Bonds in the big miners offer a way to profit from rising commodity prices without enduring the volatility of shares in the same companies

Commodity prices have rallied over the past few months, as have shares in the miners that extract them. It has been a fantastic ride if you managed to get on board at the low point.

Just to put it into perspective, the price of iron ore recorded in the Mid-Year Economic and Fiscal Outlook just before Christmas at an assumed $US39 a tonne has recently climbed to about $US70.

You would have had to be brave and, just like riding the crest of those big waves in Hawaii, could have suffered a serious crash. So you are justly rewarded for taking the risk. A less risky option would have been to invest in the bonds of resource companies, which are lower risk and less volatile but still potentially very rewarding.

A good example is Fortescue. The company, while large, is concentrated in iron ore, so the price of the single commodity is a very strong trigger for movements in bond and share prices.

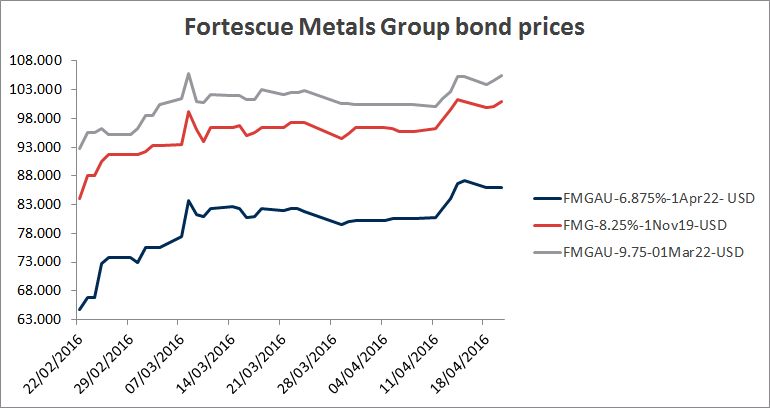

The remarkable jump in Fortescue stock has caught many by surprise, being one of the best performers among big cap stocks on the ASX so far this year. Fortescue has three USD denominated bonds of varying risk and maturity that have shown significant price rises in the past two months.

But the turnaround isn’t all due to higher iron ore prices. Management has worked to reduce the cost of production. Costs for the last quarter were down 6 per cent to $US14.79 per wet metric tonne, which rivals the costs of larger competitors BHP Billiton and Rio Tinto. This has removed doubt as to the sustainability of the company if low prices continue for a long time.

Further, Fortescue has committed to pay down its significant debt and has been buying back all three bonds on market, which has helped push prices higher. The buyback has the added benefit of signalling to bondholders the company’s intention to honour its obligations. Both measures, coupled with rising iron ore prices, have helped to restore confidence, and investors have re-entered the market pushing prices higher again.

Of the three Fortescue USD bonds available, the longer-dated unsecured bond maturing in April 2022 has outperformed, with the price increasing from $64.75 on February 21 to $86 just two months later, a 25 per cent rise.

Prices on the other two bonds also jumped, with the 2019 maturity up 20 per cent and the secured March 2022 bonds — the lowest risk and least volatile because of the defined security — up a 13.7 per cent.

Source: FIIG Securities

Source: FIIG Securities

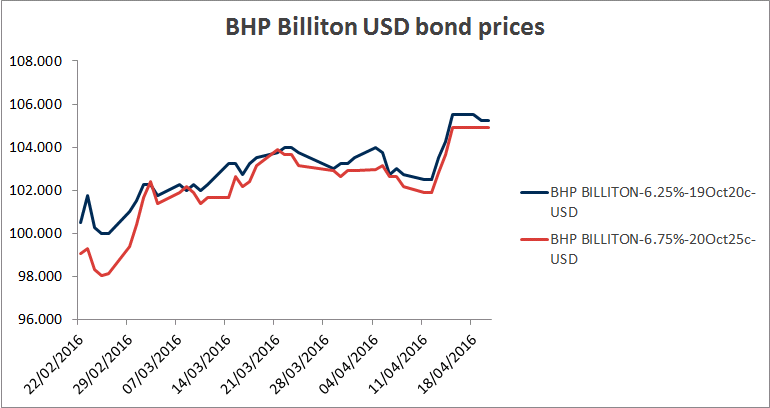

BHP Billiton is a much larger, diversified miner with leading market positions in many commodities. The company is regarded as considerably lower risk, so we would expect less volatility in the price of its bonds.

However, it has had its share of problems this year with the dam disaster in Brazil and a two-notch credit rating downgrade from Moody’s. But strengthening commodity prices have pushed bond prices higher despite the bad news.

The two BHP bonds are subordinated but still rated investment grade, implying low risk. So we haven’t witnessed the same volatility as the Fortescue bonds. Nevertheless, over the same two-month period prices on both bonds have risen. The price of the bond with a call date of October 2020 has increased by 4.7 per cent and the bond with a call date five years later in October 2025 has gone up by 5.9 per cent.

Source: FIIG Securities

Source: FIIG Securities

Volatility creates opportunity, but for those too nervous to invest in the shares, less volatile bonds may be an alternative.