Portfolio management strategy - Are you a passive or an active portfolio manager?

Are you a passive or an active portfolio manager?

A passive manager awaits the maturity of a bond before reinvesting the maturing proceeds into another bond.

An active manager would consider the alternative management strategy of selling the near maturing asset to invest in another bond that becomes available prior to that maturity.

The first key difference between passive and active management is taking control of reinvestment risk.

By awaiting the maturity date, the passive investor has limited their reinvestment opportunities to those bond investments available on the maturity date, or worse, yielding a cash return whilst they await a suitable opportunity.

A second key difference is maintaining a risk return profile.

The passive investor will hold a progressively lower yielding credit exposure as the bond they hold approaches maturity. As credit risk reduces as you get closer to maturity, so too does the return, resulting in the passive investor yielding progressively less return than their original investment profile.

This second key difference is clarified below, as many investors will query how they can possibly be yielding less than their original investment if they still hold that investment.

The key observation here is that the benchmark for comparison is not the actual bond they invested in, but their ‘original investment profile’. Professional bond portfolio managers would label this a duration and credit management strategy.

Consider that when a corporate borrower issues bonds, the credit margin paid over the risk free rate is higher the longer the bond maturity. That is because quite simply, there is more (credit) risk associated with lending for longer periods than there is for shorter periods of time. Everything else being equal, as the bond approaches maturity the credit risk decreases and the price of the bond will rally. This is also known as ‘riding the credit curve’.

A similar relationship exists for the risk free rate due to the time value of money. A normal shaped risk free (yield) curve will have increasing higher risk free rates (yields) as the term to maturity increases.

Consider the following example of the fictitious credit curve of the ‘XYZ Company’.

Table 1

The relationship between the risk free rate, credit margin and yield to maturity can also be represented graphically, as shown below.

Figure1

If at original issue date XYZ could issue semi-annual coupon bonds for terms as per column (A) at yields as per column (D), then in two years’ time, if neither the market risk free rate or the credit worthiness of the company had changed, then those bonds originally issued for 6 and 4 year terms will now have 4 and 2 year terms to maturity and will therefore be trading at the respective prices as per column (H). Further, the bond issued 2 years ago with a 2 year maturity will have matured.

If we look at the original 6 year bond with a fixed coupon of 6.50% which now has 4 years remaining until maturity, the new yield to maturity of 5.00% is lower than the coupon of 6.50%. This 1.50% rally in yield, and subsequent premium in price, is attributable to two component parts:

(1) 0.50% for ‘riding the yield curve’

(2) 1.00% for ‘riding the credit (or issuer) curve’.

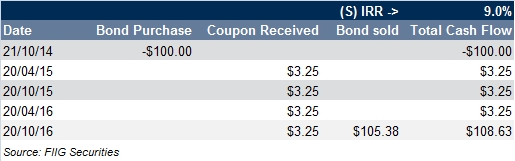

The investors in the original XYZ 6 year 6.50% fixed rate bond have been handsomely rewarded for taking both duration (1) and credit risk (2) that nets them a 9.00% p.a. return (as shown by the internal rate of return or IRR calculation below, with the bond being sold at the market value of $105.38 plus the semi-annual compounded value of the four coupon payments).

Table 2

Table 2

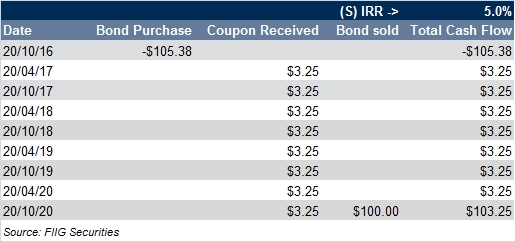

However, what to do now? Especially considering we know with certainty that the actual price will eventually gravitate back to a maturing value of $100.00 or PAR, and therefore the IRR will equate the yield to maturity of only 5.00% for the remaining 4 years. Also known as ‘pull to par’.

This is because the investment, if retained for the remaining four years, has a lower yield to maturity due to both a lower risk free rate benchmark and a lower credit risk exposure as the term to maturity has reduced. If retained (i.e. passive management), this bond will now yield a semi-annual compounding 5.00% return, being far less than the ‘original investment profile’ of 6.50% (for a 6 year term) and indeed significantly lower than the investor’s actual IRR outcome over the first two years, being 9.00%. This is demonstrated in the table below:

Table 3

Table 3

So, what should an investor do? It depends on the investor’s strategy and the investment options available.

If the XYZ Company conveniently decide to reissue into the market (having just redeemed their 3.5% bond originally issued with a 2 year term) and do so for a 6 year term, our reinvestment dilemma for active investors would be solved.

