Investors who have sufficient income and who are more focused towards capital growth may dismiss Indexed Annuity Bonds (IABs) as a product only for retirees who need to generate a high income. However, given the substantial value that they currently offer, IABs can benefit all portfolios.

IABs work like an inflation protected mortgage that is being repaid to you, where both principal and interest are indexed to CPI and paid at each preset payment date over the life of the bond. Additionally, the annuity sector is where the strongest investment grade credits are available at the best levels.

Some investors, however, view the return of capital as unnecessary and a potential reinvestment risk. Since term deposit rates have continued to fall over the past few years, many investors have experienced reinvestment risk where every time a term deposit matures, the rate offered to roll that term deposit is lower and lower each time. In a downward interest rate environment, it makes sense to lock funds away for longer.

However in a more neutral environment, the return of principal offers investors flexibility to reinvest their funds towards other opportunities while maintaining a fixed return above inflation.

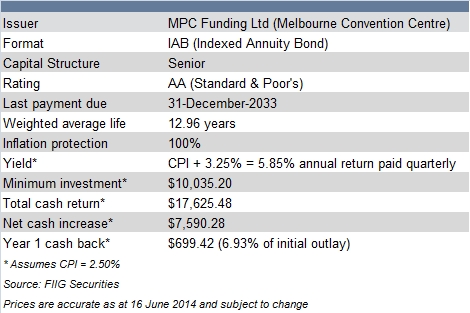

One of the strongest credits is MPC Funding (Melbourne Convention Centre).

The project is now in the low risk operational stage with 98% of revenues coming from the State Government of Victoria. MPC Funding can be traded in parcel sizes of $10,000. Based on this an initial investment of $10,035.20 will provide a 5.85% annual return, paid quarterly.

MPC is available to wholesale clients only and has a AA credit rating from Standard and Poor’s which is higher than almost all of corporate Australia, including senior bonds issued by the big four Australian banks.