The acquisition of this key Brisbane infrastructure asset will strengthen Transurban’s market position in the Brisbane toll road network. As part of the acquisition Transurban has also announced a $1.025bn equity raising to partially fund the acquisition. We believe the acquisition is credit positive for bondholders

Transurban Queensland (‘TQ’, formerly Sun Group) has reached an agreement to acquire the AirportlinkM7 toll road for $1.87bn, plus stamp duty of $108m and transaction costs of $23m. AirportlinkM7 is a quality urban tunnel completed in July 2012, connecting Brisbane Airport and the Australia TradeCoast with the CBD, Brisbane’s northern, southern and western suburbs. TQ has acquired the asset for 51% of the original build cost, and post-acquisition will own and operate six assets in Queensland, including three assets adjacent to AirportlinkM7. The acquisition is expected to close in the first quarter of 2016.

We believe the acquisition if it completes will be credit positive for TQ bondholders for the following reasons:

- AirportlinkM7 is a quality urban asset with observed traffic history and substantial additional capacity. The asset is performing well and Transurban have seen earnings lift following key developments in recent months including: the opening of Legacy Way and in July 2015, the end of the discount period for the AirportlinkM7 toll

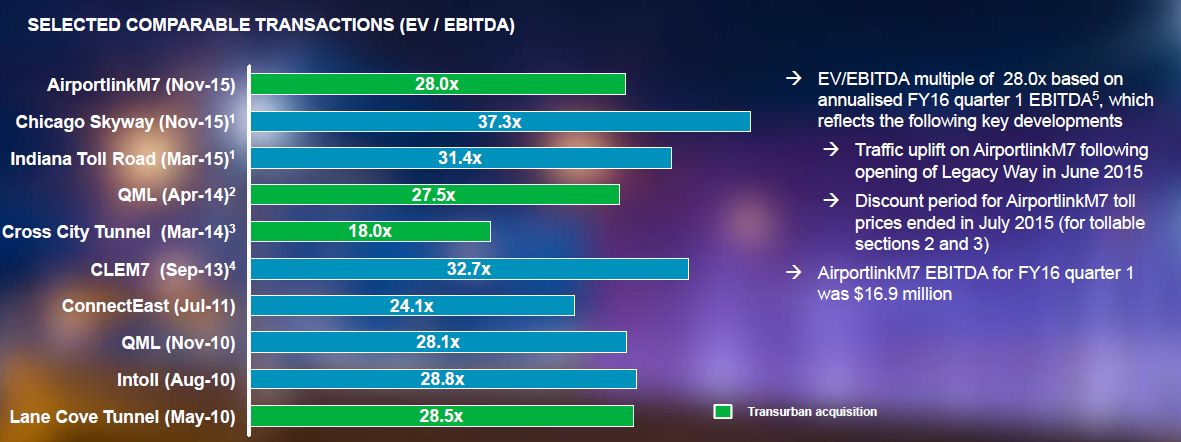

- The acquisition was completed without a competitive bid process, highlighting the fact that the market expected Transurban to be the natural buyer of the asset given its existing Brisbane toll road portfolio. The acquisition multiple is similar to the Queensland Motorways deal last year (28.0x enterprise value (EV)/EBITDA versus 27.5x EV/EBITDA), despite clear evidence that toll road acquisition multiples have increased over the past year. The figure below shows comparable acquisition multiples for a variety of toll road deals:

Source: Transurban company presentation

- With the inclusion of AirportlinkM7 into its portfolio, TQ bondholders now have the benefit of an even stronger position within the Brisbane toll road network. Further, the adjacency of the various toll roads provides operational synergies. Transurban expects to achieve EBITDA margin enhancement through integration with the broader Transurban network following this acquisition. Tolls escalate each year with Brisbane CPI providing a baseline level of growth. According to Transurban, recent upgrades to the network including Legacy Way and increases to toll prices have substantially increased the earnings profile of AirportlinkM7 from 1 July 2015

-

Proposed financing is 47/53 ratio of debt and equity, which is broadly in line with the gearing on the Queensland Motorways acquisition. Transurban’s strong investment grade credit metrics have been maintained following the acquisition of AirportlinkM7 and completion of the equity raising

While AirportlinkM7 previously went into receivership as a result of initial overestimates of traffic forecasts, the acquisition value of around $2bn is reflective of the actual traffic on the toll road now that it is operational. With traffic history, Transurban has been able to value the toll road based on actual data and the acquisition price of $2bn is substantially lower than the $3.5bn of debt outstanding when the AirportlinkM7 asset went into receivership. The price represents 51% of the original build cost. We are therefore comfortable with the AirportlinkM7 asset and the past receivership history is not relevant for the credit story going forward since the asset will have substantially less debt post-acquisition ($950m versus $3.5bn previously).

The Transurban Queensland 2021 fixed rate and 2024 floating rate bonds are currently offered at indicative yields to maturity of 4.30% and 4.70% respectively and are available to wholesale investors only.

Updated factsheets for the Transurban Queensland AUD bonds are now available, click for the floating and fixed rate bonds.

Please contact your FIIG representative for further information on the Transurban Queensland (Sun Group) bonds. Yields quoted are indicative only and subject to change.