Following the recent FY25 reporting season, Australian Real-Estate Investment Trusts (REITs) showed signs of a recovery following the past few years of headwinds. The results also showed improving credit metrics and stronger balance sheets, which is very relevant for bond holders. In this article we discuss the improving trends for the REIT sector.

Background

The last few years have been challenging for the Australian REIT sector as it was impacted by structural and cyclical headwinds such as COVID-19, rising inflation, and higher interest rates. FY25 saw the beginning of green shoots as all companies reported an improvement in performance and - more importantly for bond investors - stronger credit metrics. Disciplined execution of corporate strategies has started to flow through to balance sheets and alleviate cashflow pressures, while supportive market conditions aid a turning point in the sector. All REITs reported a statutory profit for FY25. That’s a material turnaround from FY24 which saw losses for most companies (Scentre a notable positive exception, reported a profit for the corresponding period in FY24 and again in FY25). The profits were underpinned by a stabilisation in asset values, with most reporting an uplift in 2H25 valuations across segments (although the Office segment lagged portfolios). Occupancy rates across Retail and Industrial segments were generally strong, flowing through to positive leasing spreads, and a trend lower in lease incentives, while Office was flat or only slightly up. With the drag on portfolios from the Office segment, REITs upgraded assets to match demand and improve returns. From a balance sheet perspective, most had implemented a mix of divestment plans, capital recycling, capital partnering, lower corporate costs and more efficient debt terms to better manage balance sheets. This was evident in improved liquidity levels and gearing ranges being lower than FY24, although interest cover ratios mostly weakened over the period. The Australian REITS covered in FY25 reporting include Mirvac, Charter Hall WALE, Dexus, GPT, Stockland, Vicinity and Scentre.

Momentum in valuations and occupancy rates

Across all REITs the Office segment continued to lag portfolios with Industrial and Retail segments experiencing the better performance over FY25. Strong demand and limited supply underpinned this quick turnaround. The Office segment showed signs of regaining momentum, however. While it underperformed in terms of valuations and occupancy, the segment outpaced Retail across most REITS in leasing spreads, with the average increase in Retail across REITs at 3.3% versus 6.6% for Office. While all segments saw positive leasing spreads, the jump was biggest across Industrial and Office. This should translate to stronger occupancy and valuation growth in the Office segment going forward.

Valuations improved for most segments across 2H25 across, but only partially offset valuation declines for 1H25, and a minority of REITs reported an increase in portfolio valuations for the full year (Industrial for Dexus and Mirvac). As mentioned, Office was slower to recover from valuation declines across all REITs, but it now seems the trough has been reached. There is growing demand through return-to-work directives and less supply coming on board which are both contributing to underpinning valuations.

