A desperate chase for yield has investors chasing income but worried about the additional risks. What market if any, offers value?

There is no question that yields on all income producing investments are at unprecedented lows, from property to bonds and equities. Artificially supressed interest rates and similar programs run by the world’s major central banks have created a desperate chase for yield that has impacted all assets. Government bonds are amongst the worst impacted – US equities and property almost as bad – and while corporate bonds have have been inside the circus tent, they have not been part of the main event.

Quantitative Easing has particularly distorted pricing of risk, particularly government bonds and equities

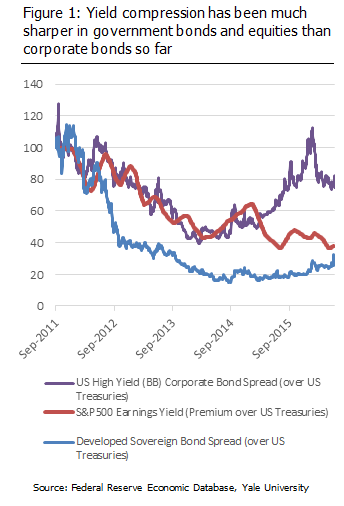

First Quantitative Easing (QE) pushed down government bond yields to record lows. Then anyone needing income from their investments, like pension funds and retirees, were forced to move up the risk curve into equities and corporate bonds. The prices of all risky assets rose sharply, forcing dividend and bond yields sharply lower as shown in Figure 1.

First Quantitative Easing (QE) pushed down government bond yields to record lows. Then anyone needing income from their investments, like pension funds and retirees, were forced to move up the risk curve into equities and corporate bonds. The prices of all risky assets rose sharply, forcing dividend and bond yields sharply lower as shown in Figure 1.

Now after years of near zero interest rates, we have the inevitable addiction to low interest rates. This means every piece of bad economic news is met with celebration by equity markets as it means cheap leverage is here to stay. Using last week’s example of Wall St rallying in response to disappointing jobs report in the US, markets have become distorted – mispricing risk left, right and centre.

But corporate bond pricing has returned to long term averages

But in late 2014, corporate bond markets returned to their long term average spreads. In fact, as of last week, the average BB and BBB rated bonds were paying a spread over the risk free rate just above their pre GFC averages.

Late 2014, was the beginning of the slide in the global oil price, with markets finally understanding that lower economic growth is the ‘new normal’. And this is where the disconnect between corporate bond and equities markets began. Yields on all corporate bonds increased back to historic averages at this time, but equities – after a short correction – continued their price rally to unsustainable all time highs.

In the five years to June 2016, central banks had spent a total of US$7 trillion buying financial assets, mostly government bonds. In that same time, earnings yields and government bond spreads have fallen 60 to 70%, while corporate bond spreads in the mid range BB rating level have fallen just 20%. It’s important to note that while not in Figure 1, the result for BBB rated corporate bonds is about the same, down 20 to 30% only.

Since 2011, sovereign bond spreads have fallen by 65% as shown in Figure 1. The spread itself has fallen from 260bps to 78bps. The spread on Spanish government bonds over German bunds, for example, has fallen from 3.25%pa to 1.09%pa since 2011 and Italy’s bonds from 7.20%pa to 1.22%pa. These falling spreads are not reflected in lower risks.

Are corporate bonds undervalued; or government bonds and equities overvalued?

Eventually the distortions caused by QE and ultra low interest rates must be unwound. It will be a slow and painful withdrawal, as any addiction treatment is, but it must eventually happen. When it does, the two worst asset classes to be holding will be government bonds and equities – particularly US equities. Government bonds will correct to whatever their new normal level is, which while very unlikely to be as high as the pre GFC levels, will certainly not be negative. Equity prices will be hit twice: firstly because of the increase in bond yields, making equities less attractive; and secondly as equity yields will correct to levels that reflect the low economic growth outlook.

The question remains as to whether it is equities and government bonds that are overvalued, or that corporate bonds are undervalued. The reality is that no one really knows; we are in a new economic environment in which growth will be lower for longer, in which governments and the private sector are now addicted to low interest rates. We are very unlikely to see a return to pre GFC normal rates, as to do so would likely put so much stress on government balance sheets it would cause major economic unrest. Low rates are here to stay, so all valuation benchmarks from the past need to adjust to this new normal.

While we don’t know whether corporate bonds are undervalued or government bonds and equities are overvalued, a switch from equities to corporate bonds represents a strategy of selling high and buying low. If it turns out that government bonds and equities are overvalued now and soon correct, any switch to corporate bonds before then will reduce losses. If it turns out that the new normal means lower yields, corporate bonds have quite a rally ahead of them.