Key points:

1. Two bonds have yields to maturity of more than 7%

2. A small allocation to high yield bonds can boost overall portfolio returns

One of the key comparisons when assessing various bonds is the yield to maturity. This takes into account the annual income paid by the bond (running yield) and also the face value returned at maturity. Below is a list of the five highest yielding bonds (and corresponding investment risks) ranked by their yield to maturity; more information can be found in the table below or contact your FIIG representative for further details of these bonds and the associated risks.

Please note, access to these bonds is subject to availability. Three bonds: NextDC, Payce and Plenary are tightly held, if you are interested in the bonds, please register your interest with your local dealer.

1. NextDC Ltd 2019 – Indicative YTM 7.86%

This five year fixed rate bond was issued in June 2014. NextDC is an ASX listed data centre service provider offering IT services such as cross connects, rack space, ID access cards and remote hands through five data centres around Australia. The bonds pay interest of 8% per annum but will also accrue a further 1% per annum, payable upon maturity.

Main risks:

- Fast moving business sector with technologies changing frequently. Changes in technology or demand for data centres could be detrimental to the NEXTDC business

- As a relatively new company, it is yet to make a profit and broker consensus estimates don’t predict a profit until FY16

- Competition risk - the rapidly increasing requirement for secure data storage has seen a number of international and local competitors opening facilities in Australia. Continued heavy investment in this sector may force pricing lower

- Technological failure – NextDC rely heavily on technology in delivering core services

2. Payce Consolidated Limited 2018 – Indicative YTM 7.41%

This senior secured fixed rate note was originated by FIIG in December 2013. Payce is a Sydney based property developer that has been listed on the ASX since 1978. The company’s core business has been the development of medium density apartments. However, Payce also develops communities where there are both affordable residential apartments and mixed use (retail and commercial) buildings. It retains its mixed use properties as part of a rental portfolio.

Main risks:

- As a property developer, Payce is subject to the risks inherent in economic and property cycles, as well as construction risk. In particular, with a focus on Sydney apartments any downturn in that market over the five year period of the notes would likely impact asset valuations as well as existing and future developments.

- Failure of a building partner part way through construction of a development

- Structural subordination with note holders lending to the holding company, Payce Consolidated Limited, and only have direct security over this entity (plus the holding companies of the East Village development project, but ranking after senior and mezzanine debt), however this is expected to be replaced by a guarantee from the owner of the East Village mixed use retail and commercial asset by the end of the year, once construction has been completed and the construction loan is refinanced as an investment loan

- Ability of the Group to pay up to 100% of cash NPAT in dividends (or share buybacks) but also limited to 40% of cumulative cash NPAT (and other controls via total indebtedness covenants)

3. Qantas Airways Limited 2022 – Indicative YTM 6.96%

When Qantas issued these bonds in May 2014, it became the first Australian company with a “non-investment grade” credit rating to sell senior unsecured bonds in Australia. It raised $300m via the eight year fixed rate note issue which was heavily oversubscribed. Qantas is an ASX listed Australian icon which has a current market capitalisation of $3.3bn.

Main risks:

- The nature of the airline industry presents a risk for bond holders due to it being cyclical, capital intensive and exposed to the cost of jet fuel which fluctuates with movements in the underlying commodity

- Qantas’ international business faces strong competition from government backed, or significantly government owned competition. An increase in competition has come with deregulation of the routes and has been a financial drain on the Qantas group

- Qantas has also faced reducing yield and profitability in the domestic market, as rival Virgin Australia has aggressively sought to increase market share through capacity increases, price competition and the growth of the low-cost carrier Tiger Australia which it partially owns

4. Qantas Airways Limited 2021 – Indicative YTM 6.89%

These seven year fixed rate notes, due in 2021, were issued just a month after the 2022’s above, in a response to strong investor demand for the earlier issue. Qantas raised $400m through the issue.

Main risks: as above

5. Plenary Bond Finance Unit Trust 2021 - Indicative YTM 6.60%

This seven year amortising bond was originated by FIIG in June 2014 in a $35m issue. Plenary is a leading sponsor of Public Private Partnerships in Australia and the bond provides exposure to eight Australian public-private partnership projects. Plenary will start to repay principal in year three. The projects include the Melbourne Convention Centre, Gold Coast Light Rail and the Victorian Comprehensive Cancer Centre.

Main risks:

- The Plenary Bond Finance notes are secured by Plenary Group Unit Trust equity shareholdings in the projects. By their nature, equity based cash flows can be expected to show some volatility dependent on the operational performance of the underlying Public Private Partnerships. In addition, the PBF notes are ‘structurally subordinated’ to the senior secured debt in each of the underlying PPP projects, in that the principal and interest repayments on the project level debt must be repaid before project level equity distributions can be made

- The most significant holding within the group is the Victorian Comprehensive Cancer Centre which remains under construction and as such this project represents construction risk to the note holders

- There remains refinance risks contained within the individual underlying projects. LEAP2s funding requires refinance in June 2016 and the AgriBio project requires refinancing before December 2020.

- Enforcement of the security is subject to project co-owner approvals

The table below shows these highest yielding wholesale bonds and the indicative returns. These bonds can be acquired in parcels of $10,000, with a minimum upfront spend of $50,000, subject to availability and price changes.

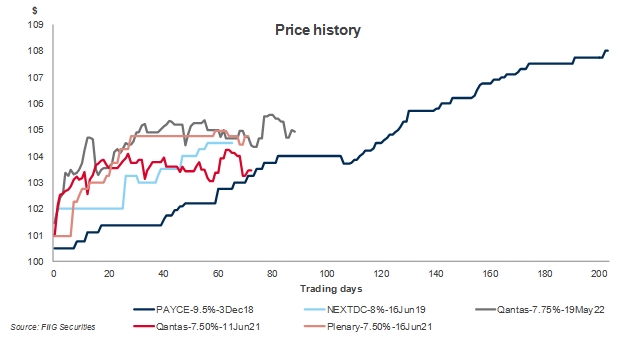

The graph below illustrates the price history of these five highest yielding wholesale bonds: Payce 2018, NextDC 2019, Qantas 2020, Qantas 2021 and Plenary 2021.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

For more information, please call your local dealer on 1800 01 01 81.

Common terms

Maturity - this is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Running yield - uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity - the return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.

If you would like to learn more about bonds, or to discuss possible strategies, please contact your local dealer.

Note: prices and yields are accurate as at 15 September 2014, and are guide only and subject to market availability. FIIG doesn’t make a market in these securities.