Hybrids and Subordinated Debt: What is the issue?

Since Basel III standards were implemented last year, the terms and conditions on subordinated debt issues – Tier 2 (T2) and Additional Tier 1 (AT1) – have included “non-viability” clauses that allow regulators to force issuers to convert these securities into equity in a worst case scenario. These securities have come to be known as “bail-in” hybrids or Contingent Convertibles (Cocos) and over time there has been a divergence of trends in these markets: commentary from professional participants has been increasingly cautionary on the risks, but simultaneously new issuance has been executed at increasingly tighter margins.

This paper is not intended to serve as a detailed source for Basel III standards or the specific amendments to standard T2 and AT1 issuance. It is instead a summary of the resulting trends and a call for investors to make your own assessment of the risk in these securities and act accordingly.

Beginning in December last year we started seeing new style T2 debt issuance in Australia, with margins offered between 2.65% and 2.80% over the bank bill swap rate (BBSW). More recently, we have seen issuance from Westpac at BBSW+2.05% and from ANZ at BBSW+1.93%. Trends in AT1 (listed hybrid) issuance have been following a similar trend.

Below is a timeline of some of the relevant commentary and events surrounding these securities, which is progressively cautionary:

- January 2014: FIIG prints three articles on the introduction of Cocos: here are links to Part One, Part Two, and Part Three.

- February 2014: Credit Suisse offers to buy back an old-style hybrid early, citing the change in regulation. The bonds were trading as high as $107 and were bought back at $103, which clearly would have been a very bad outcome for anybody who recently acquired the bond.

- 05 August 2014: FIIG research highlights the risks in new-style subordinated debt and hybrids.

- 05 August 2014: The Financial conduct Authority (UK regulator) bans

the sale of Cocos to retail investors, deeming them inappropriate risk for the mass retail market.

the sale of Cocos to retail investors, deeming them inappropriate risk for the mass retail market. - 26 August 2014: FIIG’s Head of Markets, Craig Swanger, publishes an article in The Wire warning of the risks in bail-in hybrids.

- 13 September 2014: The Economist prints an article

warning of the risks of new style bank hybrids (Cocos).

warning of the risks of new style bank hybrids (Cocos). - 15 September 2014: FIIG senior management issues internal ban on marketing of Cocos, on the basis the risks more closely resemble equity than fixed income.

- 19 September 2014: Standard & Poor’s warns that many Cocos can expect to be downgraded

in the coming weeks on higher risk of losses, with 65% of all existing AT1 Cocos expected to fall by 1 notch, 15% by 2 notches and the remaining unchanged. This would see only a very small percentage of all AT1 Cocos worldwide remain in the investment grade category.

in the coming weeks on higher risk of losses, with 65% of all existing AT1 Cocos expected to fall by 1 notch, 15% by 2 notches and the remaining unchanged. This would see only a very small percentage of all AT1 Cocos worldwide remain in the investment grade category.

One salient quote from the Economist article is “Cocos take multiple forms, but all are intended to behave like bonds when times are good, yet absorb losses, equity-like, in a crisis”. This is important, because in essence it is saying that these instruments provide all the downside of fixed income (lower returns) with all the downside of equities (higher risk).

You can glean from the above that our view on the topic is clear. But the investor must form his/her own view and act accordingly.

Hybrids and Subordinated Debt: How does it affect me?

These trends affect investors who hold new-style Contingent Convertible T2 bonds and AT1 listed hybrids (also known as “bail-in” hybrids), as these are the securities that contain the non-viability clauses. However, it should also serve as a wake-up call to those who hold old-style T1 hybrids as well; while those securities do not contain the non-viability clause, many still resemble equity more than fixed income in their terms, and will trade with equity-like volatility in times of crisis. As a case in point, the Swiss Re May 2017c T1 hybrid, which is currently trading at a capital price of around $105, was trading below $50 during the GFC.

