As global markets brace for ongoing uncertainty caused by higher inflation and rising interest rates, bonds offer investors certainty through regular coupon payments and the repayment of capital at maturity at a known price. Here we discuss these key benefits.

Background

With central banks globally chasing down higher inflation through aggressive rate hikes (even Australia’s central bank has joined the pack), equity markets are falling, and bond yields have shifted higher.

While the capital price of longer dated fixed coupon bonds is lower as a result (although we expect a flight to safety in due course that will see yields tighten), it can be said if an investor is comfortable with a bond’s individual credit quality, then they should also be comfortable looking through capital price movement.

The reason for this is that unlike discretionary dividends paid on shares, the coupon payment on a bond is a contractual agreement that a company must meet. Furthermore, unlike equities, bonds have a specific repayment date when the issuer must repay full principal back to bondholders.

Here we further delve into these key features bonds offer and the certainty they offer investors during periods of capital price weakness.

Fixed coupon bonds

With rates higher, the capital price on longer dated fixed rate bonds has fallen- remembering the inverse relationship between a fixed bond’s price and its yield. However, longer dated fixed coupon bonds form a core holding of a portfolio and offer investors a level of protection.

Irrespective of capital price movements, issuers have a legal obligation to meet coupon payments and the repayment of capital at maturity. Failure to do so is considered an event of default.

With this in mind, when selecting longer dated fixed coupon bonds, we generally prefer investment grade rated exposures and those paying a higher coupon. The higher running yield provides somewhat of a buffer for periods when there can be downward price activity. Alternatively, better returns can be achieved when bonds are purchased at a significant discount to face value, providing opportunistic entry points.

While having the assurance of a maturity date, bonds also provide an investor with the comfort of a known redemption price, whether it be optional calls prior to the final maturity date (sometimes at a premium to face value), and/or a final maturity at par ($100). This means that regardless of where the bond trades over its tenor, an investor is aware of the final capital price they will receive at redemption.

Furthermore, with the concept of time value of money, as the bond’s tenor shortens, the bond’s capital price can improve. When a bond is originally issued, the credit spread paid over the risk-free rate is higher the longer the bond has until maturity. This is due to there being more credit risk (risk of default) associated with lending for longer periods, compared to shorter periods of time, and for the optionality of redeploying funds being lost.

Over the life of the bond, as the length of time to maturity gradually shortens, the credit margin and risk-free rate both decrease (all things being equal) as duration and credit risk are gradually priced out. With this, the bond’s original yield moves lower, causing the bond price to rally.

While a longer dated bond is more sensitive to interest rate movements, impacting its capital price and making it less appealing to exit at a capital loss, a balanced portfolio with an exposure to shorter dated and floating rate notes will provide better liquidity options during these periods. Floating rate notes, where the coupon is reset each quarter, are less exposed to duration and interest rate risk.

Case study – Omni Bridgeway

To better demonstrate these key bond features, we will look at the recent early redemption of Omni Bridgeway’s 2026 fixed coupon bond. These bonds paid an attractive 5.65% coupon and were issued in 2019.

The bonds had the option of early call dates, where the issuer could redeem the notes prior to its 2026 final maturity date, but at a premium to par (compensating investors for the early redemption). In 2022, the call price was at $102.00, which then dropped by $0.50 each year until the redemption price reached par ($100) at maturity.

While the bonds had a 7-year tenor (where longer dated fixed coupon bonds can be closer to 10 years or more), they were also sub-investment grade, which saw more price sensitivity to credit spread widening.

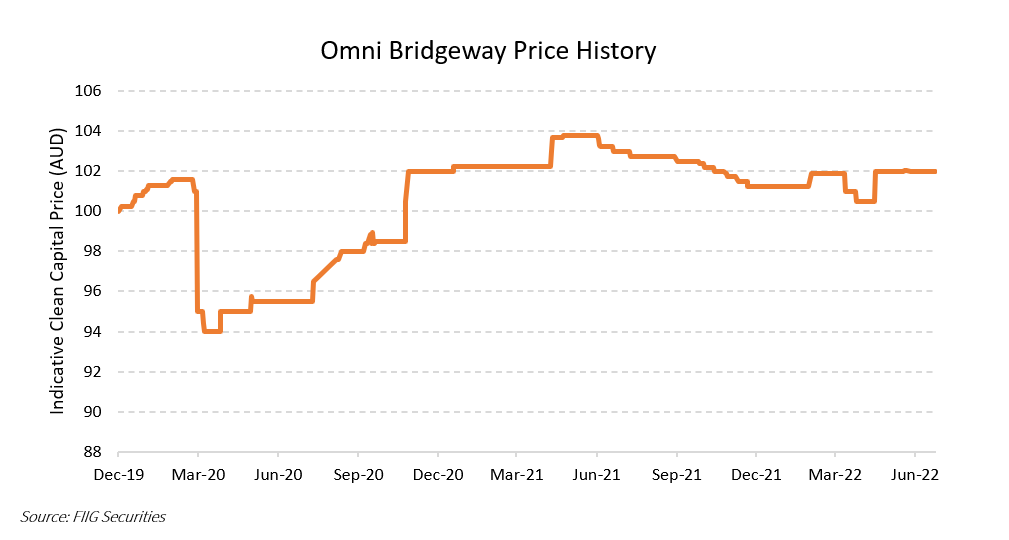

As the chart below illustrates, the capital price traded at a discount to face value at periods, reaching lows around $94 during the height of the COVID-19 pandemic. However, despite any price movements, the notes continued to pay their high coupon at each set payment date and still offered investors a known maturity date and price.

Following this capital price weakness, the notes traded higher over the course of that year and were then redeemed early at $102 in July 2022. Showing the capital price upside (and additional return) a noteholder would have forgone if they were to have exited during the price weakness.

It illustrates the importance of looking through any price volatility if an investor is comfortable with the credit quality of the individual exposures, as this does not inhibit the issuer’s ability to make coupon payments or repay the capital at maturity.

Conclusion

With equity markets correcting and bond markets repricing for higher inflation and higher rates ahead, there remains ongoing uncertainty. However, bonds provide investors with some certainty, unlike equities, with an issuer legally obligated to make coupon payments and the repayment of capital at maturity and at a known price.