The recently issued Woolworths green bond has opened up a discussion within the FIIG client base on ethical bond investments. Here we take a look at what’s on offer in this space.

Ethical bonds, which cover a spectrum of investments within the environmental, social and governance (ESG) framework have gathered a lot of interest in the past decade as investors look to sustainable investment options.

Generally speaking, there are three categories of investors to consider when looking at the demand for ethical bonds.

- ESG agnostic investors who have a mandate to maximise yield from investments. These investors may express their ethical views in other forms such as philanthropy.

- Investors with a mandate to do no harm. These investors screen bonds to avoid issuers that may have a negative footprint. As an example, these investors avoid companies with revenues from alcohol, tobacco, weapons, gambling, animal testing or negative environmental impact. However they are also conscious of achieving higher investment returns by not pursuing specific ethical designations or screening.

- Investors that target specific bonds with a direct social or environmental impact or with ethical investment accreditations such as green bonds, noting that these investments typically pay a much lower yield.

The market

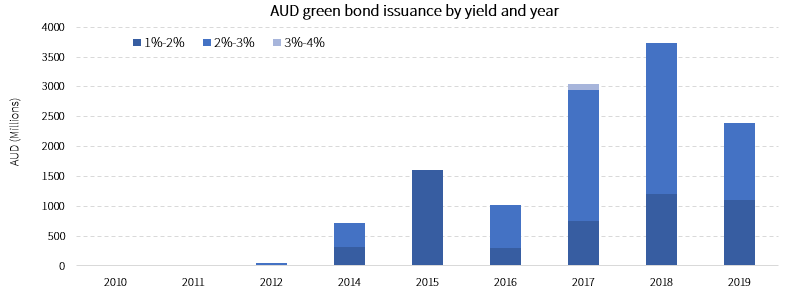

Since 2010, there have been 39 bond issues in AUD that have a green bond indicator (excluding the recent Woolworths deal). As the chart below shows, the majority of these bonds have a yield between 1% and 3%.

Source: Bloomberg. Yield represented by yield to worst.

Source: Bloomberg. Yield represented by yield to worst.

These bonds have a strong demand from the institutional investor base, specifically funds with specific mandates. These funds tend to buy at issuance and hold the bonds to maturity. This means that there is very thin liquidity (availability) of these bonds in the AUD secondary market. Also, due to strong demand, primary issuance tends to be heavily scaled.

Investment options

Below is a list of securities for ethical investors to consider. It includes bonds issued with specific ESG designation as well as those that, we believe, fit the ‘do no harm’ criteria (these are noted as N/A under ESG designation).

Investors without specific mandates wanting access to ethical investments can consider the following bonds, which do not have an ESG ranking but meet the filter of not causing any direct harm from an ESG perspective.

| Security | ESG designation | Maturity | Yield |

| Woolworths 2.85% | Green bond | Apr 2024 | 2.21% |

| IADB 1.95% | EYE bond2 | Apr 2024 | 1.53% |

| Royal Women’s Hospital IAB* | N/A | Jun 2033 | 4.34% |

| Plenary Health Finance IAB* | N/A | Sep 2029 | 4.31% |

| JEM NSW Schools IAB* | N/A | Nov 2035 | 4.48% |

| MPC Funding IAB* | N/A | Dec 2033 | 4.27% |

| Australian National University IAB* | N/A | Oct 2029 | 3.87% |

Source: FIIG Securities. Prices accurate as of 26 April 2019.

1Based on indicative pricing, subject to change

2 EYE bonds fund education, youth and employment projects

* The yield of these bonds assumes a flat rate of inflation at 2.50%