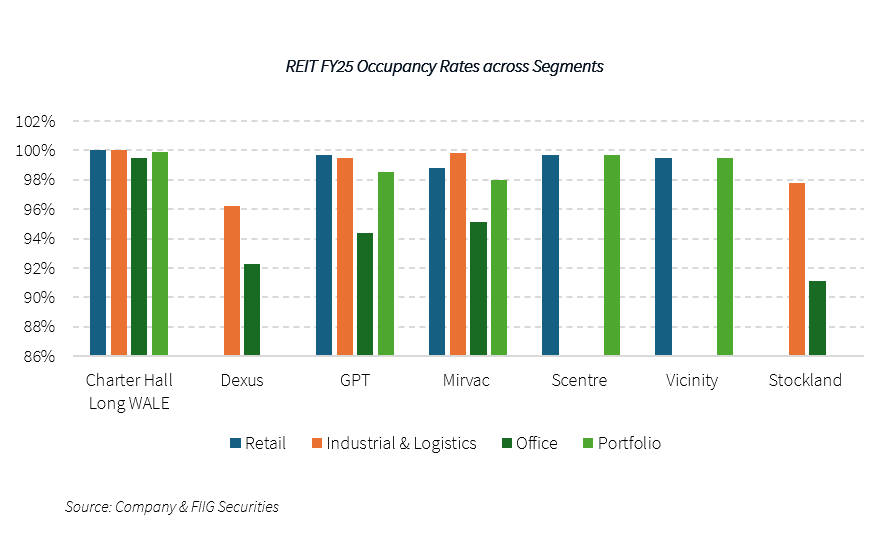

REITs recorded flat or a slight increase in occupancy rates for the Office segment in FY25, although behind other portfolio segments. The lowest occupancy rate for the Office segment was at 91.1%, compared to 96.2% for Industrial and 98.8% for Retail. Return to work directives, (noting Melbourne may lag the rest of the country as work-from-home practices are more ingrained), restricted supply, population growth and a tight unemployment rate is expected to further assist occupancy levels going forward for the Office segment. Upcoming office supply is low relative to long term averages providing scope for vacancy rates to fall and rents to grow.

A recovery in leasing spreads and portfolio quality

Stable growth in Retail and Industrial segments and stronger leasing spreads across most segments saw a trend lower in rent incentives across most REITs. The exception to this was Dexus, with higher rent-free incentives in place in the Office segment, noting these are from prior years and should trend lower. Going forward this will translate to a reduced drag on earnings and improved cashflow for REITs.

Australian REITs advanced on the improvement of their portfolio quality across all segments over FY25, in an effort to meet ‘flight-to-quality’ demand and improve performance - in particular for Office. Net absorption is strongest in premium assets, with Sydney CBD recording the highest level of net absorption in nine years over FY25. Dexus, for example, increased its premium office allocation to 58% for FY25, up from 31% in FY19 through divestments and acquisitions. The REIT increased its exposure to core CBD locations at 76% for FY25, up from 61% in FY19. Noting this was also a focus at Mirvac, which reported actively selling older lesser quality office buildings and adding premium, well-located buildings to its portfolio. This was also a theme across the Retail segment, where Vicinity has improved its premium allocation to 66% in FY25, up from 51% in FY22. This should see higher occupancy, rental growth and improved leasing spreads for REITs going forward.

Improving credit metrics for REIT bonds

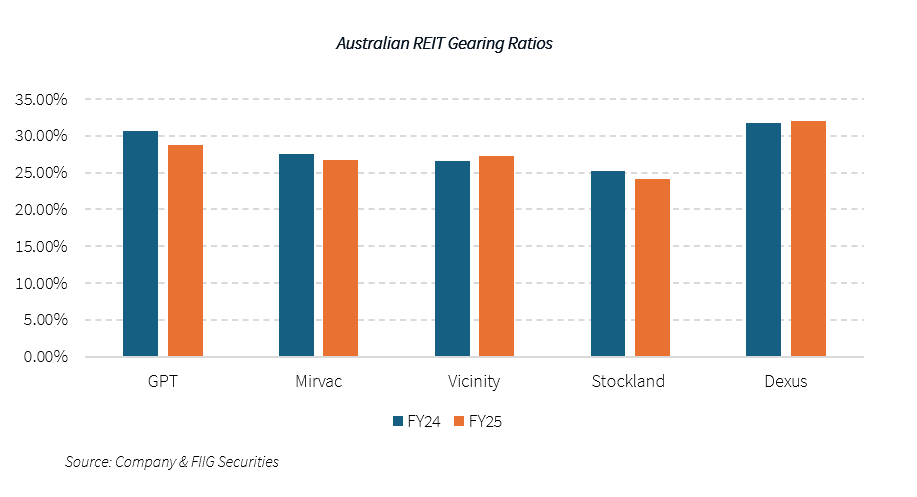

Strong capital management supported an improvement in credit metrics and balance sheet positions across all REITs. With portfolio valuations improving over the period, FY25 saw gearing ratios trend lower across most REITs with only a few higher (and all mostly within the mid-point of their target range and within rating covenants). Stockland forecast a higher gearing ratio for 1H26 due to settlement cashflows falling due in the latter half of the year but moderating lower again by FY26. All other REITs anticipate an improved FY26 gearing level with valuations trending higher.

