On average an investor is paid a premium for participating in new issues, making it more attractive to purchase in primary or soon after. In this note we highlight the opportunity and how investors can achieve better returns as a result.

Background

When a new bond is issued, generally an extra spread is offered by the issuer to incentivise investors to participate in the transaction rather than buy a similar bond in the secondary market. This premium is the difference between the primary issue yield on the bond and the yield on the same bond subsequently traded in the secondary market.

There are factors that will determine the size of the premium, and if there is a premium offered at all. The size of the issue, market conditions and appetite for the credit are some of the determinants.

Currently it’s a perfect storm for primary markets, where investors are scrambling for yield with current interest rates coming off highs not seen since 2012 and ahead of further rate cuts, fuelling demand for new issues. Yet despite strong investor demand tightening yields on new issuance, it seems investors are still paid a premium for purchasing newly issued bonds, as we discuss further below.

New issue premium

Over the past year we’ve seen strong participation in primary debt issues, where order books have exceeded the issue size and final pricing is revised tighter. For example, UBS’ recent new Additional Tier 1 (AT1) Capital note in AUD had a bookbuild in excess of AUD7.22bn, raising only AUD1.25bnand priced at a yield of 6.375% from initial guidance of 7.00% to its first call date.

There are many more examples of this, but the point to make is, despite pricing moving tighter, in most cases there remains a premium that is squeezed out the longer the newly issued bond trades in the secondary market.

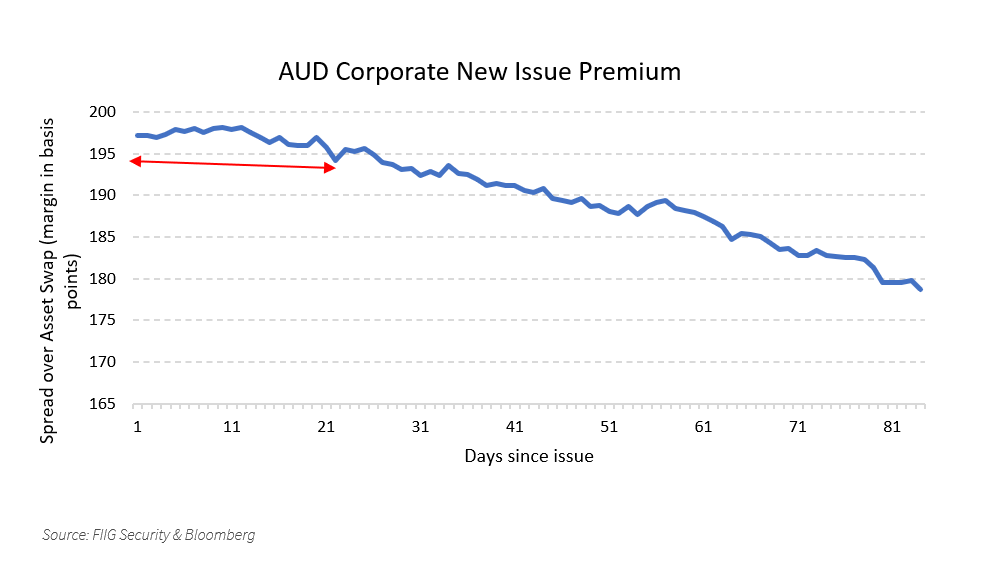

The chart below shows all publicly issued AUD-denominated bonds from January to June this year, excluding FIIG originated bonds and Residential Mortgage Backed Securities (RMBS) issues. The chart illustrates the change in the bond’s margin, remembering that lower margin (yield) results in a higher price (all other things being equal), as it trades in the secondary market post-issuance.

More broadly, it identifies on average there is price appreciation attributable to the margin when it trades in the secondary market, and more specifically this happens as late as 24-days post issuance, as shown by the red arrow. This means that even after the issue date it is worth topping up an allocation if the bid at primary was scaled to a lower-than-desired amount.

In the initial 24-day period following its issuance, on average a margin will tighten ~3 basis points (bps) from its issue margin, however the following 24-day period after this (48-days from issuance), the margin on average tightens by ~7bps. This trend continues the following 24-day period (82-days from issuance), with the margin on average tightening by an additional ~11bsp, squeezing the margin by ~21bps overall from its issue margin (and in turn pushing the price higher).

Therein lies an opportunity to lock-in higher returns by participating in the issuance at primary or purchasing within the following 24-day window as it trades in the secondary market. Following this, there has been a more significant move tighter as initial supply soon after primary is exhausted, and demand spurs the price higher.

Where the case is that new issues have been scaled in primary due to over-bid order books, the subsequent 24-days provides an opportunity for investors to top-up allocations in secondary trading while the premium is somewhat still priced in.

As mentioned, not all new issues experience an uplift in price when they trade in secondary as there are some exceptions. However, where the case exists, and depending on how significant the price appreciation is, this can also provide an opportunity to exit the position and lock-in any capital gains.

Conclusion

Issuers typically offer a premium for new debt raisings, to entice investors and ensure a strong level of participation for the deal. Even when pricing has revised tighter in primary as a result of strong order books, it has been shown that on average the margin has tightened further in secondary trading. More so, on average the price appreciation begins to gap after the initial 24-days following its issuance. This provides a window of opportunity for investors to lock-in better returns by topping up allocations in the first 24-days a bond trades in the secondary market.