Where some asset classes are inflexible with the timing of distribution payments, paying only at maturity or following half-yearly or yearly results, the many different issuance dates of bonds allows for regular payment schedules. In this article we discuss how bond holders can achieve a regular income stream from their bond portfolio.

Background

Something we often hear from clients is how they wish to achieve a regular income stream, and ideally a payment schedule that is monthly to ease budgeting pressures and to ensure fixed costs are covered. It’s not something that all asset classes can offer; Term Deposits typically pay once the term has ended (or more frequently but at a detriment to the return offered), while equity dividends are generally paid half-yearly or yearly following the reporting period.

Although fixed rate bonds typically pay semi-annually and floating rate notes pay quarterly, since bonds are issued at different times throughout the year, the timing of payments fall due at different times also. Hence, a bond portfolio can be created to offer a regular income stream, even monthly.

There will be cases where some months will see larger coupon payments compared to other months, but the regularity of income payments is maintained. The other thing to note is, that where equity dividend payments can change based on the company’s performance (and even not be paid at all), a bond’s coupon payments are known and are a legal obligation, where non-payment is considered an event of default.

Here we further explore how a fixed income portfolio can provide a monthly income stream.

Monthly paying fixed income portfolio

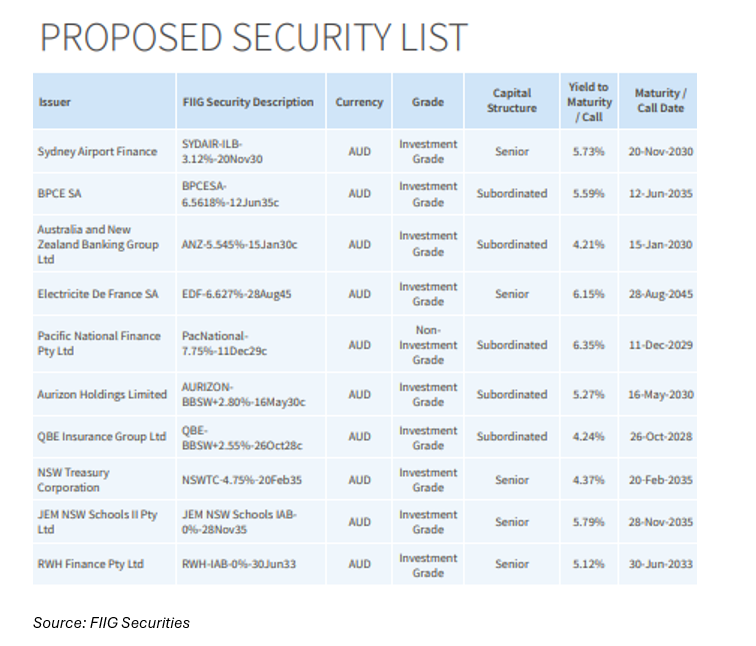

To show how a regular monthly income stream can be achieved through a fixed income portfolio we have created the below sample portfolio. This is for illustrative purposes only and is not to provide financial advice.

The portfolio is made up of ten holdings, with a $10k face value of each, and an overall portfolio spend of $106k. It’s mostly an investment grade rated portfolio, with only one that has a credit rating of non-investment grade and is mixed across subordinated and senior ranked bonds to offer diversification and a range of returns.

Based on current pricing at time of writing, the portfolio offers a yield to the assumed maturity date of 5.30%. It’s split between fixed rate bonds, floating rate notes, and inflation linked bonds such as capital indexed bonds and indexed annuity bonds. This mixture of different bond types that pay at different frequencies helps achieve a regular payment schedule.

Also noting this portfolio doesn’t have an allocation to a Residential Mortgage-Backed Security (RMBS), which typically pays a monthly coupon (as the coupon is made up of a margin above the 1month Bank Bill Swap Rate). Adding this to the portfolio would further bolster the monthly payments.

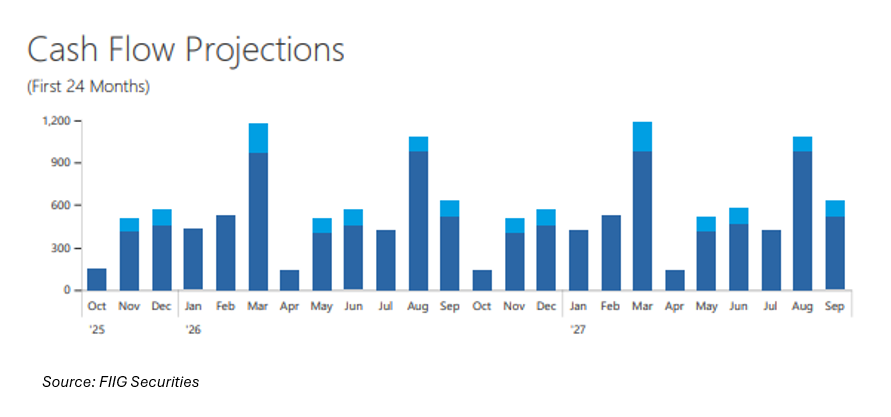

The above chart illustrates the initial cashflow over a 24 month period and demonstrates a monthly income stream. Across the entire life of the portfolio the total coupon payments are expected to be just over $48k, and principal repayments approximately $97k (these figures are forward-looking estimates only and will vary with inflation, floating-rate benchmarks and reinvestment outcomes). This payment schedule continues for the following years until some of the bonds begin to mature, which at the time of maturity or even prior (noting bonds can be sold prior to their maturity date), could then be reinvested into bonds with similar payment schedules.

As mentioned, some months pay lumpier coupons compared to other months, with the lowest coupon payment around $142 (which occurs only twice over the year), and the largest coupon payment around $1,190. The average coupon payment for next year is around $558 per month.

Conclusion

A monthly income stream can be achieved through a fixed income portfolio through a mixture of fixed rate, floating rate and inflation linked securities. The regular income stream helps investors with budgeting and also covering fixed costs for each month. While some other asset classes are inflexible with their payment frequency, direct bond ownership allows investors to tailor a portfolio to suit their income needs.