Capitol Health Limited is calling its 8.25% May 2020 bonds. Judd Bogust from the Perth office explains why the diagnostic imaging provider is calling its bonds, if you should hold until redemption or sell to reinvest now. He’s included several suggestions to reinvest your cash and relative value

ASX Listed Capitol Health Limited is calling its 8.25% Capitol Treasury 10 May 2020 fixed rate bonds. The $50,000,000 senior unsecured notes were originally issued in May 2016 via an offering co managed by FIIG Securities.

The provider of diagnostic imaging, including x-ray, MRI, ultrasound and related services, is exercising its right to redeem all outstanding notes in full on 10 May 2018 at a price of 103% plus accrued, unpaid interest.

Why are they calling my bonds early?

In 2017, Melbourne based Capitol Health sold non core assets for approximately $81.5m allowing them to reduce borrowing cost by exercising the early call on the Capitol Treasury bonds. Investors who purchased the new issue bonds from their FIIG Broker in May 2016 will have earned an annualised return of 9.88%.

Should you hold until redemption on 10 May 2018 or sell and attempt to reinvest now?

There are currently a number of bonds maturing or being called early including; FMG, CML, JEM, and McDermott. These funds will compete for investment opportunity and consume inventory. Our recommendation is to reinvest at the earliest opportunity. If sold today versus holding to redemption, accrued interest would be circa $4.30 less per bond. But, holding until redemption may mean that your top choices for reinvestment are not available.

Why would someone buy my bond with less than one month until the 10 May call date?

Institutional investors with short term investment requirements will often purchase maturing or called bonds paying a slightly higher return versus short term money market investments. We currently have an institutional buyer interested in purchasing your Capitol Health bonds for $103.00 plus accrued interest. Obviously, this offer is time and appetite sensitive.

What do you recommend to replace by Capitol Health Bonds?

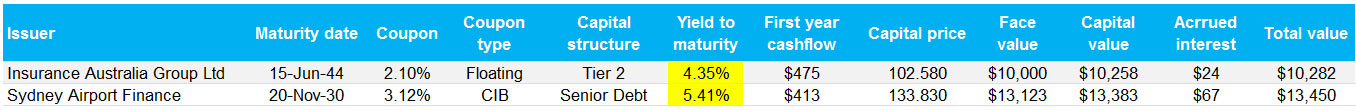

Like for like:

Source: FIIG Securities

Source: FIIG Securities

Figure 1

Investment grade:

Source: FIIG Securities

Source: FIIG Securities

Figure 2

Floating rate notes or inflation linked bonds:

Source: FIIG Securities

Source: FIIG Securities

Figure 3

Relative value chart

Source: FIIG Securities

Source: FIIG Securities

Figure 4

What’s the next step?

If your decision is to hold the bonds and reinvest at maturity, no problem. Let us know your investment parameters and we will keep an eye out for possibilities. If you want to take advantage of current liquidity and avoid the rush give us a call.