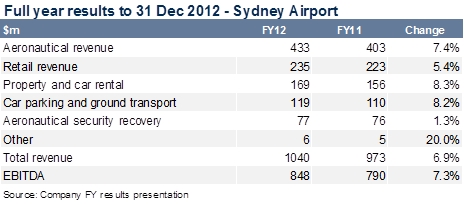

Sydney Airport reported a solid result with revenues up around 7% and growth in all major revenue streams, whilst tight cost controls across the group resulted in a 7.4% increase in EBITDA. This EBITDA growth continued the company’s trend of EBITDA growth outstripping passenger number growth (of 3.6%)

The airport delivered particularly strong growth in international passengers, up 5.6% (compared to domestic passenger numbers which grew 2.7%) with the key driver of international volumes being the introduction of new international low cost carriers and seat capacity and load factor increases. Inbound passenger numbers were particularly strong from Asian destinations including China, Malaysia, Singapore, Japan and India. This was despite the continuing high Australian dollar.

Debt management

During the year the company raised $1.1bn in new debt facilities (which were oversubscribed) with all 2013 maturities completed well in advance of actual maturity, as has been the habit of Sydney Airport’s management. The new funding included $300m of bank debt and a US$825m US private placement.

Following the refinancing in 2012 the airport has extended its average debt maturity to 2021 and maintains a strong liquidity position with $1.3bn in cash and undrawn facilities giving the company considerable financial flexibility to fund future capex. With the recent refinancing, and in particular the removal of expensive hybrid debt (i.e. the ASX listed SKIES), the debt service coverage ratio of Sydney Airport continues to improve, to 2.15x compared to 1.71x in the previous year.

ATO Position Paper

The company noted during their full year results presentation (and it has been reported in the press) that the company is subject to an ATO Position Paper relating to the deductibility of some distributions paid on redeemable preference shares (i.e. SKIES). The issue is not Sydney Airport specific (ie it would be applied to other companies as well) and no tax assessment amendment has been made. Regardless, the press release specifically notes that the issue does not affect the operating companies (Southern Cross Airports Corp. Holdings and its subsidiaries), which are the companies which issue the senior bonds. The issue is related to the listed entity, and is one of the benefits of holding infrastructure bonds at the ‘asset’ level. I only include this note on the ATO paper as we have had some calls from concerned investors, however this remains a ‘shareholder’ issue rather than a ‘bondholder’ issue.