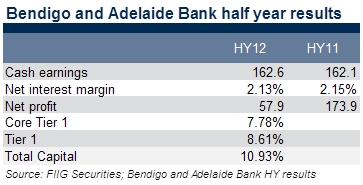

Bendigo reported a solid if unspectacular result for the half year to 31 December 2011 with underlying cash earnings flat at $162.6m, compared to $162.1m for the half year to December 2010. The statutory profit result was significantly hindered by the $95.1m write-down in intangibles announced in December 2011.

The write-down results from the company’s margin lending business which has seen significantly lower volumes in line with the continuing depressed equity markets, the key driver of margin lending volumes.

The bank reported continued slow demand for credit in the market which helped limit the effects of funding cost pressures, with the bank winding back lending in the second quarter. Funding cost pressures persist with ongoing competitiveness in the term deposit market (77% of Bendigo funding is supplied by the deposit market) as well as higher costs continuing in the bond markets. Management noted that they expect to see some easing in this pressure over the second half.

Bendigo recently increased their mortgage rates by 15bps (out of step with the RBA movement, or lack thereof) to help return the mortgage writing business to profitability. This increase was higher than the increase by the “Big 4” major banks.

Whilst there was a slight uptick in arrears at the end of the half, provisions remain relatively low and Bendigo enjoys a strong mortgage book with an average LVR of 61.8%.

The bank remains well capitalised, and its’ significant, and ‘sticky’ deposit funding model has helped drive the credit rating upgrade Bendigo achieved late last year from S&P.