Volatility in returns is one of the key differences between bonds and shares (spoiler alert) therein lies the answer to protecting your portfolio against volatility. We demonstrate this point by assessing the performance of various market indicies and CBA securities in the wake of last month’s China stock market meltdown

A key question for investors is how do we objectively measure volatility and how can we protect investment portfolios against it?

The VIX or so-called “fear index”

The most widely used and quoted measure of volatility is the VIX index. Given the relationship between volatility and fear it is also commonly referred to as the “fear index”.

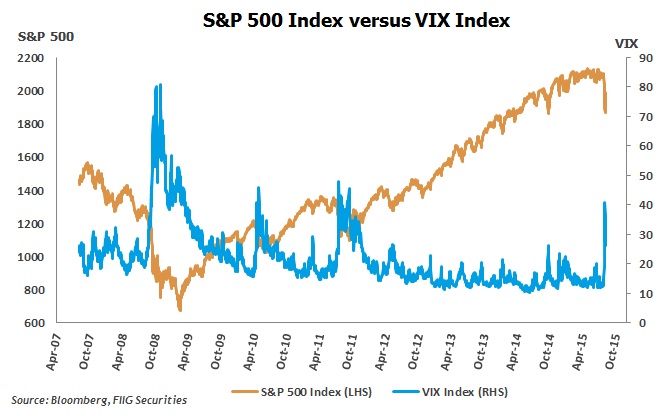

When the market expects declines in equities, the VIX rises, and rises dramatically. As Figure 1 below demonstrates, increases in the VIX (light blue line) are generally associated with declines in equities (as represented by the US S&P 500 index in orange). This was most stark in the GFC.

Figure 1

How to protect your portfolio against volatility (and falling equities)

It is the countercyclical mechanism of fixed rate bonds that provides the answer to protecting against volatility and in particular declining values from the equity portion of your portfolio.

Depending on your risk appetite and ability to withstand volatility, an allocation to bonds (particularly fixed rate bonds) will greatly reduce the overall volatility of your investment portfolio.

While we have used US data in the above, the exact same relationship occurs in Australia.

The following checklist is a useful tool for all investors. Typically speaking, a spike in the VIX will see the following trends occurring in other markets:

- Low risk appetite (“risk-off”) and a flight to quality.

- Falling equities.

- Reduction in yields (i.e. the benchmark risk free Government bond yield and swap rates).

- Increase in values of fixed rate bonds, particularly long dated bonds.

- Increase in credit spreads (which is often offset by the fall in benchmark swap rates/yield curves for fixed rate bonds).

- Greater volatility as you move down the capital structure.

- Underperformance of floating rate notes (FRNs) versus fixed rate bonds given that FRNs are impacted by higher credit spreads but also see falling base rates such as the bank bill swap rate (BBSW).

- A reduction in liquidity and wider bid-offer spreads.

CBA Case study – 17th to 24th August 2015

To show this isn’t just theory, let’s look at a recent period of volatility and analyse what occurred to various investments across the CBA capital structure (illustrated in Figure 3).

Back on 17

th August 2015, concerns over China and the surprise devaluation of the Yuan saw a meltdown in China’s stock market and a heightened period of volatility for global markets. The VIX went from a reading of 13pts on 17 August 2015 to a high of 53pts on 24 August 2015 (a massive spike as demonstrated in Figure 1 above), and the local market and CBA capital structure reacted as follows:

Australian markets 17-24 August 2015

| 17 August open | 24 August close | Change | Percentage change |

| ASX200 | 5363.80 | 5001.28 | -362.52 | -6.76% |

| 15 year government bond - price | $101.69 | $105.02 | $3.33 | 3.27% |

| 15 year government bond - yield | 3.10% | 2.81% | -0.29% | -9.57% |

| 3 month BBSW | 2.14% | 2.12% | -0.02% | -1.17% |

| 5 year swap | 2.64% | 2.42% | -0.22% | -8.66% |

| 10 year swap | 3.17% | 2.84% | -0.33% | -10.32% |

| 15 year swap | 3.43% | 3.15% | -0.28% | -8.26% |

Source: FIIG Securities, Bloomberg

Figure 2

CBA capital structure 17 - 24 August 2015

Figure 3

Using our checklist above, we now assess what the Australian bond and stock markets did, as well as the various investments available from Australia’s largest company, CBA:

