We have previously published articles explaining the particular things to look for in both an individual bond and also the issuer of a bond, when evaluating an investment.

It is important to consider these criteria before buying a bond, but events during the life of a bond can give the investor a chance to re-evaluate the position and make sure that the original thesis for investment still holds.

Bonds can have a number of pre-determined milestones built into the documentation which are important for investors to consider, such as early calls, but there are also other events that can make changes to the way investors view a bond.

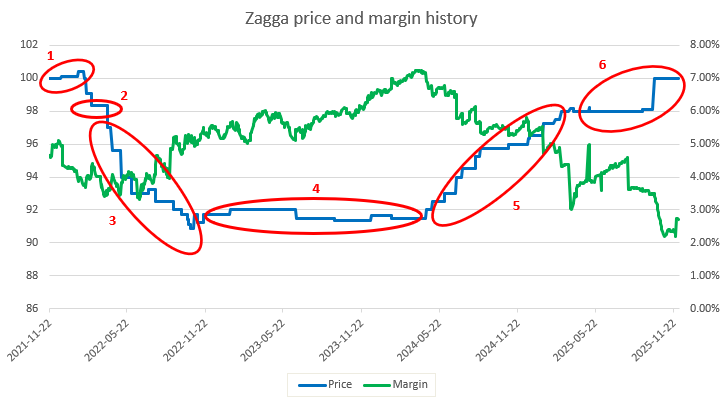

We shall use the example of the Zagga 6% November 2026 bonds to highlight some of the events that can occur over the life of a bond. This bond has just been refinanced into a new four-year floating rate bond paying 3M BBSW +4.20%.

The chart below is a graphical representation of how these events played out through the lens of the (indicative mid-market*) price and margin of the bond and show how underlying conditions or events influence the performance of the particular bond.

1. Primary issue

Zagga was founded in 2016 with a mandate to provide access to commercial real estate debt in a market space that was being left as banks pulled back from offering finance to residential property developers.

This market had traditionally operated on a single asset basis and Zagga wanted to bring securitisation principles to this hugely disconnected market by offering a pooled structure with a first loss piece ranking beneath the Notes to provide loss protection apart from that inherently contained in the conservative LVR held against the particular property lent against.

The timing, in hindsight, could not have been better for Zagga. They issued in November 2021 while interest rates were still being held near zero due to the COVID pandemic. The initial massive uncertainty and lockdowns were behind us, but the recovery was still a way away.

The initial margin was attractive for the risk at 4.30% over 4-year swaps. Base interest rates were low at the time, and the bond was priced with a 6% coupon.

Showing the characteristics of most new bonds that display a new issue premium, the price rose shortly after issue. However, in early 2022 it became clear that interest rates were too low and inflation was on its way back. The first rate rise from the RBA followed at the May 2022 meeting and rose by 4.25% over the next 18 months.

2. Tap of the bond to fund continued growth

Growth in the underlying loan book of Zagga brought them back to the capital markets in March 2022 when they raised an additional $15m.

The willingness of investors to lend further funds to Zagga, of course at the market price which was a slight discount to the par value and as a result at a higher yield than the coupon rate, marked a further vote of confidence in the business. The real test was about to come.

3. Rising rates – the fastest ever

The RBA raised rates more quickly than in any hiking cycle in history from May 2022 to June 2023. The increase of 400 basis points had severe impacts on fixed rate bond prices that were set when the rate was 0.1%.

Rising interest rates typically place lots of stress on economies, which in turn increases the risk of business failures. This is reflected in the rising credit margins witnessed during this period

The relatively short time to maturity of about 3½ years contributed to the relatively good price performance – a fall in the bond price of approx. 9%. Other bonds with higher credit ratings, lower coupons and longer maturities fell into the 80s in price as yields rose, demonstrating the impact of duration on bond prices.

Bonds with higher coupons have a lower modified duration – the measure of interest rate risk – and shows the value of taking measured credit risk as a way to manage the overall risk balance of a portfolio. In other words, don’t take just credit or interest rate risk – a mixture of both is usually the best for overall portfolio stability.

4. Stability but uncertainty remains

As the bond travelled this period after the great rate rise, the period to maturity got progressively shorter, but the price remained stable.

As a result, with an upward sloping yield curve, the margin and yield on the bond got higher as the base rate got lower due to the shorter tenor. The impact of the return of the capital price to par (100) now became a larger and larger factor in the yield of the bond.

This period persisted for about a year and a half from Dec 2022 to June 2023.

Performance of the trust and the underlying loans remained stable during this period, again enabling the payment of the 6% coupons on time.

5. Price recovery as pull to par begins

The continued stability of the underlying loans, reflecting Zagga’s robust underwriting and the fiscal support for the economy as it moved out of the COVID phase and back into normalisation began a renewed period of confidence in the bond.

The price was also at a low level given the short tenor to maturity and represented an approximate 9.0% yield to maturity, which given the performance was deemed by the market to be too high. Buyers began stepping in and the price rose in an almost straight line for a year as the credit margin reduced to more normal levels for a short-dated bond with sound fundamentals.

6. The road to repayment

The Zagga bond had a scheduled maturity date of November 2025, a year in advance of the final legal maturity date in November 2026.

Issuers tend to prefer to refinance liabilities before they get to within a year from maturity as that keeps them in the non-current section of their balance sheet – i.e. not imminently repayable. This maintains stability in the business’ funding profile and removes refinancing risk.

Yields on short to medium term investment grade bonds in 2024 were around 6%, so an ~8% yield in Zagga wasn’t unreasonable, and there it remained until October this year, when a refinancing announcement was made. The price immediately rose to par (100).

In the middle of November a new bond was priced, with an upsized $65m issue size from the earlier $45m, to support further business growth.

In the four years of the initial Zagga bond’s existence, the company has grown by approximately three times, and yet the new bond offered a very similar credit margin to the first time, at 4.20%.

7. Conclusion

Many events over the life of a bond influence the price and the appetite of investors to either buy, hold or sell the bond.

Some of these are discussed above and provide investors with checkpoints to ensure the original thesis still holds, and then to take action or not.

Understanding the fundamental credit risk of lower or unrated bonds is critical to these decisions as we have outlined above.

*Note this is not a price at which bonds may be bought or sold, but is the indicative ‘fair value’ price in the middle of the bid and offer prices at which bonds were sold and bought respectively