Moving down the capital structure of higher rated corporate issuers can be a smart way to add higher returns to well diversified portfolios. In this article, we take a look at what the capital structure is.

Background

The current interest rate environment, with inflation remaining stubbornly high and the likelihood of cash rate cuts being pushed ever outwards, has left many investors wondering about how to improve investment returns without taking on too much risk. Unfortunately, the relationship between risk and returns means that it is difficult to achieve better returns without taking on more risk, but some ways remain better than others.

There are two ways to take on additional risk in fixed income: either by increasing credit risk or by taking on more interest rate risk. Within credit risk, there are also typically two further ways to add incremental risk to generate a higher return.

The first is to invest in bonds issued by companies with lower and/or sub-investment grade credit ratings (such as the Emeco 6.25% July 2026 senior secured bond), and the second is to invest in junior ranking securities issued by larger investment grade rated companies (such as the Societe Generale 8.50% March 2034c hybrids). The Emeco bond and SocGen hybrid both have sub-investment grade ratings but sit at opposite ends of their issuer’s capital structures.

In this note, we will take a closer look at the second of the two options mentioned above – moving down the capital structure to junior ranking securities.

Capital Structure

So, what exactly is the capital structure? The diagram below should be familiar to most of our readers. It describes the simplified capital structure for a typical bank (as it includes term deposits). A corporate issuer would be the same but without this particular rung in the ladder.

A few of the main considerations when analysing the capital structure of a company include:

- Risk - ranging from senior secured debt as the least risky down to equities as the riskiest.

- Priority of payment in liquidation/administration - senior debt should be paid out first (with secured debt having first call on the specified security), then all subordinated debt, then all hybrid debt and if any funds remain, equity holders share the balance. Some lower ranking securities also have the ability to defer coupons, which are usually cumulative.

- Application of losses - equities bear the first loss and the security of senior debtholders’ investments are only threatened once all other junior capital sources have been exhausted.

- Maturity/call features - securities ranked lower in the capital structure tend to have longer (or perpetual) maturity dates with optionality for the issuers to redeem (call) the security prior to maturity. In accordance with risk, the expected long-term return increases as you move down the capital structure.

However, if as an investor you feel comfortable with the credit risk of a company, then by that logic you should feel comfortable investing lower down the capital structure of that company as the likelihood of receiving all the coupons and capital back on a subordinated bond is very high. Conversely, if the credit quality of the issuer is not as strong, then it makes sense to move higher up the capital structure when investing in the bonds issued by the company.

Also keep in mind, even when we talk about the most junior fixed income securities, they still remain far less risky than shares. If you feel comfortable investing in a company’s shares, you should feel even safer again about the risk of investing in even that company’s most junior bonds.

Current opportunities

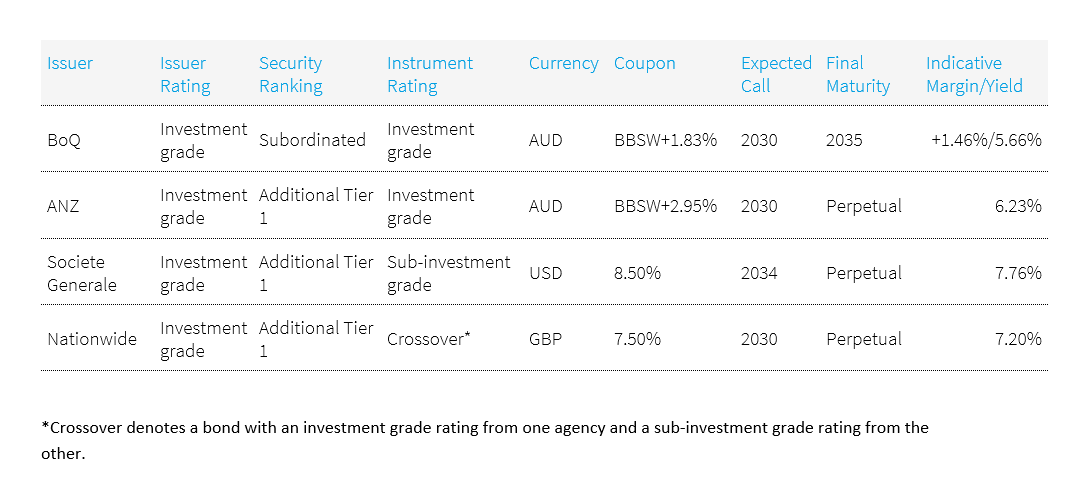

Below is a list of some recent investment opportunities, which sit lower down the capital structure of the issuer that our clients have been considering. Please contact your Relationship Manager if you would like further information about the risks and mitigating factors associated with these securities.