In light of the August 2025 reporting season coming to an end, FIIG’s Research team provides a summary of the different sectors and how they performed over the period. The overview includes consumer-facing corporates, financial institutions and insurance companies, resources and infrastructure, as well as Real Estate Investment Trusts (REITs).

Background

The August Reporting Season is now over. Results were generally fine, with very few companies showing any reason to be concerned, but also fairly few able to “shoot the lights out”. There’s a decent amount of pressure in the system at present (“a difficult backdrop”) and that’s showing as diligent companies putting up solid earnings results but no better.

There’s some early signs that there is a recovery underway on that consumption side of the economy, but there are also signs that consumer-facing businesses are suffering (or were suffering during the January-to-June period which was mostly the focus of these being reported). This is pressure, however, rather than failure. The banks, which are consumer facing in a way, have seen mild weakening in their arrears statistics but nothing overly concerning. Although overall, they remain stable and are still attractive for investment.

Miners have had quite divergent outcomes, depending on which type of commodity they are exposed to. Iron ore prices have shown significant resilience, gold prices have risen substantially, but lithium prices are falling and making life difficult for some. REITs continue to improve in terms of valuations and credit metrics, from what has been a challenging few years. Office space lags portfolios although some selective opportunities are emerging.

Here we provide a detailed overview for each sector’s FY25 reporting season.

Consumer Facing Corporates

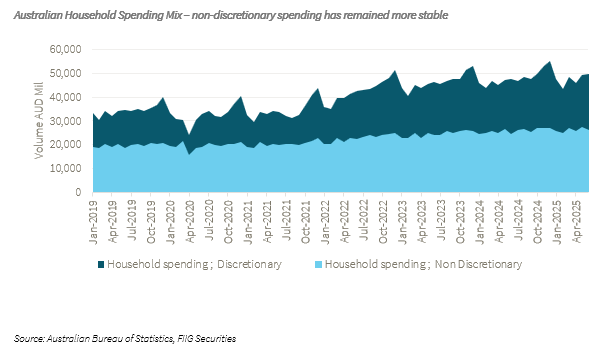

FY25 results from consumer-facing corporates highlighted the resilience of defensive supermarket earnings alongside weaker trends in discretionary categories. This aligns with the Australian household spending mix, where non-discretionary spending has remained more stable, while discretionary spending has been more volatile and slower to recover through the cycle. The two major players, Coles and Woolworths, delivered stable top-line growth despite ongoing cost-of-living pressures, but margin expansion opportunities through price increases remain limited. As a result, both groups are leaning more heavily on efficiency and automation, with large-scale investment in distribution and fulfilment centres expected to deliver structural cost savings over the medium term, even as dual-running and commissioning costs weigh on near-term profitability. For smaller players such as SPC Global, the path to sustaining margins lies in specialisation and moving into higher-value product categories. The group’s integration of Nature One Dairy and expansion into international channels highlight this pivot toward higher-margin niches, though leverage and execution risk remain important considerations. Liquor and discretionary retail banners, by contrast, continue to face headwinds from subdued consumer confidence and price sensitivity.

Overall, the sector remains anchored by the supermarkets’ predictable cash generation and conservative balance sheets, which underpin their investment-grade standing. Further down the spectrum, smaller food and beverage corporates offer higher risk-reward profiles, with upside potential from strategic repositioning but more vulnerability to competition, refinancing pressures, and cyclical weakness.

Banks and Insurance Institutions

The FY25 earnings season reinforced the resilience of Australian financial institutions, though with diverging pressure across segments. The major banks remain well-capitalised and highly defensive but face persistent cost growth and margin headwinds. Regional and speciality banks demonstrated stronger growth momentum, often outpacing system averages, though execution risks from integration, digital rollouts, and concentrated exposures leave them more vulnerable in a downturn. Non-bank financial institutions (NBFIs) continued to grow origination volumes and maintain funding access, but remain structurally more exposed to wholesale market conditions. The sector overall provides a defensive anchor, but risk-return vary meaningfully across segments.

Margin and costs remain the central themes across the majors, with net interest margin broadly holding up thanks to the residual benefit of the past RBA’s rate hikes and disciplined funding and cost management. CBA reported an increase in NIM by 9 basis points (bps), while NAB and Westpac posted small gains supported by treasury income and stronger business lending margins; ANZ lagged, with softer loan growth constraining revenue despite a steady margin. Cost pressure remains persistent, driven by wage inflation, higher technology and service costs, and ongoing investment in digitisation and regulatory compliance; while these initiatives should bolster long-term efficiency, they are weighing on near-term profitability and tempering the benefit of stable or improving margins. As the RBA’s easing cycle advances and deposit competition intensifies, the tailwind from higher interest rates is expected to fade, suggesting sector return are likely to stay under pressure despite generally sound asset quality and contained provisioning.

