In Australia credit ratings are only permitted to be disclosed to "wholesale" clients, which means that retail clients are not allowed to be shown credit ratings in relation to a particular product or for the purpose of procuring a sale. This article provides general credit rating information and is provided solely for educational purposes.

Credit ratings are an indication of perceived risk. Each year Standard and Poor’s release a global report that shows defaults as well as rating movements (upgrades and downgrades).

The most recent Global Corporate Default Study and Rating Transitions report covers the 2021 year and reviews the rating agency’s actions taken worldwide including rating upgrades and downgrades. This has just been released (on the 14th of April), so is very much up to date.

In 2021, we obviously saw the extraordinarily fast and much better than expected recovery from one of the deepest recessions in the past 100 years. The unprecedented monetary and fiscal support softened the blow in terms of defaults, with the percentage reaching only about half of recent recessions in 2008-9 and 1999-2000.

Indeed, there were 72 defaults in 2021, of which 60 had a rating at the start of the year, and 52 of which were rated CCC or lower. In other words, 72% of defaults came from issuers who were already in stress and rated as likely to default in the following 12 months. An interesting point to note is that , distressed exchanges (where bondholders are offered a deal to exchange their bonds for new ones, usually at a price and new coupon lower than at issue of the original bond, which S&P counts as a default due to bondholders accepting terms less favourable than when the bonds were issued) were the highest reason for default in 2021, accounting for fully half of all defaults.

This was also observed in 2009 and 2016, so it seems these types of exchanges become more prevalent in economic downturns as opposed to more ‘normal’ reasons for default, being the inability of the issuer to pay.

This is further evidence that issuers are becoming more proactive and investors are increasingly accepting of this method of debt restructuring rather than a formal default or bankruptcy process.

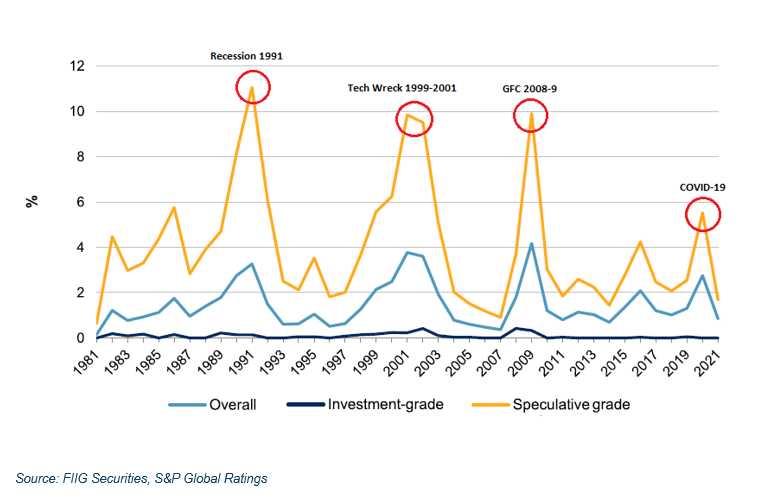

Global corporate defaults chart – investment grade versus speculative grade

The graph depicts the global corporate default percentages for investment grade, speculative grade and overall from 1981 – 2021. This approximate 10-year cycle, which coincides with global or large-scale recessions, highlights the need for portfolio asset diversification. Each of these default peaks corresponded to significant drops in equity prices. While the peak was 268 rated defaults in 2009, global investment grade defaults peaked at 14 in 2008 – from a sample of over 3,000. For investors looking to protect their capital, investing in investment grade bonds is shown to be a statistically safe way to diversify holdings and recession proof investments.

As mentioned above, the huge amounts of money thrown into the system by central banks and governments dramatically shortened the usual cycle and cushioned the blow for many issuers. The expectation was for at least as bad a cycle as the GFC, and yet we observed a relatively mild one particularly given the global nature of the pandemic and the effective total shuttering of certain sectors of the economy.

