Britain’s decision to exit the EU has shocked every asset market across the globe

The statistics on market movements reads more like a daily report from the Shanghai Stock Exchange, not so called developed markets. This volatility is caused not only by shock from the vote itself, but also the timing: markets were already nervous about the global economy and high valuation levels in equity markets.

This volatility could trigger a major shift in asset allocation, back into lower risk assets such as cash, bonds and gold. It could also mean a renewed nervousness about the potential for the next big vote, the US presidential election, to go against the odds.

What does it mean for the British and European economy and asset markets?

In the long run, Britain’s decision to leave could be better for its economy, particularly due to its ability of continually attracting migrants (even if the political leaders of the day don’t choose to use this new ability) while controlling the flows in slower economic times. However, the next two years at least will be very volatile times for all British investments: currency, property, equities and bonds.

For Europe, this is nothing but bad news. In the short term, 10 year German Bunds (government bonds) were sold off, despite the likelihood of more monetary support being injected by the ECB. Equity futures markets are pricing in 6 to 10% falls across all markets when they open in a few hours.

In the longer term, this potentially spells the beginning of the end for the EU. Nationalist movements have been on the rise across Europe, with Brexit simply being the first to go to a vote.

The EU’s stability was tested by Greece, continued to be tested by the Brexit vote announcement, and then worsened several political parties creating anti EU sentiment across Europe in recent months. This vote will create support for “leave” campaigns across the union, and weak leadership shown during the Greek crisis did not instil confidence that the EU will be able to manage this much larger issue.

Is the selloff a buying opportunity?

Markets react immediately to these shocks because those responsible for investing shareholder or investor’s monies will take money out of the market while they consider the bigger picture. This means there is usually an excessive shift out of risky assets and into cash, bonds and gold. Whether markets bounce back depends upon what the implications of Brexit are for institutional traders and those that set their risk limits.

In the immediate term, it is still far too early to tell. Setting positions on based on the likelihood of markets overreacting would be consistent with historic market shocks, but that doesn’t change the fact that this is a high risk trade. For more conservative investors, the favoured course is, as always, to step back and look at the fundamentals.

Those economic fundamentals will be impacted by Brexit, but to wildly varying degrees. Britain and Europe face a great deal of economic and financial market volatility now: Britain simply because it will take years to figure out the ramifications of their exit; and Europe because of the knock on impact for the stability of the EU itself.

For the US, China and Japan – the three other economic superpowers – the impact will be limited to the financial markets by and large. Some impact from the change in currency levels will flow on to export markets, but otherwise it is business as usual.

Back to the big picture

With the first of the three big sideshows of 2016 behind us and the markets now pricing in Brexit (or at least their initial thoughts of Brexit’s impact), it’s time to move back to the big picture: how to invest for income in a lower for longer global economy.

Employment growth picture tells a thousand words

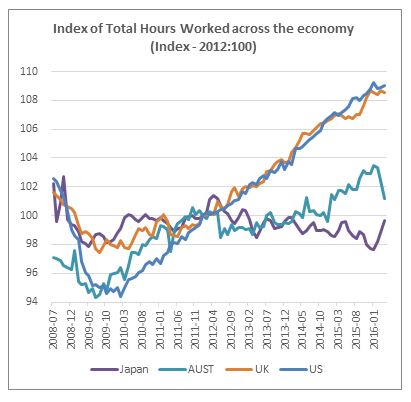

The chart illustrates:

- The weakness of the Australian employment market in the past few years.

- The strength of the US and UK* economies since 2012

- The weakness of the Japanese economy since the GFC

*With Brexit now a reality, the future of the British economy is more uncertain than that for any major economy since the GFC. There is a high likelihood that the orange UK line on this chart will move sideways for some time, which could cause the Bank of England to lower rates and hold them lower throughout the transition period.

*With Brexit now a reality, the future of the British economy is more uncertain than that for any major economy since the GFC. There is a high likelihood that the orange UK line on this chart will move sideways for some time, which could cause the Bank of England to lower rates and hold them lower throughout the transition period.

The chart measures the total number of hours across the whole private sector for each of the economies. It is “centred” around January 2012, when the mining boom slowed suddenly and defined the start of the post mining boom Australian economy.

The chart shows that the US economy was the most affected by the GFC, but has bounced back strongly and remained on a solid recover since 2012.

The UK and Japanese economies had smaller dips, and the UK economy continued on a growth pattern by 2012, like the US. Japan on the other hand has not recovered, and other than a recent minor recovery, is trending lower year after year.

The Australian economy had a similar scale dip to the UK and Japan, but thanks to the mining investment boom, recovered much faster. However, in stark contrast the UK economy, Australia’s job growth has stalled since 2012.

Conclusion

That’s the key point for Australian investors: Australia’s economy is at its weakest since the recession of the early 1990s. Job growth is weak, leaving wage inflation at record lows. This in turn leaves the outlook for inflation very low, and so the RBA has little reason to raise rates and plenty of reasons to lower them.

Lower rates in Australia means a weaker Australian dollar. And at the current levels of 73c to 76c (73.45c at the time of writing), markets are yet to fully price in this weakness, particularly relative to continued strength in the US economy. Despite the shockwaves caused by Brexit today, US interest rates are far more likely to increase in the next few years than Australian rates. For long term investors, that is the bottom line.

While the volatility from the Brexit vote plays out, opportunities to get a higher price for AUD switching into USD remains. Investors confident about the future of Britain once the dust settles will certainly have a great opportunity to switch AUD for GBP at very attractive levels, but this is a trade for the brave at least for the next few days, if not weeks.

For investors looking to position themselves in USD denominated corporate bonds, this is a great time to consider what bonds are available and whether they suit your portfolio. The AUD is still overvalued in my view and the chances of Brexit being the catalyst for a major shift into lower risk assets is high and rising.

Market movements during the day

I have written the article several times already today and no doubt by the time it is read, these statistics will change again and updates should be obtained online. However for those interested this was the summary at the time of writing:

- The GBP fell 11% against the USD and 7.5% against the AUD

- UK equities futures are off 10%, Germany’s DAX futures are off 9%

- The Yen jumped against the USD on the back of expectations of their central bank increasing its Quantitative Easing program will step up again

- The AUD fell against the USD by 2.9c to 73.8c by mid afternoon (3.8%) and a unprecedented 8.4% fall against the Yen to 74.6¥

- The Euro fell by around the same as the AUD against all currencies

- Nikkei (Japanese share market) fell by 8% due to the impact on their earnings from the sudden rise in the Yen

- Australian shares were off 3.5%, with major exporters like BHP and Macquarie off more than 7%

- US markets are closed, but their futures are implying a 3.5% fall in line with Australia

- Bond yields have fallen in most markets (ie prices have risen), except the UK:

- US 10 year bond yields dropped below 1.5%pa and the 2 year yield implied that the US Fed will only increase rates twice in the next 2 years

- Australian bond yields are off around 20bp across 2 year, 5 year and 10 year durations. This implies the RBA is expected to drop rates at least twice more in the next two years and stay at those levels for the next five years

- UK bonds on the other hand are up in yield terms and off in price as investors sell off all UK investments