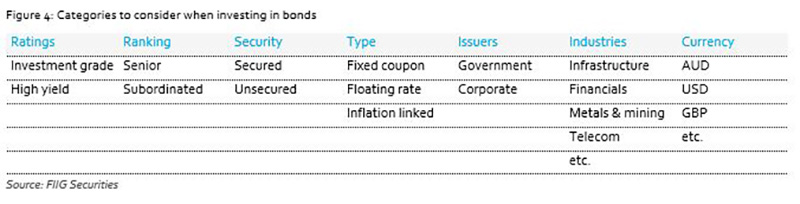

Diversification is vital within a single asset class as well, such as a bond portfolio. This can be achieved by holding a mix of bonds across the various categories highlighted in the table below. This list is by no means exhaustive, there are also other factors such as maturity profile that should be considered when building a portfolio.

Current opportunites

The recent market correction and extreme volatility have again highlighted the importance of diversification.

Open an account with FIIG in less than 5 minutes

Diversification across asset classes is a key consideration for all investors to understand and implement for their own protection. Equally, diversification within a single asset class is also an essential element of protecting investment returns. Price moves and dislocation across asset classes during this time provides an ideal opportunity to assess portfolios and make adjustments at both an asset class and individual investment level.

At present there are a number of bonds trading at either dislocated prices or with strong relative value, presenting an opportunity for existing and new bond investors to diversify their investments.

In investment grade bonds we are seeing opportunistic trading in bank sub debt issued by NAB as well as Bendigo and Adelaide Bank, Sydney Airport 2020 and 2030 inflation linked bonds, Queensland Treasury Corp 2033 bonds, super senior tranches of RMBS and short dated Qantas bonds.

In high yield, there are opportunities in bonds issued by corporates with strong liquidity on balance sheets or those in industries less affected by Covid-19 shutdowns such as Plenary, NEXTDC, Omni Bridgeway (formerly IMF Bentham), Maurice Blackburn, Barminco and Ford Motor Credit Corp.

Please contact your Relationship Manager or myself to discuss this report or any of these specific opportunities.

OECD Global pension statistics