Inflation-linked securities should be in every portfolio to build wealth and protect investors against inflationary pressures, while maintaining a steadily growing income stream.

A fixed income portfolio should have a proportion of its funds invested in inflation-linked bonds, which provide capital protection against rising prices. Inflation-linked securities such as Indexed Annuity Bonds (IABs) and Capital Indexed Bonds (CIBs) are core investment securities, which are adjusted for inflation each quarter.

Background

CIBs and IABs offer inflation protection by keeping cashflow paid to investors in step with the rate of inflation. This is an important consideration for investors looking to protect their spending power against destructive inflation. Inflation presents a major risk to savings as a failure to earn in excess of the level of inflation effectively delivers wealth erosion and depletion of savings in real terms.

In Australia, inflation linked securities are predominantly issued by investment grade rated entities and offer long-term inflation protection and an inflation linked income stream. The return for these securities is a margin over and above the CPI (or a real yield). The real yield can then be added to an estimated forward-looking inflation assumption to calculate the nominal return.

The real yield ensures that the bondholder is cushioned against any unexpected spike The real yield ensures that the bondholder is cushioned against any unexpected spike in inflation, as measured by the CPI. Key characteristics, including structural details of CIBs and IABs, are set out below.

Capital Indexed Bonds - CIBs are also known as inflation indexed bonds or CPI bonds.

CIBs are similar in nature to most corporate bonds in that they pay regular interest and repay principal in full at maturity. The primary difference between CIBs and regular corporate bonds is that the principal amount on which interest is received changes with inflation.

At maturity, investors receive the increased capital face value that has been indexed over the life of the security in step with inflation. Therefore, the final capital value is higher than the par value of $100 or the purchase price in an inflationary environment.

For example, assuming an annual rate of inflation of 2.5% and a coupon rate of 5%, the face value of a bond issued with a $100.00 nominal amount will increase to $102.50 at the end of year one and to $105.06 by the end of year two. Therefore, this bond will pay a coupon of $5 in year one, $5.13 in year two (coupon paid on $102.50 nominal value) and $5.25 in year three (coupon paid on $105.06 nominal value), and so on until maturity.

The above example sets out the dynamics of inflation linked bonds to give investors an understanding of the basic principles of these securities for the purpose of clarity. In reality these bonds usually pay quarterly coupons indexed quarterly following the CPI data release.

Due to their nature, CIBs are a highly recommended investment option for those in accumulation. Given CPI contributes to capital growth over time, CIBs are a preferred investment for those simultaneously building wealth and wanting inflation protection.

Indexed Annuity Bonds

IABs are annuity structures with regular payments that include an interest payment or coupon and a principal repayment component. The cashflow is adjusted quarterly for inflation. Annuities pay a steady stream of principal and interest, such that the full amount of principal is repaid over the life of the annuity with no lump sum principal repayment at maturity.

An IAB’s equal repayment amount, known as the base payment, is indexed to inflation so that the value of the base payment remains constant in real inflation-adjusted terms. While these securities are amortising bonds by nature, meaning the principal is returned to investors over the tenor of the bond rather than repaid at maturity, the advantage is higher regular cashflow which is often sought by investors and, in particular, retirees.

Figure 1 below shows a theoretical cashflow on an IAB with a base payment of $100 per quarter. If we assume an inflation rate of 2.5% pa, the cashflow received by investors grows substantially compared to an annuity bond that is not indexed where the inflation assumption is 0% pa. However, while the nominal impact is dramatic, the impact on real returns is zero. This is because the indexing merely returns nominal values to an amount that keeps pace with inflation.

IABs allow investors to invest in securities with strong credit ratings without sacrificing income. These securities are popular with investors, particularly those in a drawdown phase, requiring high cashflows.

Conclusion

Inflation linked securities offer unique protection, which is an important consideration for building wealth and sustaining purchasing power.

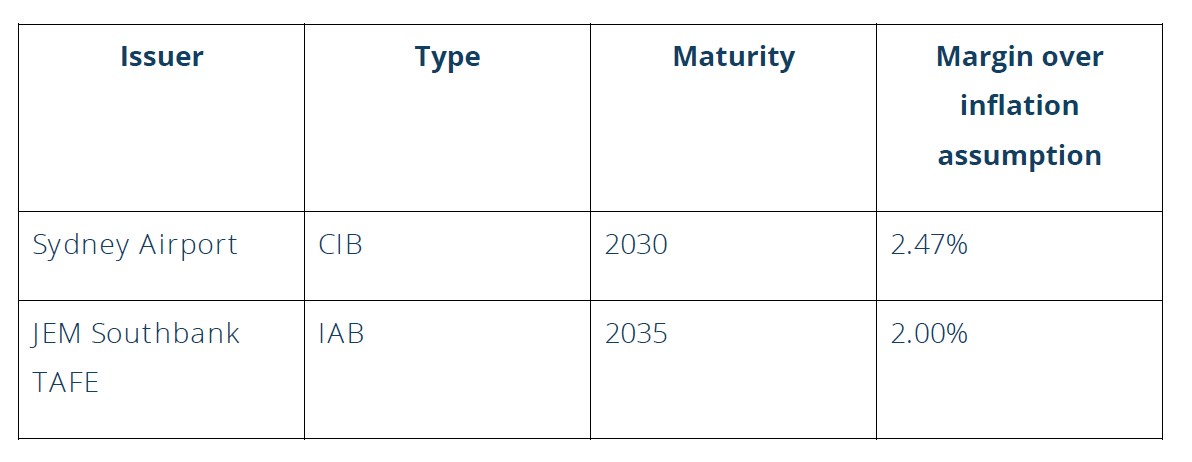

CIBs and IABs are issued by companies such as AGN, ALE, Sydney Airport, Royal Women’s Hospital and Australian National University, to name a few.

Margins correct as at 17 June 2022.

Please note both bonds shown are retail available.