It’s been a big year for fixed income primary markets, both in terms of the amount of issuance and also the demand from investors. Here we look back at trends that emerged over the year in new issuance.

Background

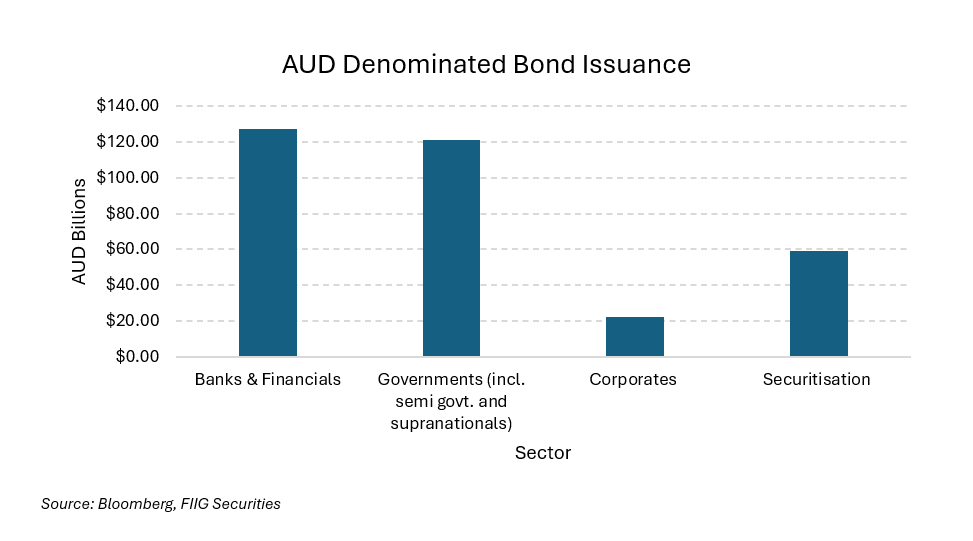

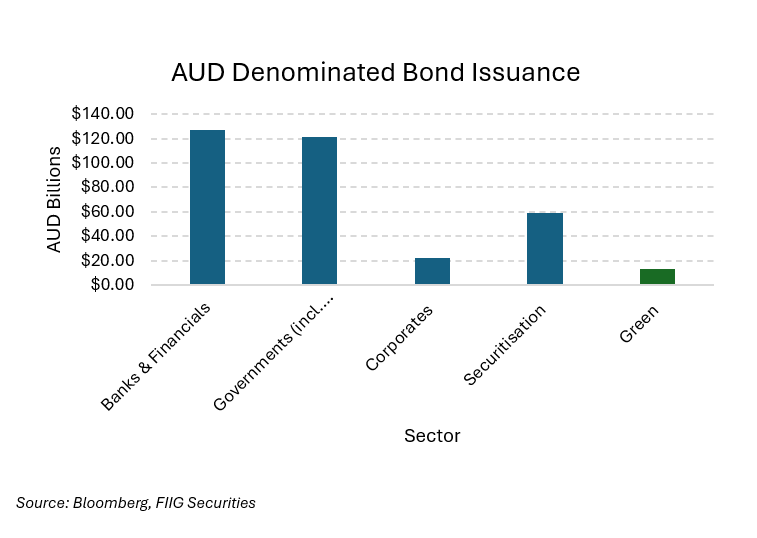

Over AUD270bn worth of AUD-denominated bonds have so far been issued in the 2025 calendar year across corporate, financial institution and government issuers, and over an additional AUD58bn worth of securitisation transactions. We expect further new issuance right up until year-end, so these figures include issuance up until time of writing.

While it’s a solid volume of issuance for the year, demand has been equally if not stronger, with pricing revised tighter from guidance on average across corporate and bank and financial order books.

Appetite for yield seems to have been one driver of demand, as investors took advantage of yields ahead of further Reserve Bank of Australia (RBA) rate cuts with an additional cut more likely than not. This also saw some new-style structured issuance come to market at better yields.

There was also a flurry of offshore issuers and investors turning to the AUD-denominated bond market for its stability when tariff related turbulence created uncertainty in the US market.

We further discuss below the key trends to emerge over the year in the primary bond markets.

A review of 2025 issuance

As is typically the case, government (AUD121bn) and banks and financials (AUD127bn) were the largest bond issuers by sector over the year, with both having larger funding requirements compared to corporates. The issuance size across these sectors can be seasonal depending on upcoming government projects and also regulatory capital requirements for banks and financials.

Trailing behind these sectors by volume was corporates, with AUD21.9bn issued for 2025. On average demand remained strong for corporate issues, possibly as a result of the smaller volume issued, with investors outstripping supply in primary.

The securitisation sector, which includes Asset Backed Securities (ABS) and Residential Mortgage Backed Securities (RMBS), had another robust year of issuance. In fact, in October this year it was the fourth largest month of issuance since 2017 according to Royal Bank of Canada, with AUD10.95bn printed across 13 public transactions.

There was AUD13.6bn in Green issuance for the 2025 calendar year, over double what was raised in the 2021 calendar year of AUD6.85bn, showing how rapidly the sub-sector has increased. Typically, Green transactions are heavily bid for in primary, as investors align their financial goals with their core values. This also means they can tend to price at tighter margins over benchmark compared to non-Green new issues, and at lower returns. However, investors are willing to sacrifice yield in return for holding an ethical investment. As such it can be a cheaper source of funding for issuers.