The securities held by our clients that could be affected are specifically as follows:

New Style T2 Securities (unlisted)

- Insurance Australia Ltd 19Mar19c floating rate note

- Bendigo and Adelaide Bank 29Jan19c floating rate note

- ANZ Banking Group 25Jun19c floating rate note

- Westpac 14Mar19c floating rate note

New Style T2 Securities (listed)

- AMP Subordinated Notes II (AMPHA)

- Suncorp Subordinated Notes (SUNPD)

- Westpac Subordinated Notes II (WBCHB)

Old Style T2 Securities (listed)

- ANZ Subordinated Notes (ANZHA)

- Colonial Group Subordinated Notes (CNGHA)

- NAB Subordinated Notes (NABHB)

- Westpac Subordinated Notes (WBCHA)

New Style AT1 Securities (listed)

- ANZ CPS3 (ANZPC)

- ANZ Capital Notes (ANZPD), ANZ Capital Notes II (ANZPE)

- Bendigo/Adelaide Bank CPS (BENPD)

- Bank of Queensland CPS (BOQPD)

- CBA PERLS VI (CBAPC), CBA PERLS VII (CBAPD)

- IAG CPS (IAGPC),

- Macquarie Group Capital Notes (MQGPA)

- NAB CPS (NABPA), NAB CPS II (NABPB)

- Suncorp CPS2 (SUNPC), Suncorp CPS3 (SUNPE),

- Westpac CPS (WBCPC), Westpac Capital Notes (WBCPD), Westpac Capital Notes II (WBCPE),

Old Style T1 Securities (unlisted)

- Swiss Re 25May17 fixed coupon bond, Swiss Re 25May17 floating rate note

- AXA 26Oct16 fixed coupon bond, AXA 26Oct16 floating rate note

- National Capital Instruments 30Sep16 floating rate note

Old Style T1 Securities (listed)

- ANZ CPS2 (ANZPA),

- Bendigo Bank Peps (BENPB)

- CBA PERLS III (PCAPA)

- IAG RES (IANG)

- Westpac TPS (WCTPA)

Income Securities

- Macquarie Bank Income Securities (MBLHB)

- NAB Income Securities (NABHA)

- Suncorp-Metway (SBKHB)

Hybrids and Subordinated Debt: What should I do?

As an investor, if you hold any of these securities you first need to consider whether the risk/reward trade-off is acceptable. Are the securities paying enough return to your portfolio to accept the inherent downside risks? If the answer to that is “yes”, then there is no action required on your part.

If, however, you decide that the securities are not appropriate for your fixed income portfolio, the decision needs to be made as to what represents a suitable replacement. With only a few exceptions, these T2 and AT1 securities are all floating rate notes (FRNs), and finding FRNs that offer good relative value and don’t fall into one of these risk categories is currently quite difficult. Some of the few bonds in that space are as follows:

Without exception though, all of these can be troublesome to find at times, as supply is only sporadic. However, alternatives to these may lie in the inflation linked bond universe, with a range of capital indexed bonds and indexed annuity bonds offering good spreads over the rate of inflation. There is a school of thought that maintains these instruments are suitable replacements for a portfolio of fixed and floating rate bonds, as they contain a fixed element (the yield over CPI) and a floating element (the actual CPI rate).

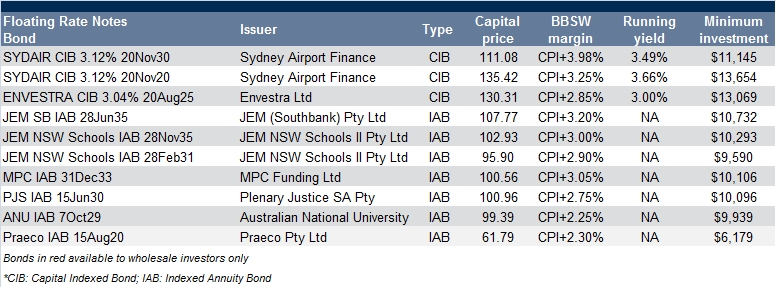

There is a broad cross-section of inflation linked bonds in the Australian market to choose from, with varying degrees of availability. Some of the securities we see frequently are as follows:

For investors less concerned about asset allocation into floating rate or inflation linked securities, there are a wide range of fixed coupon alternatives that could be considered. Further information can be provided on these or most other bonds upon request.

Please contact your FIIG representative if you wish to discuss measures that can be taken to reduce this or any other portfolio risk you may have concern over.

The various bonds prices or yields referred to in this email are the market prices available through FIIG as at the date of this email and subject to change without further notice.