Each year FIIG client portfolios receive a formal Risk Review, in addition to any carried out throughout the year. With the annual portfolio review process coinciding with the new year, it’s timely to discuss the importance of conducting a regular review and the many benefits that come with it.

Background

To ensure a portfolio still meets its investment objectives, it’s important the portfolio construction is regularly reviewed. Over any given period, market conditions change and so too does an individual investors’ circumstances. As such a portfolio needs to adjust to reflect this.

FIIG’s Investment Strategy Team conduct a yearly Portfolio Risk Review for all FIIG clients with portfolios holding above $150,000, inclusive, across a minimum of five bonds. This is in addition to portfolio reviews carried out by the Relationship Manager across the year.

Our Portfolio Risk Review measures key factors that can impact the performance and risk of a portfolio, including the level of concentration, currency risk, sector exposure, credit risk and duration. FIIG is licenced to provide general financial advice only and as such our reviews do not take into consideration individual circumstances or risk profile.

We further discuss the benefits of these portfolio reviews below, such as adjusting for market moves and outlook, improving portfolio returns and managing risk and portfolio volatility.

Aligning with market moves and outlook

The Portfolio Risk Review is conducted at the beginning of each year to ensure it is timely and relevant for the upcoming year. A portfolio constructed the year prior would have faced different market conditions and a changed outlook compared to this year.

There can be missed opportunities, underperformance, and elevated risk if a fixed income portfolio isn’t constructed to reflect the change in macro themes and outlook.

This is evident when we compare the average FIIG client account’s exposure from the beginning of last year to now. Keeping in mind at the start of last year the Reserve Bank of Australia (RBA) hadn’t begun raising rates yet, resulting in investors reaching for yield.

Over the course of last year as yields began to rise, the returns on new investment grade corporate issuance surged higher also. Also noting, with inflation continuing to rise, fuelling speculation of further rate hikes, issuers were quick to shore up debt funding ahead of additional rate hikes. This saw investors spoilt for choice.

As a result, the average portfolio allocation across FIIG has a higher exposure to investment grade bonds, and a lower concentration to any single bond, as multiple bond purchases were made. Where the median wholesale exposure to sub-investment grade bonds was 53% in 2022, this has now dropped to 36%, where investors can achieve attractive returns through investment grade bonds.

The Portfolio Risk Reviews FIIG provide also include a measure of the portfolio’s duration. Duration is dependent on the portfolio’s maturity profile and refers to the sensitivity of the price in relation to a change in interest rates.

Longer dated bonds are more sensitive to interest rate movements, and hence carry more duration risk, compared to floating rate notes of the same tenor and shorter dated bonds. As such, diversification remains important and including shorter dated fixed coupon bonds and floating rate notes mitigates an unexpected rise in interest rates.

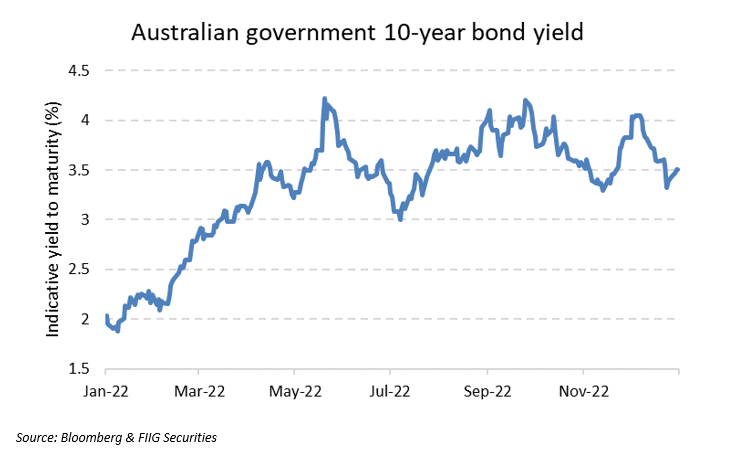

The 10-year Australian Commonwealth Government Bond (ACGB) yield has roughly doubled following the RBA began increasing rates last year and has since moved around in a rough up-and-down cycle over the past year on rate views, as the chart below shows.

