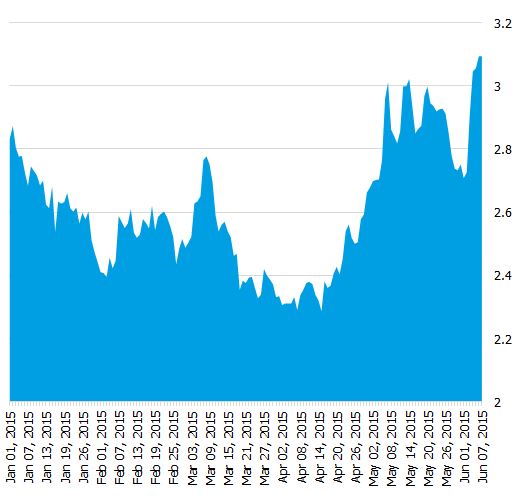

Australian bond yields have leapt nearly 70 basis points since April without fundamental justification. Some of this will be a reversal of yields falling too low, but the premium to the current cash rate is not justified based on current economic fundamentals. The facts simply don’t support the view that the Australian economy will perform at its capacity any time soon. Without such economic performance or an unexpected outbreak of inflation, the RBA will not increase rates, and in fact is likely to reduce them

Joe Hockey celebrated the release of a “terrific set of numbers” last week, namely Australia’s GDP data. Markets reacted sharply, with the AUD jumping nearly 1 cent against the USD, and Australian 10 year Government Bond yields leapt nearly 0.30%.

But Joe shouldn’t have celebrated. In fact, other than Australia digging more iron ore and coal out of the ground and shipping it, there is very little to celebrate in the Australian economy at present. This won’t be a popular view, but it’s time to face certain facts: the Australian economy is in poor fundamental condition.

Australian Government 10 year bond yields, 2015 YTD

Source: FIIG Securities, Bloomberg

Bond yields in Australia are higher than fundamentals justify

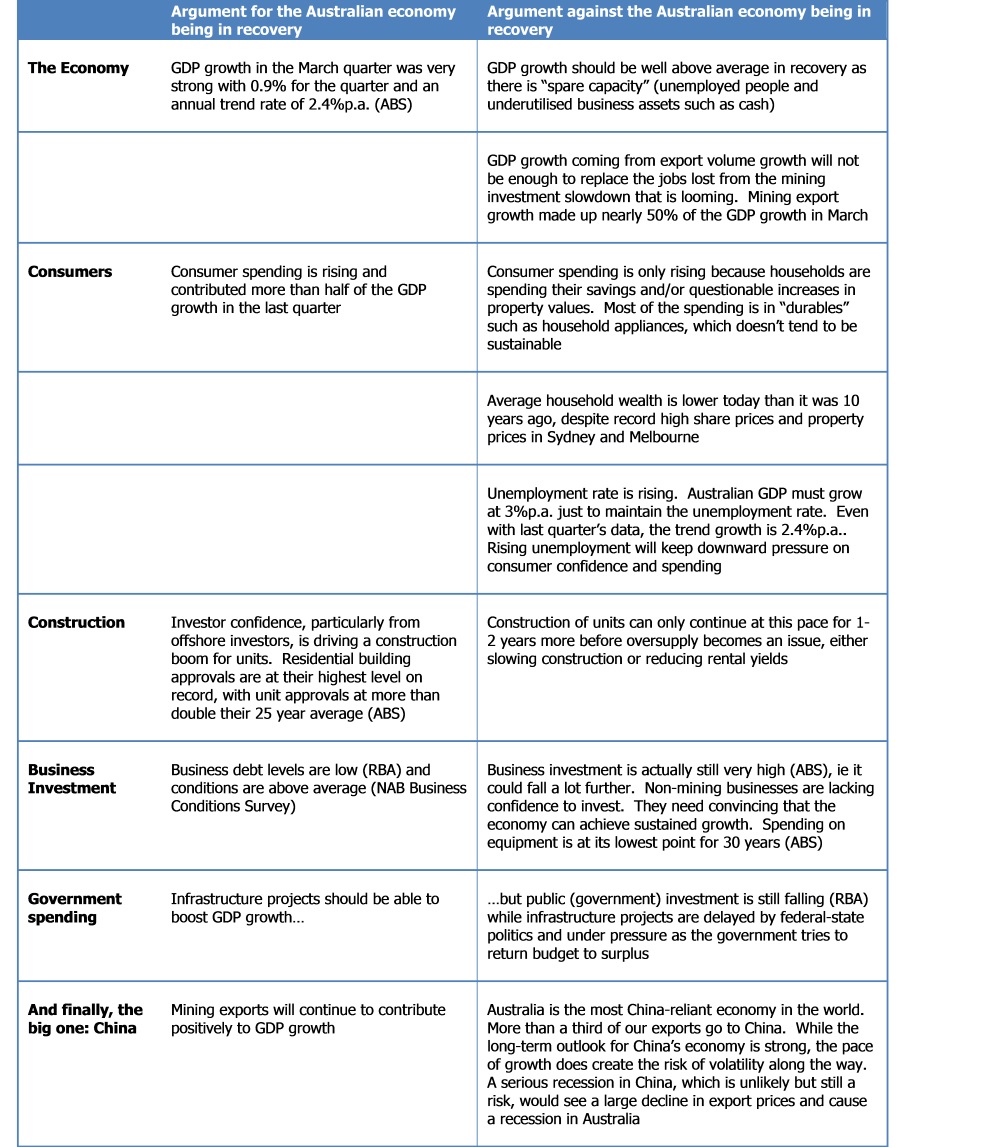

The arguments for and against these numbers being reason to celebrate appear below. The balance is clearly supporting the case against celebration.

While foreign currency (FX) markets corrected very quickly, with the AUD falling 2 cents by the end of the week, bond yields are still very high relative to recent averages. The difference in the two markets’ reaction comes down to liquidity – FX markets are highly liquid and therefore efficient, but bond markets are currently quite inefficient, creating an opportunity for investors to lock in temporarily over-priced bond yields.

For and against - Arguments regarding the real strength of the Australian economy

Source: FIIG Securities

Suggested bonds

Fixed rate bonds with slightly longer terms until maturity will benefit most. Below are four suggested bonds, with the Sydney Airport inflation linked bond with its fixed margin over CPI, the most attractive on a yield to maturity basis (assuming inflation runs at 2.5%, the RBA target mid-point). This is also the only bond available to retail investors, the other three are for wholesale investors only.

If you’re interested in foreign currency bonds, our suggestion would be the USD Newcrest 2022 bond, which has a yield to maturity of 4.65% and a running yield of 4.32%.

For more information please call your local dealer.