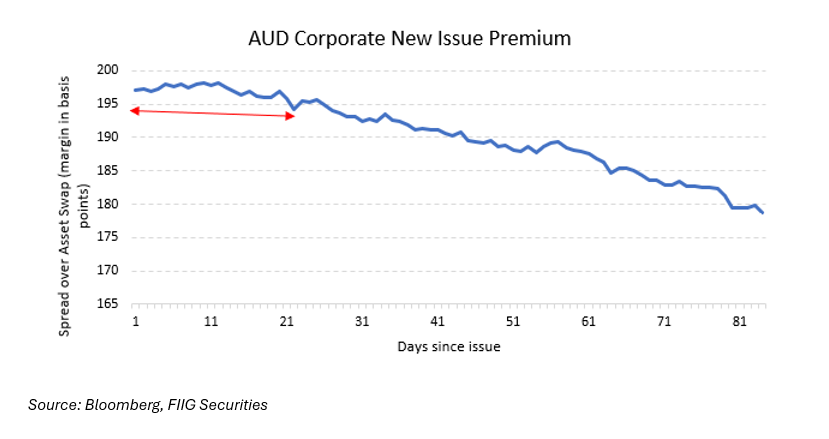

While, on average, demand remained strong in primary bond markets and margins crept tighter as a result, investors were typically still paid a better return than what was offered by secondary markets (new issue premium) for the equivalent bond. We further discuss this trend that emerged over 2025.

Red hot demand, tighter pricing, but a new issue premium still exists

Major central bank rate cut expectations, among other factors, helped fuelled a rally in global bond markets over the year. This was evident in the AUD-denominated bond market in particular, with some transactions being met with insatiable demand from investors and bumper order books. There were instances where primary issues were many times oversubscribed and pricing revised much tighter than what has been typically the case.

AMP Limited issued a new Tier 2 Subordinated 10-year non-call 5-year floating rate note, tightening from initial guidance of a margin of 215 basis points (bps), which then tightened at launch to 205bps and then again at final pricing, issuing at 190bps. The hot demand saw the transaction eight times oversubscribed and an order book in excess of AUD1.01bn, with only AUD125m raised.

Another example is from Global bank, UBS, which issued its first Additional Tier 1 (AT1) Capital note transaction since 2019. Very hot demand saw pricing revised significantly tighter to a yield of 6.375% to its call date, from initial guidance of 7.00%, and an order book of over AUD7.22bn (lowered from AUD8bn following revised pricing),with only AUD1.25bn issued. While this type of insatiable appetite, heavy scaling and a large revision in pricing is not typical of the Australian bond market, it’s very much true for European AT1 market norms.

But it was Commonwealth Bank of Australia (CBA) that had record-breaking demand for its senior unsecured 5.25-year and 10-year dual-tranche transaction. The order book was around AUD13.2bn, the largest in Australian credit history, while only AUD5bn was issued across both lines. Investors were keen to add safer allocations of a higher credit quality to portfolios with risk assets trading at record highs at the time.

These show the more extreme demand and price tightening seen in the AUD-denominated primary market over the year. Most deals, where the pricing was revised tighter and demand was strong, behaved within ‘normal’ standards. We have previously discussed this in an earlier Wire article (read here), where we showed despite pricing moving tighter, on average there remains a premium that is squeezed out the longer the newly issued bond traded in the secondary market.

The chart above shows all publicly issued AUD-denominated bonds from January to June this year, excluding FIIG originated bonds and RMBS issues. The chart illustrates the change in the bond’s margin, remembering that lower margin (yield) results in a higher price (all other things being equal), as it trades in the secondary market post-issuance.

More broadly, it identifies on average there is price appreciation attributable to the margin when it trades in the secondary market, and more specifically this happens as late as 24-days post issuance, as shown by the red arrow. This illustrates that despite solid demand in primary markets, there is typically further price tightening in the secondary market, and new issue premiums can still on average be offered in the primary market.

New issuers in AUD market and new types of issues

There was also a trend of European and offshore domiciled issuers raising debt through an inaugural AUD-denominated transaction, where previously these issuers would have tapped the US bond market. German leasing company, Grenke raised AUD125m through a 5-year fixed rate senior unsecured bond and French government owned utility EDF raised AUD1bn through a 10-year and 20-year senior unsecured fixed rate bond. Another example is the Republic of Indonesia, which launched its inaugural Kangaroo 5-year and 10-year senior unsecured notes.

It's advantageous for investors in the AUD-denominated bond market, as they were able to access returns and exposures that otherwise wouldn’t be available. Furthermore, it broadens the depth and liquidity of the domestic bond market.

With US trade talks causing market turbulence and the independence of the US Federal Reserve called into question over the year (not to mention the longest running government shutdown taking place), issuers were diversifying away from US exposures. This saw issuers that would otherwise tap the US bond market issue bonds in the AUD-denominated bond market.

Along with new issuers, a new type of issuance also crept into the AUD-denominated bond market, a Tier 2 Subordinated 20-year fixed rate bullet note. ANZ was the first to launch this type of tenor and structure, where typically Tier 2 Subordinated notes have an optional call date prior to the legal maturity and as such a shorter tenor (where they are assumed to redeem at the call date). However, this longer tenor provides a bigger pick-up in yield, and ANZ’s order book was skewed towards the 20-year bullet note compared to the 15-year non-call 10-year note it was also issuing at the time. More recently, Westpac followed suit and issued its own 20-year Tier 2 Subordinated fixed rate bullet note.

Conclusion

It’s been a big year for the AUD-denominated bond primary market, spoiling investors for choice across tenors, returns and issuers. Solid demand on average held up despite the volume of issuance, and even despite an additional three rate cuts from the RBA over the year. Investors were attracted by the more attractive yields on offer in the primary market.