Over the past two years, the USD has risen against all major currencies by around 18%, including a 15% rise against the AUD. But the USD has fallen back slightly in recent weeks. This has caused some debate whether the USD’s bull run has come to an end

In this article we examine some of the factors driving this volatility and look at the implications for the AUD/USD exchange rate, Australian bond yields and US bond yields in particular.

Key points:

- Global economic growth over the next 5 to 10 years will be below historic averages.

- Central banks will maintain interest rates at much lower levels than seen prior to the GFC.

- The US economy is the most fundamentally sound of the major economies, but cannot withstand rapid escalation in the USD.

- The USD is likely to continue its rise against most currencies in coming years, but Fed will hold rates lower to minimise the impact on the economy.

- The Australian economy faces a substantial uphill battle to replace the mining investment boom’s contribution, particularly given this weak global outlook.

- Deflating the AUD is a must in this environment.The AUD has not yet responded to the low interest rate differential with the US, but will eventually concede probably triggered by another rate cut or even a shift in traders’ sentiment. I expect the AUD/USD cross will fall toward 70c and potentially beyond.

- Volatility remains a key feature as global markets adjust to the “new normal” of lower interest rates, and to decipher genuine economic growth from temporary QE responses.

Back to basics - Currencies are heavily driven by bond yields, which are in turn driven by economic fundamentals

Currency markets and bond markets are linked. The higher the bond yield in one currency, the more attractive that currency will be to investors on a like-for-like basis for other factors like risk (higher yielding Greek bonds are not more attractive than German bonds for example).

Yields will rise if the market perceives that central banks are more likely to increase interest rates, which they will do if they perceive a risk that their economy is overheating and likely to push up inflation.This means that all other things being equal, a stronger economy increases the chances of rate rises, and conversely a weaker economy reduces the chances (or increases the chances of rate falls).

So the question of whether currencies are over or under-valued ultimately comes back to the economic outlook and whether markets have over-bought or over-sold that economic outlook. As we outline below, in many cases we believe that markets have over-bought growth, that is growth will be lower than markets are expecting.

Where do the fundamentals point?

Macro themes globally point to a slower global economy for some time:

- Other than India, every major economy faces a declining working population.

- Currency wars are damaging global recovery, as seen with the impact of the USD on the US economy this year.

- Deleveraging financial institutions results in declining lending, particularly to small business.

- Government debt overhang will constrain fiscal spending and/or result in more taxes, constraining economic growth.

- And the process of weaning economies off years of quantitative easing is proving challenging even for the relatively strong US economy.

Data over the past two years has confirmed this slow rate of recovery. Figure 1 shows that economic momentum, as measured by the OECD, has become increasingly negative in the past 18 months.

Figure 1. OECD Economic Momentum

Source: OECD, FIIG Securities

Slow global growth will mean central banks will keep rates lower. Moreover at present, many central banks are using interest rates to keep their currencies competitive, that is keeping interest rates lower to keep their currency down.

In combination, fundamentals and this policy approach will keep global rates lower for longer.

The only question is therefore which countries will surprise markets with stronger economic growth than that priced into their bond yields and currencies.

Life isn’t quite that simple - Fundamental values are distorted by shorter term drivers

The challenge of course is that life isn’t this simple - short term market forces also influence the market such as institutional trading activities and intervention by central banks.

So this means we need to look through the volatility created by these activities, and the associated media commentary that goes with that, and identify long term value.

The weakness in the USD over the past few weeks is a strong example of the importance of understanding the difference between short term trading trends and long term fundamental value. The US economy is the strongest of the world’s major economies, but because there was too much money trading on the rise in the USD, it rose faster than the US economy could cope with, ironically causing the Fed to slow its interest rate cycle.

Similarly, traders buying bonds issued by EU countries ahead of the ECB’s QE program caused rates on those bonds to fall to almost zero, and in some cases into negative territory.

Now the USD and EU bonds bull trading is unwinding a bit. The USD has slipped back, and EU bond yields have risen, although this is changing daily.

Implications for the USD

In the long run, when QE is finally wound back, rates in the US will be higher than in Europe reflecting its stronger long term prospects. This will support a stronger for longer USD.

The challenge for investors in USD is that the transition through the ECB’s QE program and the associated volatility for currency, bond and equity markets, will mean that the USD will have phases of weakness. This is a buying opportunity for those able to see through the short term noise, but for those not wanting volatile investments, currency markets may not be the best choice as long as QE remains in place.

Figure 2. US versus German bond yields

Source: USEU, FIIG Securities

AUD outlook

When looking at the AUD’s relative value therefore, we have to take into account the above fundamental factors and the actions of the RBA and short term traders’ reactions to news flow.

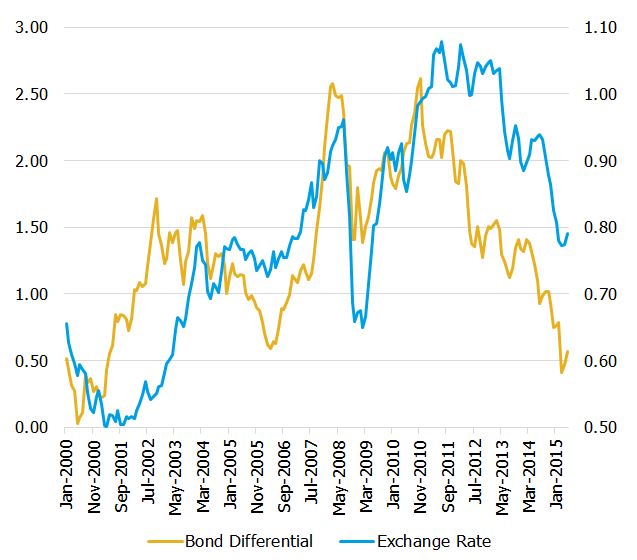

Fundamental factors point to an overpriced AUD. Figure 3 shows that the interest rate differential between the US and Australian economies has fallen far more than the AUD/USD exchange rate.

Based on differentials, the AUD/USD should be more like 60-70c. Then looking at the outlook for interest rates, a fragile Australian economy, a central bank with a stated policy of pushing the AUD toward 75c at least, and further downside risks should China not navigate its deceleration effectively, all add up to little prospect for rising interest rates in Australia.

While the US interest rate outlook isn’t for steep rises, their next move is clearly upward whereas Australia’s is downward.

For this reason, despite the recent trading levels, most of the major banks now have their forecasts for the AUD/USD around 70-72c, with some of the major global banks forecasting as low as 65c.

Figure 3. Major economies including AUD

Source: FRED, FIIG Securities