Asciano’s FY15 result reflects a solid performance under challenging domestic economic conditions. In addition, Brookfield Infrastructure Partners has confirmed a binding offer to take over Asciano

FY15 results

Asciano’s FY15 result is highlighted by a turnaround to positive free cash flow and an improvement in profitability despite lower revenues, reflecting cost cutting initiatives and significant reductions in capital expenditure.

From a credit perspective, the key points from the FY15 result are summarised below:

- Revenue was down 3.9% to $3.8bn, while underlying EBITDA increased by 8.6% to $1.1bn, underlying EBIT increased by 9.7% to $790.2m and underlying NPAT was up 18.6% to $414.7m. Strong coal volumes and above market container growth was offset by weak economic activity particularly in Western Australia impacting intermodal volumes and soft grain volumes

- Free cash flow after capital expenditure for the full year increased from a negative position of $12.9m in the prior year to a positive $108.4m. This was largely driven by a 24.8% reduction in capital expenditure to $566.9m. Asciano is forecast to generate significantly higher free cash flows is FY16 as a result of a further reduction in capital expenditure as well as lower restructuring costs

- Asciano had a weighted average debt maturity of 4.7 years and the interest rate on approximately 84% of the company’s debt was fixed as at FY15

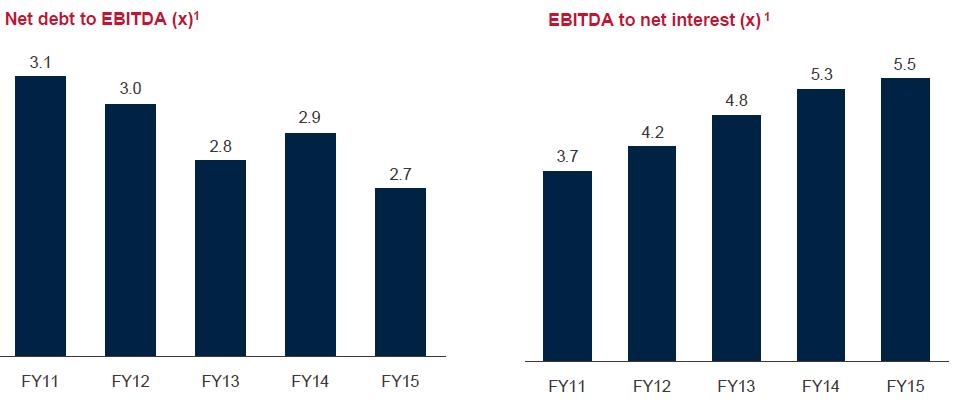

- As highlighted in the figure below, Asciano’s credit metrics have progressively improved over the past five years. Leverage (as measured by net debt to EBITDA) of 2.7 times was within Asciano’s range of 2.5-3.0 times and is expected to be at the bottom end of Asciano’s target range by the end of FY16

Key credit metrics

The figure shows Asciano's key credit metrics from FY11-15 including: net debt to EBITDA and EBITDA to net interest.

The figure shows Asciano's key credit metrics from FY11-15 including: net debt to EBITDA and EBITDA to net interest.

Source: Asciano presentation

Brookfield Infrastructure Partners confirms takeover offer

Brookfield Infrastructure Partners (BIP) has confirmed its takeover offer for Asciano in the form of a combination of cash and BIP units. The bid is at an implied value of A$9.15 per share valuing Asciano at an total enterprise value of approximately A$12bn. The takeover bid is subject to a number of conditions including domestic regulatory approvals and is expected to be completed by year end.

BIP intends to keep Asciano’s existing debt facility, bonds and syndicated facility in place. It is not expected that the transaction will have an impact on Asciano’s investment grade credit rating.

The Asciano 2025 bonds contain a change of control provision which grants the bondholders the right to require Asciano to repurchase the bonds at par on a change of control, but only if the change of control would trigger a downgrade to sub-investment grade at least one rating agency. Given that Asciano’s credit rating is expected to remain investment grade, we consider it highly unlikely that bondholders will be able to trigger the change of control put option.

BIP has also received in principle approval for an Australian share market listing from the Australian Securities Exchange (ASX). It intends to use the listing to further expand its infrastructure business in Australia. The group already owns Brookfield Rail, a 5100-kilometre freight rail network in Western Australia, as well as the Dalrymple Bay Coal Terminal in north Queensland.

Please contact your FIIG representative for more information on the Asciano bonds available to FIIG investors.