Investment grade stacks up over the life of the study

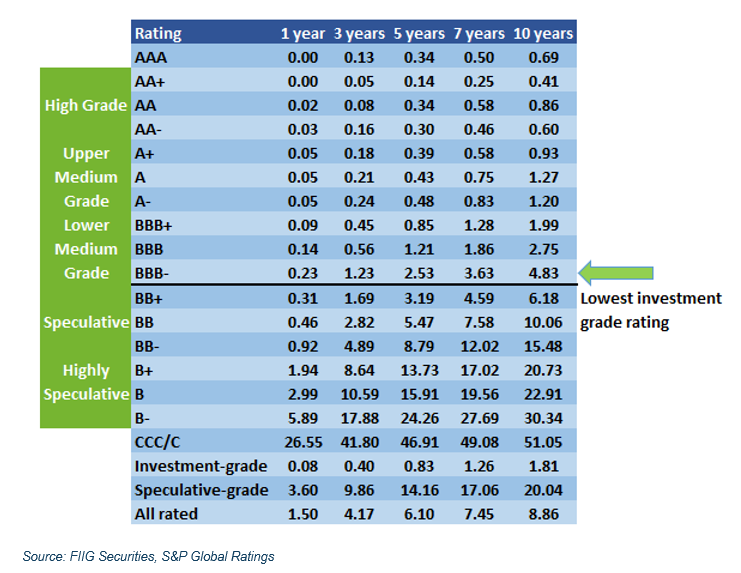

The statistics over the ~40 year study period should give confidence to investors in highly rated bonds. The table below shows the probability of default given the term to maturity. For example, an A- rated bond has a probability of default over five years of 0.43%. This increases for the lowest investment grade credit rating to 2.53%. Both are approximately 0.10% lower than two years ago, reflecting the recent stability of investment grade issuers and their ability to access low cost funding.

There were no defaults of investment grade rated issuers in 2021.

It’s important to note that a default means the company failed to meet its interest or principal obligations by the due date and does not mean the investor lost money – see a definition at the end of the note and here for further information.

Global S&P cumulative default rates

The table shows the historical percentage incidence of default for AAA rated to BBB- including average default rates of investment grade, speculative grade and all rated. The majority of defaults for 2021 were, as usual, recorded in the US, reflecting its large bond market which is the most mature of bond markets globally. However, the largest default was the well-publicised Evergrande Property, the highest profile of the Chinese developers, with over US$11bn outstanding – a sign that perhaps the state support of highly leveraged players is receding amongst the newer political goals rather than the previous growth-at-all costs focus.

An Australian default?

Historically, the Australian default statistics are lower than the global statistics, in part due to our almost exclusively investment grade market, but also due to our concentration towards stronger, larger financial institutions.

Boart Longyear, which performed a distressed exchange in 2019 unfortunately succumbed and formally defaulted in 2021.

What constitutes a default?

For the purpose of the S&P study, a default is recorded on the first occurrence of a payment default on any financial obligation that is rated or unrated – other than when subject to a bona fide commercial dispute. An exception is when an interest payment is missed on the due date but is made within the contracted grace period. Preferred stock is not considered a financial obligation; a missed preferred stock dividend is not normally equated with default. Distressed exchanges are considered a default; that is when bond holders are coerced into accepting substitute instruments with lower coupons, longer maturities, or any other diminished financial terms. On-market purchases at a deep discount to face value are also generally considered a default.

S&P deem ‘D’ (default); ‘SD’ (selective default); and ‘R’ (under regulatory supervision) as defaults for the purpose of the study.

Loss given default

As mentioned above, it is important to distinguish between a default, which can be for many reasons (some of which are discussed above), and the loss that may eventuate as a result of that default, which is termed ‘loss given default”.

An example perhaps illustrates best:

Axsesstoday, an unrated issuer, defaulted in late 2018. It had issued a number of secured bonds in the OTC market as well as an unsecured listed retail bond on the ASX.

Investors in the secured bonds received 100% of their capital back but the unsecured bondholders are received less than 1/3 of their capital.

Therefore, from the same event of default, different investors had different loss outcomes depending on whether their bonds were secured or not.

This is an example of how capital structure is one of the many other determinants of risk in investing in bonds. We have focused in this article on ratings as there is an excellent data set which allows historical comparisons, but investors should be aware that ratings alone cannot quantify the risk of a bond investment, although they provide a good and relatively simple place to start.