Background

FIIG’s Head of Research, Philip Brown, recently released the Quarterly Macro Outlook, providing insight into what to expect from markets going into year-end. We bring you condensed version of the full report, where we explore the key themes, trends and the strategies. In this week’s edition of The Wire, we discuss Part 1, where we look at the current economic landscape and the outlook for the Reserve Bank of Australia (RBA). In Part 2, which will be included in the next edition of The Wire, we discuss some of the risks we currently see in the market as well as how we believe investors can best position their fixed income portfolios to best mitigate these risks. Please click here to read the FIIG Quarterly Macro Outlook in full.

The economic outlook for Australia

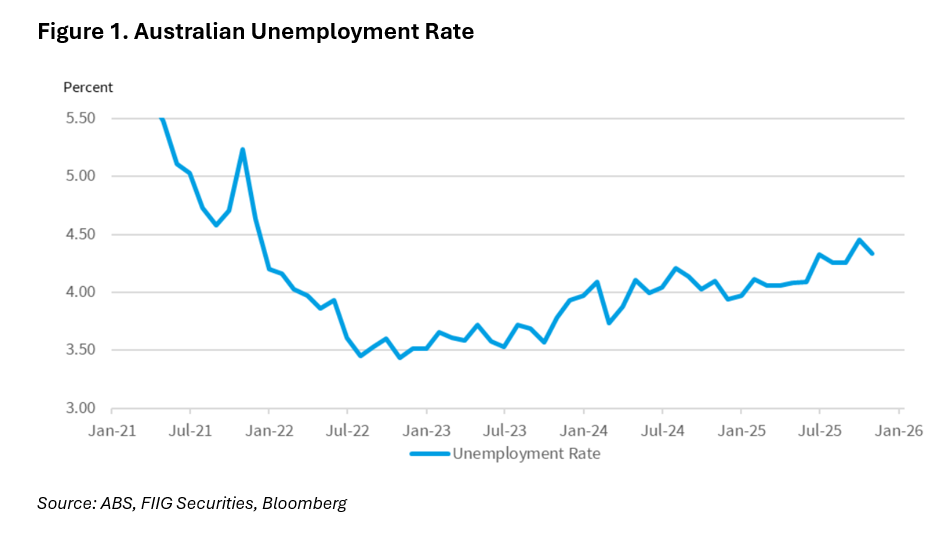

The Australian economy is currently performing well, especially in areas the RBA can influence. Inflation has moderated into the RBA’s 2–3% target band, though it remains near the upper end. The latest unemployment rate has fallen slightly to 4.3%, painting a seemingly positive headline figure. The fall from 4.5% in the previous month of September might seem large, but when viewed to two decimal places, shows that the improvement was just modest decline from 4.45% to 4.34%. Taking a step back, the broader trend in the unemployment data is clear, there is an upward trajectory to it.

This suggests that there is a gradual weakening in the labour market rather than a robust recovery that most headlines are reporting. This nuanced view of the labour market is important because it challenges the perception that employment conditions are strong enough to justify monetary tightening. Instead, the data implies that the labour market may be more fragile than it appears, reinforcing the case for caution in adjusting interest rates.

The economy has shown signs of strength, but nothing too out of the ordinary. However, there have been material signs that the economy couldn’t take even a moderate increase in growth without a substantial rise in inflation.

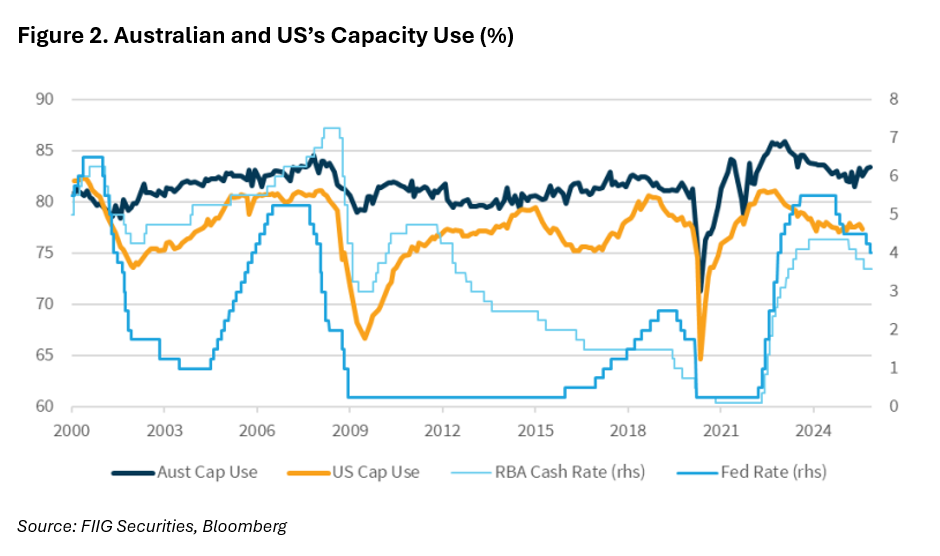

To explain this, we use the concept of capacity utilization, which measures how much of the economy’s productive potential is currently being used. When demand exceeds what the economy can comfortably supply, capacity utilization rises, often leading to inflation. During the inflation surge in 2022–2023, capacity utilization was very high. Although inflation has since moderated, capacity utilisation remains elevated, not low enough to indicate meaningful slack. This concern was echoed by RBA Deputy Governor Andrew Hauser , who warned that without slack, growth and inflation become tightly linked.

Contrast this with the decline in capacity use in 2009, where capacity usage was trending downward towards the 80% level while inflation was trending lower too, suggesting that slack was developing the economy.

The recent upswing in credit usage, with housing lending data for Q3 rising 9.6% on the quarter, along with RBA commentary on a lack of spare capacity means that it is unlikely we will see rate movements in the short term. FIIG Research is still of the opinion that a rate cut is more likely than a rate hike in the near and medium term, but the balance is much closer than it used to be three months ago. Moreover, we maintain our view that the most likely path for the RBA is a long, elongated rate cutting cycle.