The corporate world consists of a vast array of industries – but they’ve all been releasing results during the August reporting period. While some companies performed better than others, they are all faced with the challenges presented by

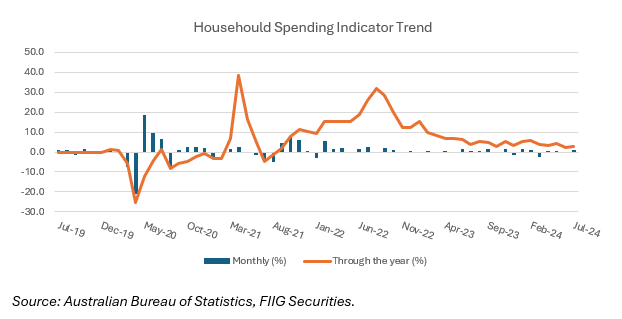

weaker economic conditions. The recently reported lower GDP growth, along with ongoing sticky (although moderating) inflation and higher interest rates have resulted in weaker consumer purchasing power. Household budgets were compressed, which reflects

the declining trend in household spending.

As a result, we saw some pull back on sales growth in certain consumer industries during the recent reporting season. However, corporate sales continue to benefit from Australia’s low unemployment rate (though slightly higher now) and population

growth, so companies have not yet experienced a material drop in sales performance (merely a lower volume of sales). The inflationary impact on raw materials and increasing labour costs have also added pressures to margins of many corporates. Companies

that focus on cost control / cost efficiencies and react quickly to changing consumer consumption behaviour changes have performed better. For example, Coles delivered a stronger result than Woolworths, underpinned by its greater focus on providing

greater value for price products and launching ready-to-eat meals, targeting both the more price conscious market and the growing population of people cooking at home instead of eating out.

Across the commodity sector, the majority of players are being pressured by weaker commodity prices. For most Australian commodity and mining companies, the potential upside over the coming years seems limited as China, Australia’s largest trading

partner, continues to experience a weakening in economic conditions. This is applying pressure throughout the sector, particularly evident in commodities such as iron ore (it has fallen over the last month but remains above levels seen during the

iron ore glut from 2015-19). With Chinese property development likely to decline due to lower GDP growth and other investment activities reliant on iron ore also looking likely to fall, it seems likely prices will decline. Companies that are diversified

across commodity types will, all else being equal, be in a better position to fend off single exposure risk. Companies that have a presence in precious metal production such as gold may benefit from a flow of investment into safe-haven assets as the

US election seems likely to result in even-larger US deficits, regardless of who wins.

Similarly for industrial and infrastructure industries, we are seeing cashflow pressure from large projects previously approved and working through the system. Companies that are able to push back or spread-out discretionary capex spending should be able

to weather any downcycle longer. Management’s willingness to adjust down dividend payout ratios are also viewed positively during this period where cash conservation is more relevant. This is particularly so if rates remain elevated longer than

current market pricing, which is FIIG’s view of the likely outcome. The interest rate hedging policies of the infrastructure companies are material too. Companies which have strong hedging policies are still enjoying low-cost funding from prior

years, while companies without hedging are facing higher interest costs already.

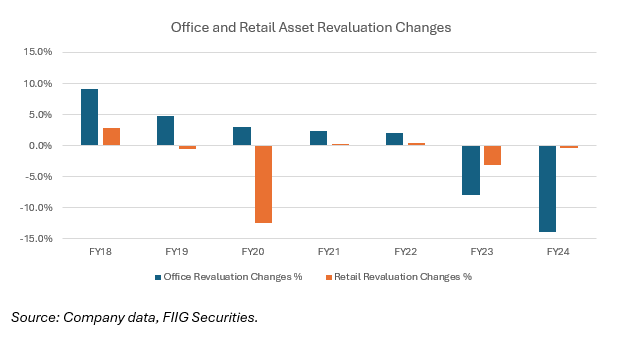

Real Estate Investment Trusts (REITs) continued to struggle as statutory profits were impacted by lower valuations. Office assets are still bearing the brunt of asset value falls as work-from-home arrangements remain a fixture in the labour market. Office

space is one area where more monitoring is required as the return to office progression is much lower than anticipated. Retail assets on the whole also declined, but only very marginally (and were positive across some individual companies) as the

lagged impact of the post-COVID spending continued and immigration increased. This, however, in our view, is a normalisation from peak levels in FY22 and FY23 and is likely to soften as time passes.

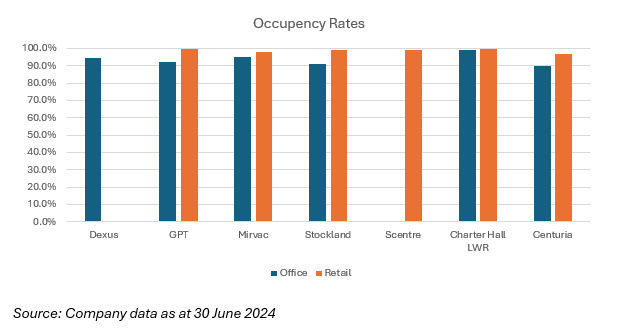

Rental income in some segments has been impacted by lower occupancy rates, though again, this has been largely isolated to the office sector. Retail assets generally saw increases over the last year.

While we expect REITs’ earnings will continue to be challenged in 2025, companies that do best will be ones with a mix of:

- A portfolio of prime assets with high levels of occupancy and limited vacancy rates.

- Ability to raise equity (if required)

- Successfully achieve asset sales.

Companies with these qualities should be able to better manage their cashflow and leverage positions. Companies that may be well positioned to execute the above are Charter Hall LWR, Scentre Group, and Dexus.

Conclusion

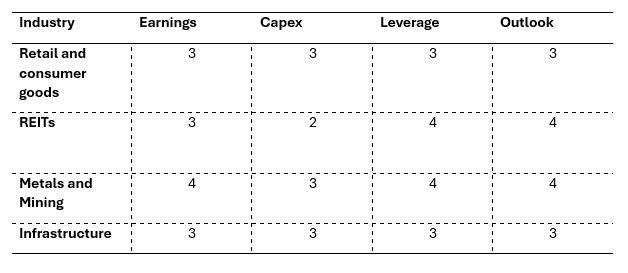

The map below summarises our assessment of credit performance by each of the industries that FIIG covers from the August 2024 reporting season. We rate this from 1 to 5 (1 = Positive, 2 = Moderately Positive, 3 = No Change, 4 = Moderately Negative, 5

= Negative ).