Investors can now earn 2%-3% above an all-time low cash rate by investing in Australian investment grade corporate bonds. We highlight opportunities in recently issued ‘BBB range’ bonds

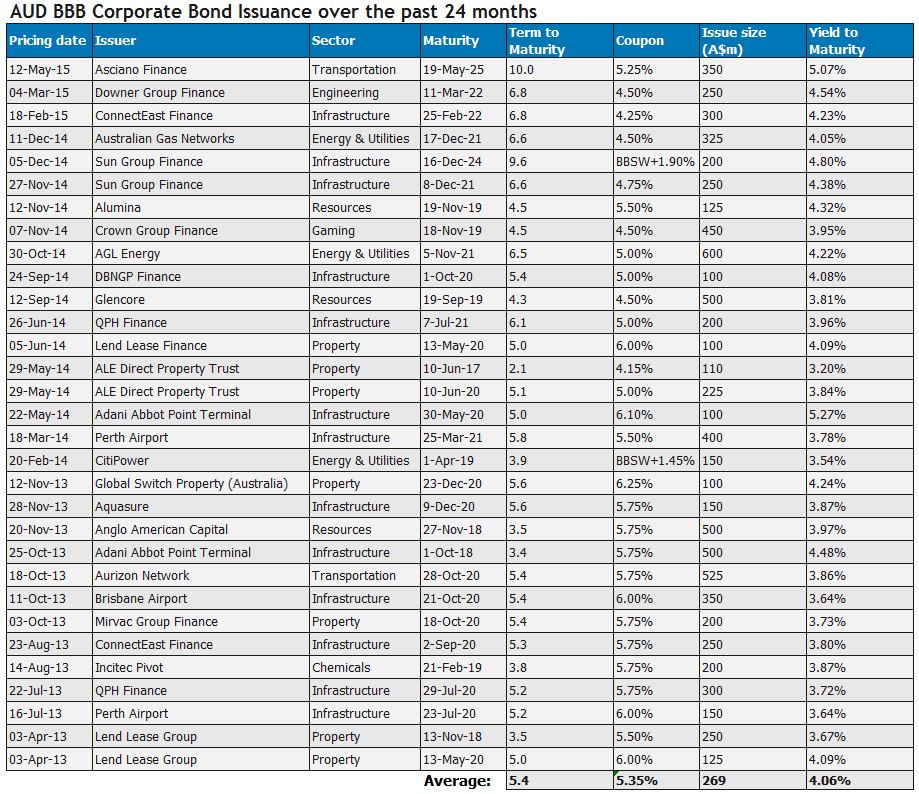

A hike in longer term bond yields coupled with a 2.00% cash rate has improved the return premium Australian investment grade corporate bonds offer over the cash rate. The average yield to maturity on 31 recently issued Australian ‘BBB range’ corporate bonds is currently 4.06% which is more than 2% higher than the cash rate (see table below). Bonds such as Adani Abbot Point and Asciano are generating even higher yields of more than 3% over the cash rate. All of the ‘BBB range’ bonds are considered relatively low credit risk being rated investment grade. With a good variety of Australian investment grade corporate bonds available, now is a worthwhile time to consider diversifying your investment portfolio through an exposure to Australian investment grade corporate bonds.

Over the past couple of years there have been multiple Australian corporate bonds issued in the ‘BBB range’, that is, rated BBB+, BBB flat and BBB-. In a sign of increasing confidence from ‘BBB’ issuers, Asciano launched a debut 10 year bond in the market last week. Such long dated issuance is rare in the Australian market and there have only been two other ten year issuances from a ‘BBB’ rated issuer in the past five years. Asciano sold AUD350m of ten year fixed rate bonds with a 5.25% coupon, priced at a credit spread of 215 basis points over swap.

The table below highlights corporate bonds rated in the ‘BBB range’ issued in the last two years. Note this list doesn’t reflect the full universe of Australian ‘BBB’ corporate bonds, of which there are many more. Also, the bonds listed are only available to wholesale investors.

Source: Kanganews, FIIG Securities

Looking at the list, the variety of Australian dollar investment grade corporate bonds available is probably greater than you initially would have thought. What we are seeing is increasing depth and a maturing Australian corporate bond market which is generally positive for investors. Investors have good optionality across both sector and maturity, both of which are important considerations in a well-diversified bond portfolio.

In the chart below, we compare the relative value of corporate bonds in this subsector. For ease of reading, we’ve highlighted only the bonds above the trendline. These are the specific bonds where we are seeing good value at the moment relative to the subsector group. Names such as Adani Abbot Point, Asciano, Downer, Alumina and Sun Group Finance particularly stand out on yield to maturity comparison. In particular, both Adani Abbot Point and Asciano are currently yielding more than 3% over the cash rate.

Source: FIIG Securities

Please note the pricing quoted above is indicative and subject to change. Please speak with your FIIG representative if you are interested in investing in Australian dollar investment grade corporate bonds.