An ‘active’ investor, who is still positively disposed to XYZ, would consider selling their old exposure to the now 4 year term to maturity bond, and re investing in the new 6 year issue. They are simply rolling their risk and return profile up the curve, managing both their duration and their credit exposure to more closely match their ‘original investment profile’.

However, if they were ‘passive’ they would forgo this opportunity in favour of holding their original investment, despite the knowledge that the value of the bond will eventually fall to $100.

(Note that the above discussion assumes a normal shaped yield and credit curve. It is possible to have inverted yield and/or credit curves and different strategies may be applied in those circumstances).

Do you own the following assets?

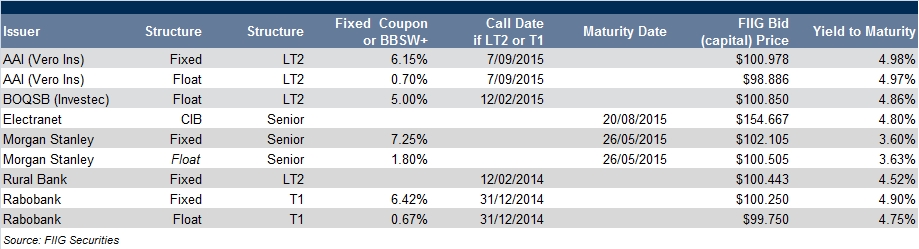

Investors should consider the FIIG Originations that have performed well and are trading at significant premiums.

There are also some glaringly obvious short dated bonds approaching maturity that are trading at low yields having performed extremely well in recent times. These bonds are detailed in the table below.

Table 4

Table 4

Note: Some of these assets are callable, at the issuer’s discretion, and although the probability of a non-call event is considered minimal, as reflected by the market price.

The yield to maturity (YTM) quoted for the Electranet Capital Indexed Bond (CIB) is the real yield plus a 2.50% inflation assumption applied

All these assets can be sold at or near (dependent upon market volatility) the quoted prices.

Q&A

Who buys these short dated assets as they approach maturity and for what reason?

The bond market is very large and liquidity is very deep. Investors, whether they are HNW SMSF or Institutional Funds, will all have different risk and return profiles. Those who buy short dated low yielding assets will do so because that is the profile to which their ‘investment mandate’ is a subscriber. In particular, there are a number of large credit funds that have a mandate that only allow credit investments with a maximum term to maturity of one year. This often results in increased demand once a bond transitions into the ‘one year bucket’.

What if the sale of a near maturing asset cannot be replaced with another asset that maintains my portfolio diversity?

A very good question. If the increase in total return achievable by the new portfolio does not match or exceed the investor requirement for compensation for the loss of diversity, then the risk is higher than the return required, and the investment opportunity should not be undertaken.

But the Electranet CIB gives me inflation protection. So why would I sell it and what would I alternately buy?

Managing term exposure of CIB assets is especially important. Your inflation protection lasts only as long as the bond remains outstanding or that bond’s maturity date. The closer to maturity the easier it is to predict inflation, and the less meaning any marginal deviation between estimated and actual will have for total returns.

When selling CIBs, and unable to get other CIBs, the best alternate maybe an FRN (floating rate note), as the RBA charter effectively links inflation, the cash rate and the bank bill swap rate.

However, whilst the FRN headline period return may be correlated with the CIB, the total return will be markedly different for many reasons, not the least because the FRN distributes all income whilst a CIB retains a portion and compounds it, care of the face vale increasing. Therefore a ‘duration’ matched FRN may be a better alternate.

Can I earmark these assets for sale in advance of reinvestment opportunities?

Yes, and that would be a wise ‘active’ portfolio management strategy. If there is no current investment alternate, being actively aware of preferred sale targets in advance of forthcoming opportunities will assist an investor’s ability to secure the opportunity.

Summary

Investors should consider the advantages of actively managing their portfolios and the disadvantages of being passive. By letting the maturity date of assets dictate the timing of investment decisions, investors are potentially compromising higher returns.

By understanding their true investment risk and return profile and maintaining a focus to constantly rebalance their exposure given the performance of bonds as they approach maturity, in light of investment opportunities and liquidity that may be offered independent of those maturities, investors are taking active control.

Our Head of Portfolio services, Ryan Poth, is constantly reviewing both market opportunities and investor exposures for the purpose of making recommendations. A key component of this strategy is riding both the yield and the credit curves in pursuit of higher returns. If you wish to have your portfolio reviewed, your FIIG representative can arrange Ryan to do so.

Further, if you wish to discuss any of the observations in this paper, please feel free to direct your questions to your FIIG representative and I will answer the aggregated questions in future WIRE editions.