1. Low risk appetite (“risk-off”) and a flight to quality – this was clearly observed with global stock markets falling and government bond prices rising across the globe. Locally, the ASX200 index fell 6.76% whereas the 15 year Australian Government bond rose 3.27%. The AUD also fell.

2. Falling equities –the ASX200 fell 6.76% and CBA shares fell 9.98%.

3. Reduction in yields (i.e. the benchmark risk free Government bond yield and swap rates) – 10 and 15 year Australia Government bond yields fell 28bps and 29bps and the 5, 10 and 15 year AUD swap rates fell 22bps, 33bps and 28bps respectively. All very significant falls in just the space of a week as the markets priced in lower yields.

4. Increase in values of fixed rate bonds, particularly long dated bonds – there is an inverse relationship between yields and price of fixed rate bonds. The 15 year Australian Government bond rose $3.33 in price. CBA have two senior bonds both with a maturity date of 18 October 2019, one fixed and one floating. The fixed rate bond increased in value by $0.79 while the FRN, which doesn’t get the benefit of the falling yields, saw a $0.11 reduction in price.

5. Increase in credit spreads (which is often offset by the fall in benchmark swap rates/yield curves for fixed rate bonds) – CBA five year credit default swaps, a proxy for credit spreads, rose 15.2bps from 71.5bps to 86.7bps. A rise in credit spreads, all other things being equal (i.e. no change in swap rates), results in a fall in bond prices. However, the five year swap rate fell 22bps, more than compensating for the credit spread rise, and the reason the fixed rate bond actually rose in price despite the wider credit spread.

6. Greater volatility as you move down the capital structure – it is clear from Figure 3 above that as we move down the CBA capital structure, both the risk and price volatility increased. CBA has a floating rate subordinated bond with a first call in May 2019. This fell $0.65 over the week and more than the senior FRN. The recently issued CBA Perls VII hybrid fell a sizeable $2.60 or 2.79%.

This demonstrates a very important point – hybrids are not defensive fixed income. Hybrids do not offset equity moves in times of stress for two important reasons: (i) they are typically floating rate so don’t get the countercyclical benefit of lower yields, and (ii) they are low in the capital structure and hence more susceptible to volatility and credit risk.

The lowest point in the capital structure, CBA shares, fell a massive 9.98%.

7. Underperformance of floating rate notes versus fixed rate bonds given that FRNs are impacted by higher credit spreads but also see falling base rates such as the bank bill swap rate (BBSW) – the rise in credit spreads (point 5 above) was more than offset by the fall in yields/swap rate used for the fixed rate bond (point 3 above) and the reason the CBA 2019 fixed rate bond rose $0.79 in price (remember the inverse relationship between fixed rate bonds and yields, with yields the sum of the swap rate and credit spread). The 2019 FRN fell $0.11 as the credit spread move is not offset by a lower swap rate. In fact, FRN investors want to see a higher benchmark rate (i.e. 3 month BBSW) but this fell, as expected, 2bps.

The higher the quality and longer the maturity (or “duration”), the greater the price rise will be for fixed rate bonds. This is clearly demonstrated by the $3.33 rise in the 15 year Australian Government bond versus the $0.79 rise for the CBA 2019 fixed rate senior bond with just four years to maturity.

8. A reduction in liquidity and wider bid-offer spreads – this was observed across all markets.

Every single point in our checklist behaved as expected and in many regards answers the question, “Why own bonds?”

A portfolio that has a mix of shares and high quality fixed rate bonds would have seen significantly less volatility and reduction in value. It is the countercyclical nature of high quality, fixed rate bonds that is the key reason as to why investors should have bonds in their investment portfolios.