This week the quarterly March inflation figures are due for release. We thought it timely to offer some insight into how best to manage inflation in this environment. Head of Managed Income Portfolio Service, Kieran Quaine tells us his strategy

Inflation linked bond benchmark rates rallied in the longer maturities during the December quarter, following the performance of nominal bonds.

Actual December quarter inflation, at 1.70%, confirmed yet again that actual inflation is sitting below the RBA’s low end tolerance band of 2.00%.

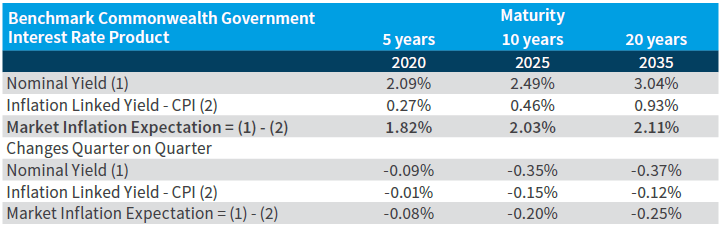

Break even inflation, or the rate of inflation required to justify holding inflation linked bonds, has fallen across the maturity profile curve as tabled below. This reflects market confidence that these short term inflation outcomes will continue in the long term.

The message is a repeat of the prior quarter: Lower global growth and commodity price declines continue to put downward pressure on prices and now the market’s expectation is for longer term inflation to track the lower end of the RBA tolerance band of 2.00% to 3.00%.

The table below shows the market’s inflation expectation at the end of March. This is calculated by taking the difference between the Australian government nominal bond and inflation linked bond yields at the various maturity points.

On the surface, the implications for portfolios invested in inflation linked bonds (ILBs), be they capital indexed bonds or indexed annuity bonds, are lower accretion rates and therefore lower returns.

That is true, however, those portfolios invested in the sector at quarter commencement, benefited from the rally, as they benefited from higher entry yields.

FIIG’s Managed Income Portfolio Service (MIPS) has taken account the backdrop of low short to medium term inflation to pursue the following strategy for our Inflation Linked Income Investment Program.

We look for economic advantage that can be extracted from two sources:

- Firstly, investing in ILB’s that offer compelling relative value.

- Secondly, investing in higher yielding medium tenor floating rate notes (FRN’s) as a substitute for ILB’s. We have invested in this strategy combined with a subordinated debt (T2) investment strategy and chosen ANZ and Members Equity subordinated debt (T2) FRN’s as the preferred assets to hold.

These two assets are also held by the MIPS Income Plus Program. At this point in time, the Portfolio Management Team’s investment strategy is to favour investments in FRN’s where compelling relative value in ILBs is not available. The current portfolio mix is 80% ILBs and 20% FRNs.

Kieran Quaine is Head of Managed Income Portfolio Service (MIPS) which provides wholesale investors day to day professional portfolio management, while retaining beneficial ownership of fixed income securities. MIPS offers three Investment Programs – Core Income, Income Plus and Inflation tailored to an investor’s risk appetite and investment goals. Kieran is based in the Sydney office and can be reached on (02) 9697 8703.