A review of all rating activity undertaken by the agency across the globe including monitoring defaults as well as rating movements (upgrades and downgrades).

Standard & Poor’s last week released their 2013 Annual Global Corporate Default Study and Rating Transitions report. This report reviews all rating activity undertaken by the agency across the globe including monitoring defaults as well as rating movements (upgrades and downgrades).

In 2013 there were a total of 81 defaults in the S&P global universe (of around 6,000 ratings), none of which were rated ‘investment grade’ (BBB- or better). There was a single default recorded by an Australian entity during the period, an entity rated CCC+ (discussed further below).

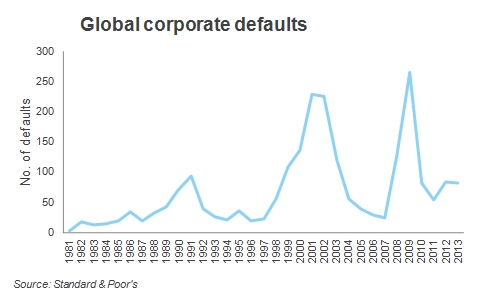

Defaults decreased from 2012 (where 83 were recorded) reflecting the stable conditions being experienced over the last two years, following an uplift from 2011 when the European crisis affected defaults. We note however that markets continue to recover post the global financial crisis where defaults hit an all time peak of 265 in 2009 (see Figure 1 below). The study, which goes back over 30 years demonstrates the cyclical nature of markets as shown in the graph where there are distinct peaks in defaults which align with the GFC in 2009, the recession surrounding the ‘tech-wreck’ in 2001 and the recession a decade earlier in 1991.

Figure 1

Figure 1

This 10 year cycle, which coincides with global or large scale recessions, highlights our persistent theme here at FIIG for the need for portfolio asset diversification. Each of these default peaks corresponded to significant drops in equity prices. Whilst the peak of defaults was 2009 with 265 rated defaults, 14 defaults is the peak of global investment grade defaults – from a sample of over 3,000. For investors looking to protect their capital, investing in investment grade bonds is shown to be a statistically safe way to diversify holdings and recession proof investments.

Investment grade stacks up over the life of the study

Whilst this makes for good reading for the 2013 year for the investment grade market, the statistics over the 30 year study period also give confidence to investors in highly rated bonds.

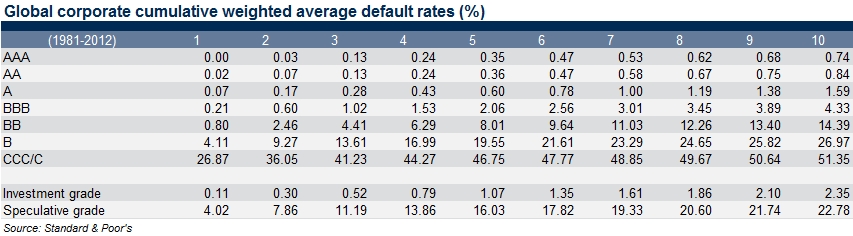

Table 1

Table 1

The cumulative default rates in Table 1 show the lowest investment grade ratings (BBB-category) cumulative default is only 4.33% over a 10 year period. Default rates step up considerably once you move down to sub-investment grade with a 10 year cumulative default rate of 14.39% for BB rated companies. The majority of defaults globally were recorded in the U.S. reflecting their bond market which is the broadest and most mature of any of the global bond markets and the decision of the Fed to maintain extremely low yields on government Treasury bonds forcing investors up the risk curve to chase higher yield (and lower quality) credits.

Download the Deloitte Corporate Bond Report

Rating transitions for the year were relatively benign with upgrades slightly outnumbering downgrades with the ratio near parity.

An Australian default?

Historically the Australian default statistics are stronger than the global statistics, in part due to our almost exclusively investment grade market, but also due to our concentration towards stronger, larger financial institutions.

This year however Australia did record its first default (since the beginning of the GFC) with CCC+ rated Mirabela Nickel Ltd missing an interest payment on its USD loans. The company was originally rated B- by S&P, identifying the risk associated with this issuer. With effectively no sub-investment grade institutional bond market in Australia, the sub-investment grade rating was mandated to tap the US markets.

What constitutes a default?

For the purpose of the S&P study, a default is recorded on the first occurrence of a payment default on any financial obligation rated or unrated (other than when subject to a bona fide commercial dispute). An exception is an interest payment that is missed on the due date but is made within the contracted grace period. Preferred stock is not considered a financial obligation; thus a missed preferred stock dividend is not normally equated with default. Distressed exchanges are considered a default; that is when bond holders are coerced into accepting substitute instruments with lower coupons, longer maturities, or any other diminished financial terms.

S&P deem ‘D’ (default); ‘SD’ (selective default); and ‘R’ (under regulatory supervision) as defaults for the purpose of the study.