While periods of higher yields create opportunities to add longer dated fixed investment grade bonds at more attractive entry points (remembering a change in interest rates and bond prices move in opposite directions), it’s important to review portfolios and identify overweight positions where valuations will be impacted.

Improving returns

Through reviewing portfolio construction, the overall return can be improved by adjusting individual positions and identifying opportunities.

In a ‘risk-on’ market, such as the steady economic recovery currently taking place, it’s worth considering the portfolio’s allocation to high yield bonds. Investment grade bonds are a core part of a portfolio, but where overweight, this will impact the portfolio’s ability to generate better returns.

Likewise, where allocations have rallied in price and yields have tightened, a portfolio review will identify opportunities to exit exposures and ‘lock-in’ capital gains, while finding suitable alternatives to switch into.

Actively managing bonds nearing maturity and call dates is another way to improve a portfolio’s returns. Where a bond is trading above its redemption price, noteholders can sell ahead of schedule and take profits.

Locking in the premium above par and exiting ahead of the maturity or call date will see an investor achieve a higher overall return than if they were to hold until the redemption date. Where the bond is trading above $100 (and if the redemption price is $100), then the investor isn’t rewarded for holding the bond for the additional time period.

Managing risk

A regular portfolio review is a useful tool for identifying the level of risk (and type of risk) in a portfolio and adjusting the construct accordingly.

Currency risk is one such risk, but it only impacts portfolios with a foreign exchange exposure. FIIG clients have access to bonds denominated in Euros, Pounds and US dollars, which can carry exchange rate risk.

A portfolio review can help identify where there is too large an exposure to foreign denominated bonds and hence carry a larger currency risk.

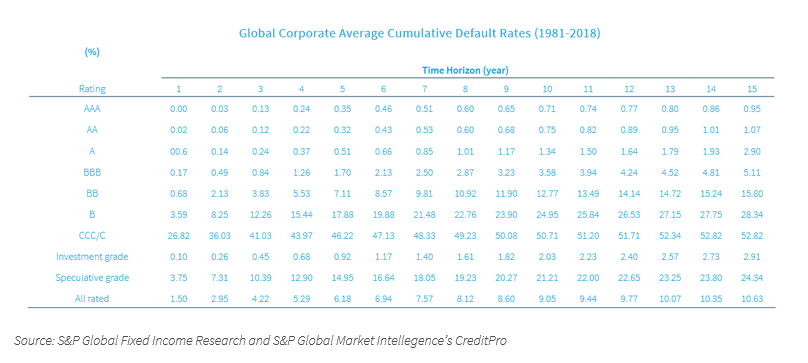

Another key risk is credit risk, which refers to the risk of default through the borrower failing to make coupon and capital repayments. One of the ways to assess credit risk is using a credit rating assigned by a rating agency (Moody’s/S&P/Fitch).

As the chart above shows, the historical probability of default decreases the higher the credit quality and the shorter the duration. For example, a AAA rated bond maturing in four years has a historical 0.24% rate of default compared to a B rated bond maturing in 10 years with a 24.95% incidence.

Unrated and sub-investment grade bonds are crucial in a portfolio to help achieve a higher level of income. It is the size of the exposure that is important, and a review of the portfolio’s mix of investment grade and sub-investment grade bonds can help ascertain the level of credit risk.

Sector exposures are another layer in determining the level of risk inherent in a portfolio. Sectors range from financials, infrastructure, consumer discretionary and resources to government, real estate and utilities, to name a few.

Within the segment, certain sectors are inherently riskier than others, and withstand economic cycles differently. Utilities and infrastructure are considered non-cyclical and more defensive sectors, whereas real estate and consumer discretionary are typically less resilient in downturns.

Conclusion

It’s beneficial to have a regular fixed income portfolio review, ensuring the portfolio is still fit-for-purpose. FIIG’s Investment Strategy Team conducts an annual review of client portfolios, in addition to portfolio reviews carried out throughout the year. This assists clients to better understand the construction of their portfolios to make more insightful investment decisions.