Gold has been a hedge against risk for thousands of years. And while it is effective more often than not, as far as income production goes, it offers nothing. But for Australian investors, there is a gold investment that can also provide income; the corporate bonds of gold producers

Gold has been used throughout history as a form of money and as a standard for assessing currencies’ relative values. The Gold Standard as this currency valuation benchmark was called was only dropped in the US from 1971 to as late as 2000 in Switzerland.

Like all other commodities, its value is set on supply and demand, but unlike other commodities its demand is driven by investor sentiment, not consumption. Almost all of the gold ever mined is still in existence totalling around 160,000 tonnes, meaning that its price is not driven by annual supply which is only 2,500 tonnes, but rather by the willingness of holders of gold to sell at a given price.

In recent times, the use of gold by individual investors has risen as Chinese and Indian middle classes started to hold more of their wealth in reserve in gold. China became the world’s largest “consumer” of gold in 2013.

How to invest in gold

There are three ways investors typically invest in gold:

- Direct gold investment (via physical gold, derivatives, ETFs or other structured products)

- Equities of gold producers

- Corporate bonds again, issued by gold producers

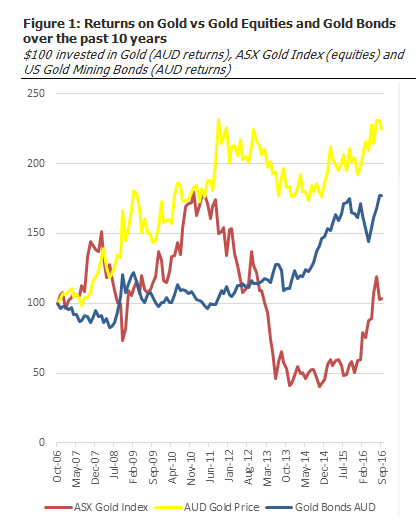

Figure 1 below compares the returns on each of these over the past ten years.

Gold producers’ share prices do not rise with the price of gold. In fact, they are negatively correlated, that is the prices actually move in opposite directions more often than not. While there is no doubt that a rising gold price is good for gold producers’ share prices, when that rising price was because fear had returned to markets, the fear driven selloff hurts the miners’ share prices more than the benefits of the higher gold price.

On the other hand, because bonds and gold are positively correlated, that is their prices tend to move in the same direction, the bonds of gold producers are a good proxy for investing in gold. Gold producers’ bonds will not rise (or fall) as much as the gold price does, but the potential lower gains are compensated by something that investing in gold does not offer – income.

On the other hand, because bonds and gold are positively correlated, that is their prices tend to move in the same direction, the bonds of gold producers are a good proxy for investing in gold. Gold producers’ bonds will not rise (or fall) as much as the gold price does, but the potential lower gains are compensated by something that investing in gold does not offer – income.

| Investment | Capital gain | Income | Total returns | Biggest fall in value |

| Gold price | 8.45%pa | 0.00%pa | 125% (8.45%pa) | 24% |

| ASX Gold Index | 0.34%pa | 0.12%pa | 5% (0.46%pa) | 77% |

| Gold corporate bonds | 0.73%pa | 5.14%pa | 77% (5.87%pa) | 17% |

Source: FIIG Securities, Bloomberg

The table in Figure 1 illustrates the point that physical gold has provided the best returns overall, but offers no income and is slightly more volatile than the bonds.

Gold producer equities on the other hand have performed in line with equity markets overall, poorly, and unlike other equity sectors, offers very little in the way of income.

Gold producer bonds have benefited from both the rise in the price of gold and for fixed rate bonds also lower yields as markets shifted to the new “lower for longer” environment.

Importantly, corporate bonds in gold companies have moved in the opposite direction to equities, particularly Australian equities.

As Australians typically have a large allocation to equities, gold producers’ bonds make an ideal hedge.

Unique relationship between the AUD and gold producers’ bonds

When markets get nervous, the flight to safety and away from risk tends to result in:

- An increase in the price of gold

- An increase in the price of bonds (fall in bond yields), particularly fixed rate bonds

- A fall in the price of equities

- A fall in the AUD (considered a “growth” currency)

This means that the AUD value of gold producers’ corporate bonds, which are mostly in USD, benefit from rising gold and bond prices, and the rise in the value of the USD as the AUD falls. This is why gold producers’ corporate bonds make such a great hedge.

Gold corporate bonds in the post QE period

As shown in Figure 1, the price of gold in AUD has again achieved its 2011 peak price. This is due to the combined effect of the fall in the USD gold price from a peak of USD1,861 in September 2011 to its current price of USD1,324 (down 29%) with the fall in the value of the AUD from $1.07 to $0.76 (also down 29%).

In the same time, the ASX Gold Index (index of ASX listed gold producers’ share prices) has fallen by 41%, led by the largest Australian gold miner, Newcrest, which is down 47%.

Gold producers’ corporate bonds have risen in that time, up 72%.

Conclusion

For Australian investors looking to invest in gold as a hedge in an increasingly uncertain economic environment and one with increasingly inflated equity markets, gold producers’ corporate bonds make for a great option. Yield to worst on Newcrest, Kinross and IAMGOLD bonds range from 3.15%pa* to 6.66%pa*, with income from 3.97%pa to 6.74%pa. These are all in USD, creating the hedge effect discussed above.

*The yield to worst (YTW) is the lowest yield an investor can expect when investing in a callable bond. Indicative as of 4 October 2016 but subject to change.