Typically, corporate bond credit spreads fall when equity markets and government bond yields rise. In the past few months, particularly during the Trump rally of last week, the relationship failed. Equity markets and government bond yields rose, but credit spreads have fallen behind. This either means that both equity and bond markets are mispriced and due for a correction, or that credit spreads are due to tighten

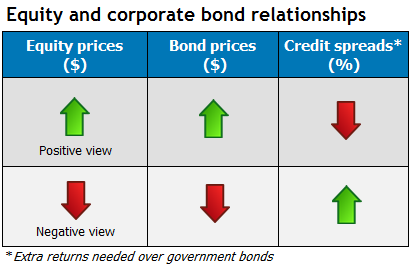

The relationship between equity prices and bond prices is widely understood – when equity prices rise, bond prices fall and vice versa. In other words when equity prices rise, bond yields rise. This relationship is intuitive; equity prices rise when investors are happier to take on more risk. Investors will reallocate from bonds to purchase equities, given that bonds and equities are the two major asset classes for the world’s largest investors. Likewise, equity prices will fall and bond prices will rise when investors want to reduce risk.

Relationship between credit spreads and equity prices (and what is credit spread?)

The relationship between credit spreads and equity prices is less widely understood, but no less intuitive. A credit spread is the amount of yield above the risk free government bond yield that an investor is paid, for taking on the extra risk of a particular company defaulting on its bond obligations. This is called credit risk.

When investors are feeling more positive about a company’s prospects, they should be willing to both pay more for the equities and accept less yield for taking on credit risk in that company. The result is that credit spreads tend to fall when equity prices rise and vice versa.

Like all such relationships in financial markets there are no guarantees, but for statistically minded readers the correlation is -0.70, that is a very strong negative relationship. Figure 1 illustrates the strength of the negative relationship by inverting the credit spread chart (flipping it upside down). You can see that they follow a similar pattern over the last five years until the last few months.

Credit spreads are out of sync with equity and bond prices

In our webinars and seminars in June to August this year we showed equity yields, government bond yields and credit spreads all on one chart. It showed that credit spreads for BB rated bonds had not tightened as much as they should have, given the rise in equity prices and the change in government bond yields. Since then, US credit spreads have tightened 60 basis points (bps), profiting anyone that followed that trade at the time.

As shown in Figure 2, after that tightening, spreads resumed their negative relationship with bond yields until the FBI announcement about Clinton’s emails just prior to the election. While they then recovered part of that rise in spreads in the Trump rally last week, there is clearly a disparity between the large jump in bond yields and the fall in spreads.

Conclusion

Based purely on numbers, credit spreads would need to drop around 30 to 40bps to align with the big change in bond yields last week. Or it could be that bond yields overreacted and need to fall by that same amount. What your view is will depend on whether you think Trump will cause as much inflation as the market has now priced in. Either way, corporate bond yields are set to drop and therefore their prices set to rise – either because government bond yields will drop or because credit spreads will drop.

This data is from the US market, however similar patterns have occurred in Australia. Investors can take advantage of this result by using US or Australian corporate bonds of sufficient duration to profit from the fall in yields, but at the moment we suggest not taking too much duration risk until Trump’s actual policy positions are clarified.

Glossary

Credit risk

The risk that an issuer may be unable to meet the interest or capital repayments on the loan when they fall due. Generally, the higher the credit risk of the issuer, the higher the interest rate that investors will expect in order to risk lending funds to the issuer. Ratings agencies like Standard & Poor's and Moody's provide an independent credit rating service that allows investors to assess and grade issuers.

Credit spread

The difference between two securities' yields based exclusively on the variation in credit quality. For example, Australian government bonds which are rated AAA and a corporate bond of a lower credit quality, single A. For investors to accept a higher risk asset like a corporate bond they must be paid a higher yield. The difference in margin between the government bond and the corporate bond is known as the credit spread.

Yield

The yield is the expected return on an investment. For more information on the different types of yield, please visit this article.