Liquidity levels were another key credit metric that was stronger over FY25, and overall debt management, with most REITs reducing debt levels over the year. All REITs had increased their liquidity profiles (including cash and undrawn facilities) from FY24 and had sufficient headroom to cover short-term debt obligations. Charter Hall Long WALE REIT had AUD2.7bn of liquidity and no debt due over FY26 as it had refinanced over FY25 and extended its maturity profile. This was the case for other REITs also, with Dexus executing over AUD1.5bn of debt refinancing and new funding over the year at better terms.

Cost of debt was mixed across the REITs for FY25, overall though it’s expected the cash rate easing cycle will see lower borrowing and interest costs improve earnings going forward. While Mirvac’s average weighted cost of debt for FY25 decreased by 20bps, GPT recorded an increase of 50bps over the same period. Noting this sector has a larger amount of debt compared to other industries and will benefit from lower rates and ongoing active debt management.

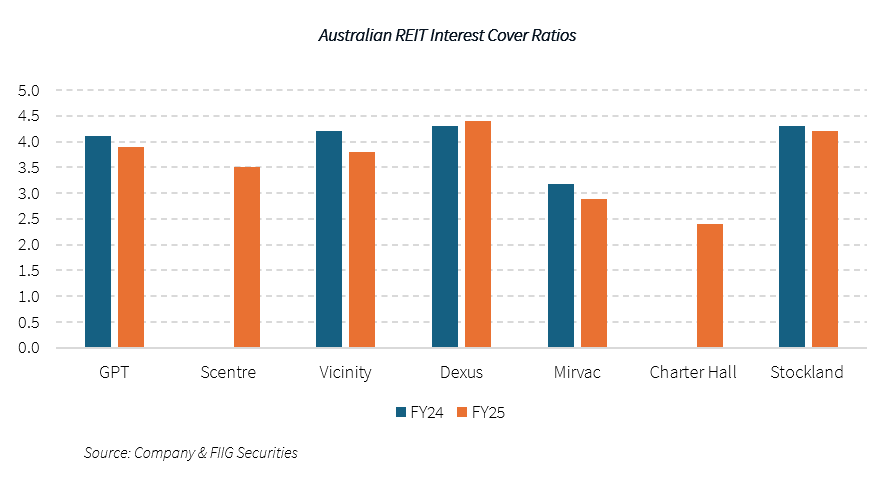

While the REITs reported improved credit metrics, generally the FY25 interest cover ratios weakened across the sector compared to FY24 (and longer). The REITs remain within their interest coverage limits for their ratings; it’s not a new trend and one that has been noted previously. Vicinity’s interest cover ratio weakened the most over the period, from 4.2 times in FY24 to 3.8 times in FY25. Noting as debt with lower borrowing and interest costs matures and is refinanced with a higher cost of debt, this will flow through to a lower interest cover. Vicinity had a jump of 20bps in its debt funding for FY25 from FY24. As we move further into the easing cycle this should see an improvement in interest coverage ratios.

With a recovery in the sector beginning to take shape, it’s worth looking at adding a REIT exposure to portfolios to benefit from the stable outlook for bond holders. While most of the issuers we discuss in this article have had existing bonds in the market for some time now and are becoming shorter in tenor (and lower in yield), Scentre Group recently issued a new fixed rate bond offering attractive value. The senior unsecured bond pays a semi-annual coupon of 5.35% and is available at a capital price near its issue price (at time of writing) in the primary market. It is offered at an indicative yield of 5.225% to its maturity date, which is in September 2035 (noting the bond can be sold prior to its maturity date as a key feature of a bond is they are tradeable). Also worth noting is the higher credit rating the bond has assigned from both S&P Ratings Global and Moody’s rating agencies. Scentre Group (Scentre) is a retail property group focused on investing and operating retail shopping centres in Australia and New Zealand. It is a vertically integrated REIT, with capabilities including property management, leasing, design, development, construction, marketing, and funds management. It is the largest owner and operator of shopping centres under the Westfield brand.

Conclusion

Overall, the FY25 reporting season saw the beginning of a recovery in the REIT sector, with signs of improvement across the Office segment, leasing spreads, occupancy and other measures that had been negatively impacted by headwinds in the sector. Credit metrics are also stronger over the period, although noting some weakness still lingers across some measures, which should improve going forward. After a period of challenges in the sector, we anticipate period of strong performance and returns going forward.