Inflation due out, professional fund managers buying at record levels

The Australian Bureau of Statistics (ABS) is due to release the 1Q15 inflation figures (CPI) 22 April and ahead of this there has been a noteworthy milestone in the inflation linked bond market. For the first time ever, inflation linked bonds issued by the Australian Commonwealth Government sold at tender on Tuesday last week, for an average (real) yield below zero. For more details on this please see the article, Less than zero: a market milestone you shouldn’t miss, by Elizabeth Moran. The vast majority of purchasers of government inflation linked bonds are professional fund managers and the oversubscription for the most recent government ILBs is a clear indication that those managers expect inflation over a longer timeframe to increase, even though the average economist expectation for the upcoming figure is a very low 1.3% (year-on-year) figure. This is consistent with repeated verbiage from the Reserve Bank of Australia (RBA) that they are comfortable that core inflation will remain within the 2.0%-3.0% band over a longer period.

The continued fall in the AUD (from an average of 0.846 in 4Q14 to 0.790 in 1Q15, or a 6.6% drop in the quarter) and a recovering oil price should both contribute to rising inflation. Furthermore, a strong employment figure last week of +37,700 coupled with a significant positive revision to last month’s figure (+42,000 vs previously reported +15,600) provides further support for the case of improving inflation.

On balance, it makes sense that professional fund managers are purchasing inflation linked bonds at a record pace, but there is little room for error in the Commonwealth bonds if inflation continues to fall over the short term.

Corporate inflation linked bonds offer good relative value

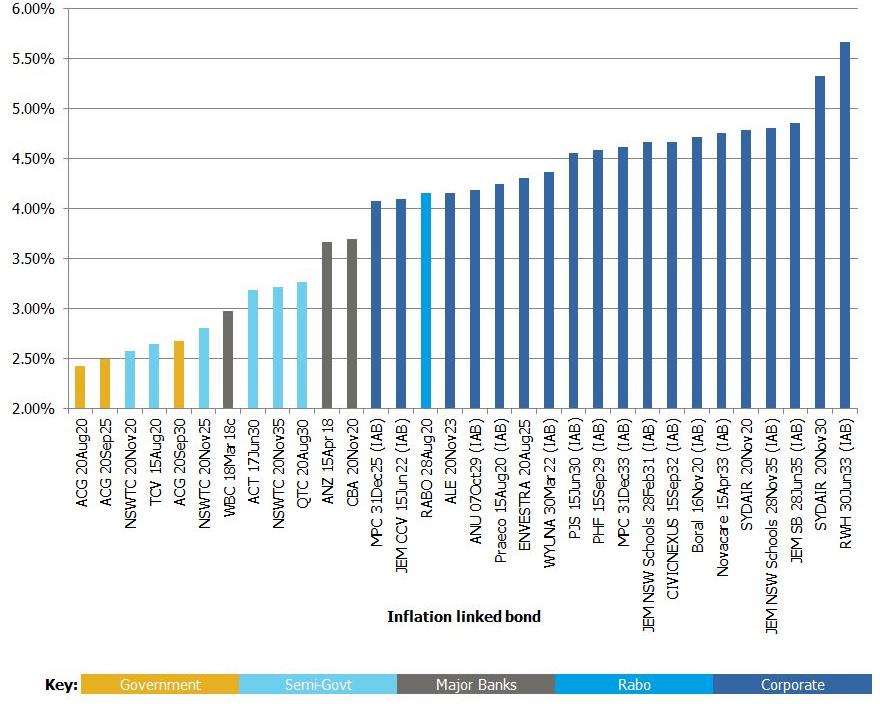

The market for corporate inflation linked bonds, nearly all of which are investment grade and linked to infrastructure, remains comparably attractive. As is evidence in the chart below, there is a clear differential when comparing the implied yields on corporate inflation linked bonds with those issued by the Commonwealth government, Australian states, and major banks.

Implied yield at 2.50% CPI Chart

Note: yields current as at 16 April 2015 and subject to change.

Note: yields current as at 16 April 2015 and subject to change.

Source: FIIG Securities, Bloomberg

The graph leads me to conclude that, even though corporate inflation linked bonds have performed very well over the past year, they still offer compelling value when compared to their government, state, and banking sector peers - and with the funds management industry clearly comfortable with negative yields on those instruments, investment grade corporate yields between 150 and 300 basis points higher deserve further attention.

If your portfolio is underweight inflation linked bonds, it may be worthwhile to consider increasing the allocation to these products. More importantly, if your portfolio includes the much lower yielding government, state, or bank inflation linked bonds, returns can be significantly enhanced by switching this exposure into corporate inflation linked products.