The rise in rates since the start of the year has been historic – the fastest in the bond market in nearly 40 years.

This means that there are opportunities across the whole spectrum of the market for the first time in a long time, as yields on all bonds are markedly higher, and in many cases higher than the dividend yield available on the equivalent shares.

Banks are often looked to for their strong dividend yields, but also have many options available as they issue bonds from all parts of the capital structure.

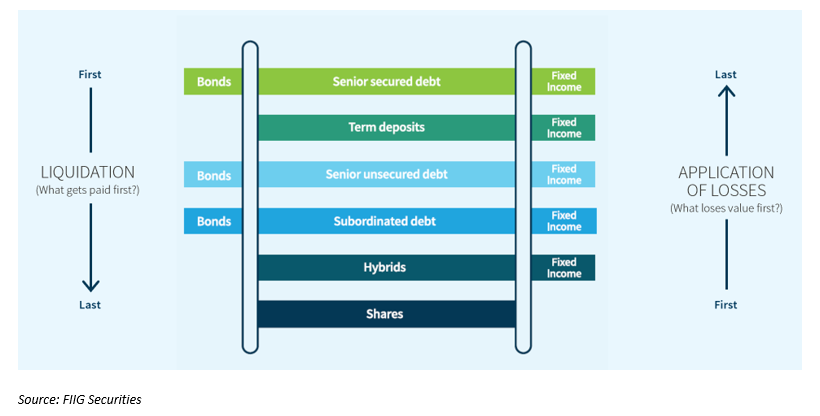

As a reminder, the capital structure determines the order in which funds are paid out to creditors if the business is wound up, as shown in the below diagram.

Therefore typically, the lower in the structure, the higher the risk, and also the higher in yield for bonds issued by the same entity.

One major consequence of the rise in yields since the start of the year is that the most conservative bonds, the equivalent of senior secured bonds from banks, also known as covered bonds, are offering attractive yields.

Rated AAA due to them being guaranteed by a pool of mortgages which is required to have a value maintained at more than the amount outstanding in the bond. They are legally unsecured obligations of the issuing bank, but the guarantee effectively places them above other unsecured bonds in the pecking order (hence them being the equivalent of senior secured debt).

For example, in the Royal Bank of Canada’s covered bond program, as at June 30, the value of mortgages supporting the bond program was approximately CAD $118.6bn against the value of bonds outstanding of approximately CAD $57.3bn.

Given the AAA rating assigned to these bonds, they represent some of the lowest risk bonds available. However, the yields they offer, along with the liquidity available in the bond market versus a bank deposit for example, makes them an attractive proposition.

They are also typically available in a fixed or floating rate option for investors who would rather one over the other, or both types of coupon.

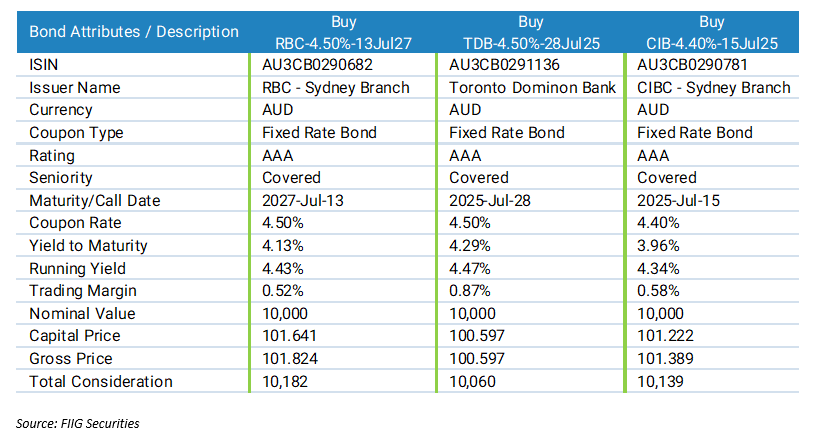

The Canadian banks (Royal Bank of Canada, Toronto Dominion and Canadian Imperial Bank of Commerce) have been recent issuers of these bonds, and those available are shown below:

We would recommend these bonds as core holdings for conservative investors. To find out more regarding portfolio construction please contact your FIIG contact or for further reading please visit our website here to view several articles on the topic.