Donald Trump’s inauguration speech was full of rhetoric but completely lacking any policy details. Is Trump all talk and no trousers? Investors will find out over the next few weeks

As expected, during Donald Trump’s inauguration speech – that was actually well delivered to its target audience – his populist and nationalistic election campaign chatter was back, with the focus on returning power to the people.

Trump stated, “What truly matters is not which party controls our government, but whether our government is controlled by the people. January 20th, 2017, will be remembered as the day the people became the rulers of this nation again. The forgotten men and women of our country will be forgotten no longer.”

Trump later said, “From this day forward, it's going to be only America first. America first. Every decision on trade, on taxes, on immigration, on foreign affairs will be made to benefit American workers and American families.”

He also returned to his rally cry of, “And, yes, together, we will make America great again.”

Despite Trump’s usual bravado he only had one comment on immigration, which was to “bring back our borders.” I’m not sure I agree with this but Trump added, “protection will lead to great prosperity and strength.” In this regard, Trump has already used his executive powers to pull out of the Trans Pacific Partnership (TPP) and has signed an order to renegotiate the North American Free Trade Agreement (NAFTA).

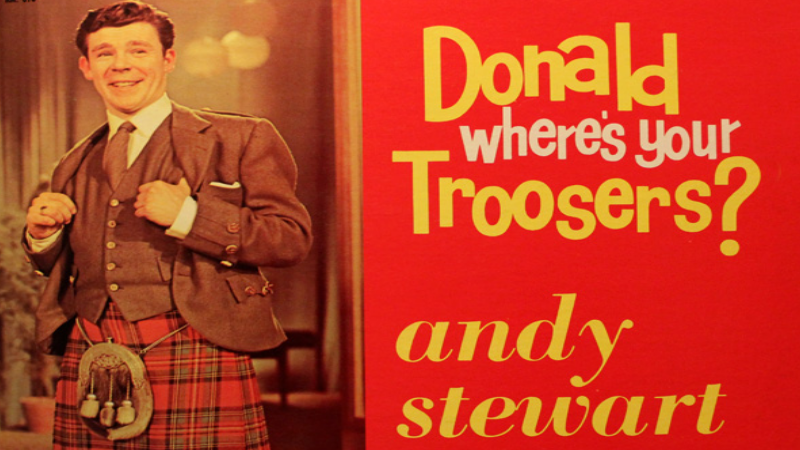

For those that remember the song ‘Donald where’s your troosers’, I don’t think that Andy Stewart was talking about the incoming President, Donald Trump. However, as Trump said, “The time for empty talk is over. Now arrives the hour of action.”

Investors are hoping for some concrete policy actions over the coming weeks or there are plenty that will be disappointed. If there are few clues about fiscal spending or tax cuts, then the Trump rally, which is already starting to show signs of fading, could rapidly disappear.

At the moment, equity markets appear to be flying blind on a wing and a prayer. Given future volatility in financial markets appears to be a given, once again I urge investors to address their portfolios from a risk perspective to check they are comfortable with the asset allocation.