For insurers, FY25 results reflected a mix of strategic repositioning and cyclical tailwinds. Life companies are reshaping their portfolios toward more durable earnings streams, with short-term margin volatility giving way to improving long-term stability. General insurers, by contrast, enjoyed a strong year as benign weather and supportive investment returns boosted profitability and allowed for capital management. These results were also supported by the benefits of earlier premium increases, but with pricing momentum now moderating, that tailwind is beginning to fade. Taken together, the sector demonstrated strong capitalisation and franchise strength, though the sustainability of current earnings will depend on disciplined cost control, reinsurance protection, and the ability to navigate more normalised operating conditions ahead.

Resource and Infrastructure

Several broad themes emerge across the resource and infrastructure sectors following the FY25 results updates. The common thread across results is a pivot back to what works: cash-generating core businesses. “Boring” commodities such as iron ore and coal remain resilient, providing reliable earnings and supporting growth. In contrast, future-facing commodities like lithium and hydrogen continue to face pricing and operational pressures, leading to write-downs and a cautious approach to new investments. Energy transition remains part of the strategy, but for now it is being pursued more cautiously, with companies demanding clearer pathways to profitability before committing capital.

Recent macro developments including cooling US labour data and concerns over Federal Reserve independence, have pushed gold to record highs above USD3,500/oz, reinforcing its role as a hedge against economic and policy uncertainty. Year to date, gold prices have increased by more than 30%. Anticipation of Fed rate cuts and growing institutional interest in gold further support the metal’s upward trajectory. Companies like IAMGOLD stand to benefit directly from these dynamics, as their fully exposed gold production, strong cash flow generation, and disciplined cost management position them to capture higher revenues and free cash flow, making them a compelling way for investors to gain leveraged exposure to a rising gold price.

In summary, FY25 earnings season showed that mining companies are demonstrating a cautious and disciplined approach to capital allocation. Operational efficiencies, cost reduction programs and selective divestments were key levers pulled to increase margins. Meanwhile, companies are becoming more selective about pursuing energy transition, with many companies focusing on core competencies rather than novel, and often times costly technologies.

REITs

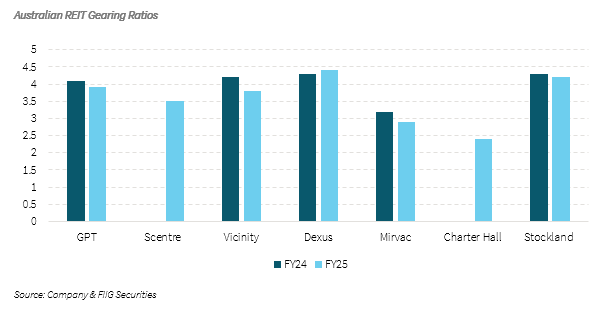

The last few years have been challenging years for the Australian REIT sector as it was impacted by structural and cyclical headwinds such as COVID-19, rising inflation, and higher interest rates. FY25 saw the beginning of green shoots as all companies reported an improvement in performance and - more importantly for bond investors - stronger credit metrics. Disciplined execution of corporate strategies has started to flow through to balance sheets and alleviate cashflow pressures, while supportive market conditions aid a turning point in the sector. All REITs reported a statutory profit for FY25. That’s a material turnaround from FY24 which saw losses for most companies (Scentre, a notable positive exception, reported a profit for the corresponding period in FY24 and again in FY25). The profits were underpinned by a stabilisation in asset values, with most reporting an uplift in 2H25 valuations across segments (although the Office segment lagged portfolios). Occupancy rates across Retail declined while the Industrial segments were generally strong. Office performance was flat or slightly up mostly, flowing through to positive leasing spreads, and a trend lower in lease incentives. With the drag on portfolios from the Office segment, REITs upgraded assets to match demand and improve returns. From a balance sheet perspective, most had implemented a mix of divestment plans, capital recycling, capital partnering, lower corporate costs and more efficient debt terms to better manage balance sheets. This was evident in improved liquidity levels and gearing ranges being lower than FY24, although interest coverage ratios mostly weakened over the period. The Australian REITS covered in FY25 reporting include Mirvac, Charter Hall WALE, Dexus, GPT, Stockland, Vicinity and Scentre.

Strong capital management supported an improvement in credit metrics and balance sheet positions across all REITs. With portfolio valuations improving over the period, FY25 saw gearing ratios trend lower across most REITs with only a few higher (and all mostly within the mid-point of their target range and within rating covenants). Stockland forecasts a higher gearing ratio for 1H26 due to settlement cashflows falling in the latter half of the year but moderating lower again by FY26. All other REITs anticipate an improved FY26 gearing level with valuations trending higher.

Overall, the FY25 reporting season saw the beginning of a recovery in the REIT sector, with signs of improvement across the Office segment, leasing spreads, occupancy and other measures that had been negatively impacted by headwinds in the sector. Credit metrics are also stronger over the period, although noting some weakness still lingers across some measures, which should improve going forward. After a period of challenges in the sector, we anticipate period of strong performance and returns going forward.

Conclusion

The reporting season in Australia shows some signs of challenging conditions for some types of companies. However, these appear mostly related to the overall economy and are, for the most part, being well managed. Concerted focus on cost control is seeing most companies still return solid results, even if few are able to achieve major successes. For an economy in the midst of an economic slowdown (and with a decidedly volatile international backdrop), things are going quite well.