With fears of escalating inflation, surging COVID-19 cases, central bank tapering, and concerns of an equity-market correction (to name a few!), there has been a bit for investors to digest this year. Here we press pause, review current market volatility, moves in the yield curve and the impact for fixed income portfolios.

Volatility – be prepared for it

It’s timely to be reviewing markets into the 34th anniversary of the Black Monday stock market crash. While we are currently seeing inflation move up and longer dated US Treasury bond yields drift higher, they are certainly not at the highs of 1987 at 4.50% and 10%, respectively.

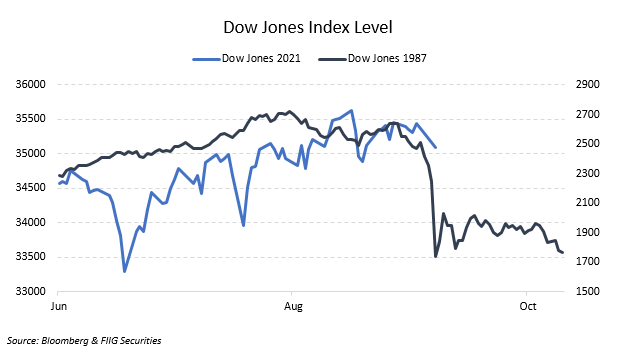

However, similarities could be drawn between the US equity market rally in 1987 compared to the recent rally. The dark blue line in the chart below shows the Dow Jones rise in 1987 (and the subsequent fall), versus the rally in the Dow Jones (the light blue line) over the past year.

While it’s hard to pre-empt if a correction is on the horizon (although many would argue we are due one), or when it might occur, what can be said of the current environment is that portfolios need to be constructed to withstand market volatility.

The VIX Index (often referred to as the ‘fear’ index- and officially known as the Chicago Board Options Exchange Volatility Index), is a measure for market uncertainty, and tracks the expected 30-day volatility of the US stock market.

While last year saw the index at highly elevated levels during the heights of the pandemic, the VIX has more recently begun to move upwards over the month of September. It’s a trend that is expected to continue as we move into the end of the year (and beyond).

While it’s not always ideal for portfolio valuations, volatility creates opportunities in the fixed income space. Generally, in times of volatility, credit spreads widen as investors are paid additional returns for the increase in the perceived risk. As a result, the yield on lower credit quality bonds pushes higher (and in turn their purchase price becomes more attractive). This allows investors to opportunistically add higher yielding bonds at better returns.

Ensuring a portfolio is well diversified is key to mitigating market volatility. Having an allocation to bonds in general is useful to offset negative moves in equity markets, and particularly higher quality bonds which are in demand during times of equity market jitters where investors look to more secure, defensive assets.

Longer dated yields - drifting higher

The recent volatility is a result of clear tapering signs out of the Federal Open Markets Committee’s (FOMC) September meeting. With the US Federal Reserve (The Fed), amongst other central banks such as the Reserve Bank of Australia (RBA), purchasing bonds as part of their Quantitative Easing (QE) programs, US Treasury bond yields (and Australian Government bond yields) have been kept artificially low. The additional demand for bonds, and lack of supply (as there is no additional issuance to balance the new demand), has seen yields tighten.

With talk from the FOMC meeting that the size of bond purchases will taper by USD15bn from mid-November or mid-December this year, markets have readjusted longer term yield expectations. As a result, the US Treasury 10-year bond yield has recently jumped 20 basis points (bp) higher.

Where the US Treasury 10-year yield will go, generally the Australian Government 10-year bond yield will follow. As per the chart below, the recent move higher in the US Treasury 10-year yield (as shown by the dark blue line), has seen the Australian Government 10-year yield drift higher also (indicated by the light blue line). US Treasury moves are the biggest driver of the 10-year Australian Government bond yield (although other factors do also play a part).

Rising yields will typically impact equity markets which have been trading on the premise that yields would stay low for longer. In theory, the value of a share is equal to the present value of its future cash flow (which is priced off its discount rate – typically a 10-year risk-free yield). This is the reason for the recent wobble in equity markets (and increased volatility).

While there are fears the rise in yields is a result of spikes in inflation, as the longer dated bond yields are a proxy for inflation views, we believe these moves higher are in response to ultra-low policy measures normalising. Yes, there have been some stronger inflation reads, more so in the US (which is ahead of Australia in its economic recovery), but mostly inflation domestically is likely to be transitory as COVID-19 related restraints unwind.

As the longer end of the yield curve moves higher, it presents an opportunity to add investment grade longer dated fixed coupon bonds at improved returns. We consider these bonds to be a core portfolio holding and will provide a stable income stream; even better if they can be purchased at elevated returns. While their market valuation will move around with the up and down cycle of longer dated yields, they will experience much less volatility than shares and investors can be confident they will receive their capital back at maturity, irrespective of any capital price movements.

Short- dated yields – mostly anchored

While longer dated bond yields are free to move as they please, shorter dated yields have been anchored by RBA policy measures, such as yield curve control. Along with slashing the official benchmark cash rate to 0.1%, the RBA has also targeted a yield of 0.1% on the three-year bond yield.

With such measures in place, short term yields are stuck at current levels close to zero, offering limited returns. To enhance returns, investors have been required to take advantage of the term premium (the additional return for investing in longer term options) over shorter term investments or have increased exposure to riskier assets.

Along with this, the 3-month Bank Bill Swap Rate (BBSW), is closely aligned to the cash rate. With the cash rate at all-time lows, so too has the 3M BBSW, which at time of writing is at 0.025%.

The 3M BBSW is a benchmark used to reset the coupon each quarter on floating rate notes (FRNs), which pay a margin over this rate. It is forward looking and gives some indication on interest rate moves.

With consistent rhetoric from the RBA that ‘conditions for rate hikes are unlikely to be met until 2024’, BBSW has remained anchored at these low levels. However, with the Reserve Bank of New Zealand (RBNZ) hiking rates last week (one of only three OECD central banks to do this since the pandemic outbreak), markets have begun to price in rate hikes sooner than has been indicated as likely by the RBA.

As a result, markets are now expecting the 3M BBSW to move above 1% in late 2023 (previous expectations were 2025). By early 2025, the expectation has moved to 3mBBSW at 1.50%, as shown by the chart below.

While this move is still from historic lows, it further reinforces the opportunity to add FRNs offered at good spreads. Should we see 3M BBSW continue to adjust higher, FRNs will benefit from the uplift as the coupon each quarter resets at a higher level. This provides an enhanced income stream for fixed income investors.

Conclusion

While markets are more optimistic than last year, there will be ongoing uncertainty as we move into the end of the year and the next. Market participants and investors alike are waiting to see more consistent data points, which currently excite on the headline, but with the underlying data appearing less promising. As central banks unwind ultra-low policy measures, we believe there will be ongoing volatility as markets readjust expectations. As such it has never been more important to build a diversified portfolio, including a meaningful allocation to bonds.