Further to Brookfield’s takeover offer, Asciano has received an alternative binding takeover proposal from a consortium led by Qube Holdings. The proposal involves the Qube-led consortium taking over Asciano and then selling Asciano’s ports business to Qube. While we remain broadly comfortable with Asciano as it currently stands, the sale of the ports business would weaken Asciano’s credit profile and increase the company’s overall exposure to commodities

Following the previous binding takeover proposal from Brookfield, as well as a non-binding proposal from Qube, Asciano has received a binding proposal from a consortium comprising Qube Holdings Limited, Global Infrastructure Management LLC, Canada Pension Plan Investment Board and CIC Capital Corporation to acquire all of its share capital. If successful, the consortium will then sell Asciano's ports businesses including the Patrick container terminals business, and retain only the rail business.

Following the announcement, S&P has placed Asciano’s credit rating on negative watch. Post the ports divestment, S&P believes that the weakened business risk profile combined with Asciano's ratio of funds from operations to debt in the mid-to-high teens would be consistent with a 'BBB-' long-term rating. Moody’s had already placed Asciano’s rating on negative outlook last year following Brookfield’s proposed acquisition.

At this stage, the Qube-led proposal appears to be superior to the Brookfield proposal on a number of fronts and is currently the more likely of the two offers to go ahead, in the absence of a revised offer from Brookfield. The sale of the ports business would reduce Asciano’s business diversification and increase its exposure to commodities, with the remaining Pacific National rail business having a significant exposure to coal haulage.

Under the 2025 bond documentation, a change of control investor put at $100 will only be triggered if the takeover results in Asciano’s credit rating falling below investment grade by at least one of the rating agencies. So if, for example, the Asciano takeover and ports divestment resulted in a one-notch downgrade in Asciano’s credit ratings (from BBB/Baa2 to BBB-/Baa3), Asciano post-takeover would still be rated investment grade by both rating agencies and the change of control investor put would not be triggered.

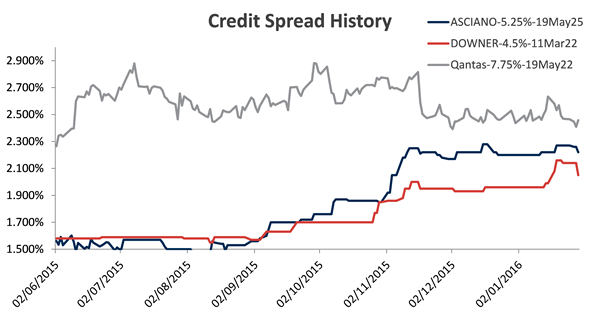

Looking at the history of credit spreads below, the Asciano bonds appear to have already priced a reasonable likelihood of a one-notch downgrade to BBB-/Baa3 (and, by implication, that one of the takeover proposals is likely to be accepted). By comparison, the credit spread currently lies between the Qantas 2022 (BBB-/Ba1) and Downer 2022 (BBB) levels.

The takeover activity around Asciano creates uncertainty around the company and its credit profile going forward, as we can see from the following scenarios:

- If a takeover proposal does not proceed or is amended to not involve a divestment, this would likely be treated as ‘good news’ for the bonds and we would expect some price uplift on the basis of no change to the company’s credit profile

- If a onenotch downgrade occurs then we may see some negative price movement on the bonds however we believe a one-notch downgrade has largely already been priced in

- If the market views the Asciano business as having greater reliance on coal rail transport following the sale of the ports business, then this may create further price pressure on the bonds, even if they retain an investment grade rating. As we have seen with the likes of other coal related bonds such as Adani Abbot Point Terminal, these bonds are attracting a relatively high credit spread given their credit rating

- If the rating agencies were to downgrade even further as a result of the takeover (to sub investment grade) then bondholders would have the protection of the change of control investor put at $100

While we remain comfortable with the Asciano credit profile as it currently stands, for investors who believe that the Qube proposal will go ahead as planned and are concerned about the loss of diversification/commodity exposure of the business then now may be good time to consider exiting their position. However given the current level of uncertainty we believe it may be worthwhile to hold off on an investment decision regarding the bonds until a definitive outcome is achieved on the takeover process.

A link to the Qube proposal is available here .

.