Benign inflation has frustrated central bankers around the world with its stubborn resistance to monetary stimulation. In Australia, inflation remains very low by historic standards, largely due to low wage growth. In this article we forecast inflation in Australia for the next 12 months, and look at two opposing shocks to CPI – tobacco and electricity prices

Over the next six months, Australian inflation is going to be particularly volatile for two reasons:

- Higher electricity prices on the 3Q17 CPI release

- Reduced weight given to tobacco from the 4Q17 CPI release

What has been driving inflation?

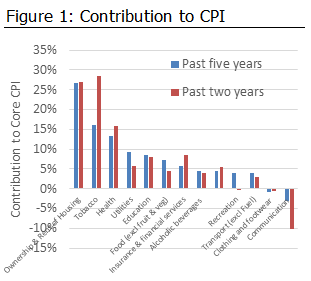

For the past five years, core* inflation has been driven by housing costs (whether ownership or rent), tobacco prices, health, utilities, education and food* costs, as shown in Figure 1. In the past two years, there have only been two categories that have materially increased their total contribution to CPI - tobacco and insurance.

For the past five years, core* inflation has been driven by housing costs (whether ownership or rent), tobacco prices, health, utilities, education and food* costs, as shown in Figure 1. In the past two years, there have only been two categories that have materially increased their total contribution to CPI - tobacco and insurance.

All other categories have been shrinking:

- Health cost inflation has barely changed, contributing a greater percentage because CPI has fallen

- Utility cost inflation spiked in September 2012 due to shock rises in electricity and gas prices. Since then, utility prices have risen in line with CPI until the March 2017 quarter when the latest energy supply issues took effect

- Previous high inflation in beef prices has dissipated over the last two years, reducing food’s contribution to inflation

*We use core inflation measure because that is what the RBA focusses on. Core inflation excludes automotive fuel and fruit and vegetable prices due to their tendency to be very volatile month to month yet rise with inflation over the long term.

What can we expect in the coming 12 months?

While inflation is difficult to predict, if we break it up into the components used in Figure 1, we can make a more considered forecast. As shown below, the net impact of tobacco’s lower contribution and sharply higher electricity prices is a small rise in core inflation to 1.79% per annum.

Headline inflation will spike in June 2017 due to the impact of Cyclone Debbie, but with oil prices remaining rangebound, it should then fall in line with core inflation from the September quarter, saving for other one off weather or oil price shocks.

| Component | Average contribution (bps) in the past two years | Outlook | Forecast contribution in the next 12 months |

| Tobacco | 47bps | Share of the CPI basket will be revised as of December 2017 quarter. While the new weights have not been released, based on expenditure estimates from the GDP data releases, the basket weight will likely fall by around 50%. | 23bps |

| Housing | 44bps | Housing has been a consistent contributor. Rents contribution declined significantly in the past two years as supply has caught up to demand, knocking around 10bps off the total contribution from housing. This is expected to continue due to rapidly rising supply in Sydney. House prices are expected to slow their ascent in the coming months, so we are forecasting a 6bps lower contribution from the owner occupied component, bringing the total figure for housing down slightly to 38bps.

There is some risk in this figure as the ABS started to include apartment prices in this measure, and they are using a cost up approach where developer margin is around 20-25% of the total. If oversupply becomes an even more significant issue in the next 12 months, this could create downward pressure on Housing’s contribution. | 38bps |

| Health | 26bps | Health’s contribution has slipped slightly over the past few years from a high of 39bps to a low of 14bps. Rising hospital service costs are offset by lower pharmaceutical costs due to changes to the PBS. So, we predict no change at 26bps over the year. Note, hospital costs typically rise sharply in the June quarter and then stay flat for the next two quarters.

| 26bps |

| Utilities | 10bps | Major change expected. Enough electricity price changes are now known to predict a 16% jump for the average consumer. This will impact the 3Q17 CPI result, pushing it up by around 42bps. Higher utility costs would normally mean higher prices for manufactured goods and some services too, but price pressure is very high and so we think this secondary effect will be very minor.

| 52bps |

| Education | 13bps | No change expected (seasonality means that all of education’s contribution comes in 1Q results)

| 13bps |

| Food (excl. fruit & veg) | 8bps | 2Q’s headline inflation will include around 39bps in contribution from the Cyclone Debbie impact on fruit and veg prices. But the core inflation figure will not be impacted, nor do we expect any change to food price contribution to CPI over the coming year. The key contributor to slow inflation in food prices has been the intense competition between Coles, Woolworths and Aldi which is expected to continue.

| 8bps |

| Insurance | 14bps | Insurance costs have been rising well above their historic averages in recent years. There is typically a jump in the 3Q period, but over the course of a year we expect a slight decline, still above long term averages but moderating.

| 10bps |

| Alcoholic beverages | 7bps | No new taxes are on the horizon, and as this is the major driver of contribution, no change forecast.

| 7bps |

| Furnishings | 9bps | Furnishings tend to be closely linked to currency as they are largely imported. If the AUD holds on to its gains, this would cause deflationary pressure. We have assumed the AUD will slip so that the contribution will remain at 9bps.

| 9bps |

| Recreation | 0bps | The next two CPI readings will include low contributions from recreation due to the volatile tourism figures. Domestic tourism prices remain depressed through winter months due to discounting, and the international tourism prices will also face downward pressure due to the higher AUD, particularly in early 3Q. After that period, we expect holiday prices to return to their longer term average, albeit slightly lower due to low wage growth and high household debt. The main driver in the fall of recreation costs over the longer term though has been the fall in the cost of audio, visual and computing equipment, part of a global trend that is not expected to change.

| 3bps |

| Transport excluding fuel | 5bps | The cost of new and used cars continues to decline globally. We have assumed that new car prices stabilise in light of recent increases in new car sales figures, bringing Transport overall back up to its longer term average of 8bps.

| 8bps |

| Clothing | -1bps | Clothing prices are also based on a global trend of falling prices. There is little reason to see this changing.

| -1bps |

| Communication | -17bps | Communication costs are falling rapidly due to jumps in technology, capacity and competition. Australia still pays far more for data than other G20 countries, so it is reasonable to expect this pace of decline to continue. The relative portion of money spent on communications has risen, but with falling prices, we expect the net effect to be a slightly lower rate of decline ahead.

| -11bps |

| Core inflation | 165bps | Despite the large increase in utility prices, the overall impact of tobacco’s lower contribution to CPI and generally depressed wage conditions is a minor increase in core CPI from an average of 1.65% per annum over the past two years to 1.79% over the next 12 months.

| 179bps |