Over the last 15 years, the FIIG team has had thousands of conversations with investors who are considering investing in bonds and other fixed income investments.

We’ve come to recognise some key concerns that investors quote when discussing a potential investment, most of which are based on false assumptions. So, if you’re still unsure about bonds, this series of articles which delves into the “Seven Key Myths” may help.

Myth #3 Fixed Income returns are low and will be a drag on my portfolio’s performance

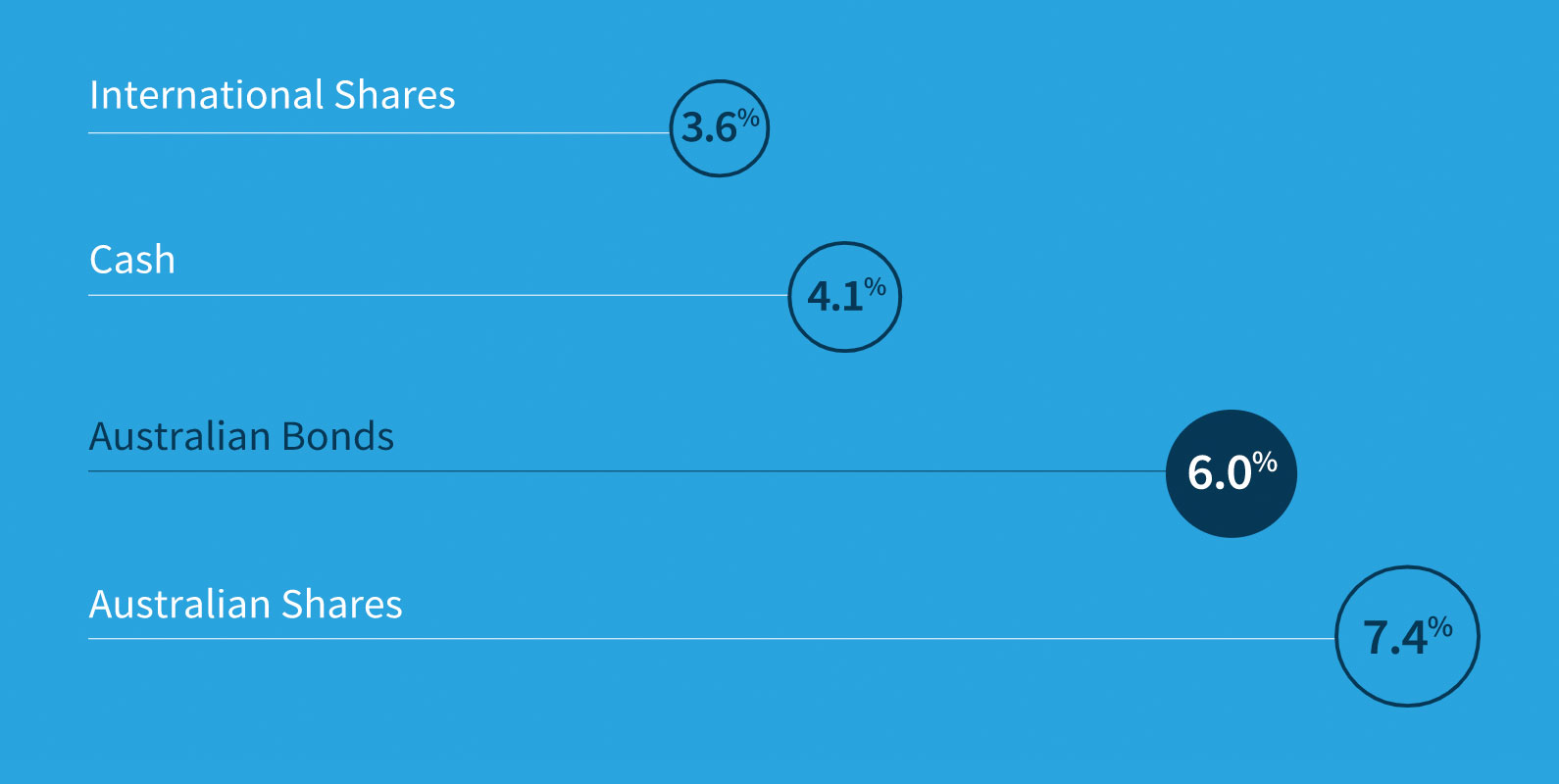

Reality #3 Fixed income returns over the 20 years to June 2020 have returned 6%, while shares have returned 7.4%, a difference of just 1.4% not what you would expect for much lower risk bonds.

Bonds range from being very low risk to high risk and there are other fixed income options such as deposits and hybrids to suit all investors. While returns are generally lower than shares, the securities are in most cases lower risk. They sit higher in the capital structure so that in the event of default they are repaid before shares and other lower ranking creditors. The exceptions being the new style bank subordinated bonds and hybrids which convert to shares under certain conditions.

In stressed markets, the bonds outperformed and had you held them in your portfolio, they would have helped smooth overall returns.

While you would expect lower returns for lower risk, investing in fixed income doesn’t mean it will be a drag on your portfolio’s performance.

Those investors that are prepared to trade their bonds would expect higher returns than the Composite Index.