Now that we are mid-way through February and as Australians we try and move into a Covid-normal environment I have had the pleasure of again talking with many clients around the opportunities and threats for 2021.

With interest rates remaining at record lows, and the RBA reinforcing its view last week that it was prepared to continue to fund its bond buying program to keep rates at current levels, many of our clients have expressed their needs and desires for increased returns on their money.

I have also had the chance to do a lot of reading since Christmas and I am seeing a lot of comments around the similarities with 2007 and the GFC - which many will remember all too well.

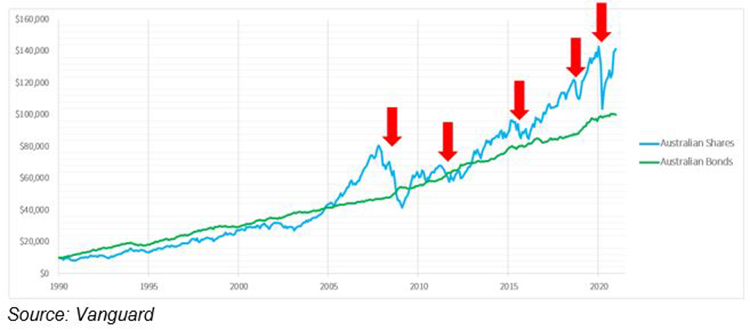

Whilst the conditions that led into the GFC were different, one thing I urge all investors to remember is that market ups and downs with occasional global shocks are par for the course and no matter what the conditions the key mantra to never lose sight of is maintaining an asset allocation in keeping with your own personal risk profile.

As we approached the GFC many investors who got their fingers burned were those who allowed their asset allocation to become heavily skewed to growth asset classes, as they got caught up in the above normal equity returns in the markets of 2006 and 2007. Many also took this opportunity to further leverage themselves through borrowed funds, also known as margin lending.

It was also during this time that John Howard and Peter Costello, in attempting to assist Baby Boomers to increase the value of their tax effective superannuation funds, allowed a one off $1m contribution to their retirement nest egg. Some even borrowed to facilitate this contribution.

A large amount of these funds ended up in the share market in timing with a final rally in the ASX200 from July to November 2007. The global shockwaves of the US sub-prime mortgage crisis then saw the market plummet 54% over the following 16 months.

It’s important to remember that your asset allocation can become skewed in two main ways.

- By changing your overall tactical asset allocation to be more heavily weighted to growth vs defensive asset classes through amending or adding cash to that asset class.

- Allowing asset values in property or shares to become inflated during times of high growth, similar to what we are experiencing now.

Maintaining and observing your asset allocation during the current market volatility is paramount when looking to observe and heed the lessons of the past. Trying to time market entry points is incredibly difficult, especially when such a large part of the current share market performance is based on central banks maintaining monetary supplies.

The way to avoid the pitfalls and capital destruction of a global market shock that will inevitably form part of investing, is to ensure your allocation to growth assets such as shares has not been allowed to creep over and above the limits you have set yourself in a post-retirement asset allocation.

Note the lack of volatility in the bond line in the chart above compared to the equities line.

I have recently had several conversations with clients who are frustrated with the level of returns they are receiving in their bond portfolio compared with domestic and global share markets.

Firstly, bonds are a defensive asset class. As a specialist in fixed income, FIIG is not trying to compete with the returns from the equities market. Whilst double-digit returns can exist in a market sitting on a price-to-earnings ratio (P/E ratio) of 20x (or for the US S&P500 over 30x), bonds are designed to provide stable capital valuations in return for reliable income streams.

Whilst interest rates remain at record lows it’s important to understand the limitations of a bond portfolio, and to remember why bonds form a crucial part of your portfolio asset allocation. Should we see a return to sub-prime crisis conditions, a well-diversified, high quality bond portfolio will cushion your capital from the shockwaves that could certainly upset your post retirement plans.

Many of you will have heard the old adage to use your age as a rough guide to your bond portfolio allocation, i.e. a 70 year old should have 70% invested in bonds/fixed income. Whilst I won’t go into the limitations of this strategy it nevertheless provides a starting point for conversation.

Certainly in the current market circumstances I would suggest reviewing what your asset allocation looks like given the speed of the stock market recovery since the COVID lows that could very easily see you sitting well and truly outside of your comfort levels of growth vs. defensive allocations.

Given the craziness we have seen in share market trading over the past few weeks with words like GameStop, Bitcoin, Reddit chat rooms and silver shorting guiding investment decisions, it is well worth remembering the words of one of the greatest investors in Warren Buffett - to be fearful when others are greedy.

Please reach out to your Relationship Manager to discuss how FIIG can look to cushion the impact of any future market shocks with a high quality diversified bond portfolio.