There are many ways investors can generate an income from their investment portfolio.

In Australia, for various reasons, equities (and other listed instruments, particularly hybrids) have long been the dominant source of investment income. The demand for franked dividends has made this an inevitability, even at the expense of proper capital allocation. Many large companies, particularly the banks for example, have paid out approximately 80% of their earnings as dividends, rather than investing in their own systems – which has resulted in regulatory failures costing them billions in fines.

However, equities, notwithstanding the issue around volatility of capital price, have a major drawback in terms of actual payment, despite the absolute level of income they provide. The vast majority of listed companies pay their dividends in two lots per year, usually sometime around March and September, depending on their various year ends.

This means investors receive large lump sums twice a year, whereas expenses by definition occur regularly throughout the year. If we assume that income is desired by investors as it is needed to fund lifestyle, then this becomes a complicated exercise in managing cashflow, on top of managing the underlying investments.

Bonds, as part of a well-diversified portfolio, typically provide much more regular income, lessening this burden on investors.

Whilst individual bonds pay less frequently – fixed coupon bonds typically pay every six months and floating rate and inflation linked bonds every quarter – a portfolio of bonds either naturally ends up paying a more regular income stream or can indeed be designed specifically to do so.

Sample portfolio income streams

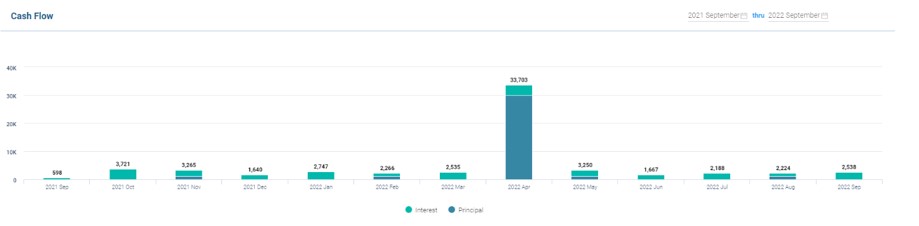

We can look at our sample portfolios (found here) for examples of how this works.

These portfolios have not been constructed with regularity of income as one of the key goals, as they are based on capturing the best value for the respective risk levels.

However, we can see that they offer the following income profiles:

Conservative:

Source: FIIG Securities

Balanced:

Source: FIIG Securities

High Yield:

Source: FIIG Securities

Therefore it is clear that, even though these portfolios have had no regard to the frequency of income payments, they still deliver a healthy monthly income. This allows investors the comfort of knowing there will be cash coming in every month, making budgeting easier.

Contrast this with the fluctuations possible in dividends, which are paid at the discretion of the company, and you see another important part of the story (using the major banks as examples):

Source: Bloomberg and FIIG Securities

Dividends are paid at the discretion of the company. In this case, when the COVID-19 crisis hit (the highlighted area above) and it was realised how serious it was, the regulator effectively forced the banks to withhold all or the majority of their dividends to preserve capital. WBC even cut their dividend completely.

This was at a time when employment was also being restricted, and as such income from investments became even more important, and dividends were reduced with no warning.

Of course, this was regulatory driven, and most companies are not regulated, but at the time all were facing a similar economic environment and generally opted to preserve capital rather than pay out.

Conclusion

Bond portfolios offer the security of an obligation to pay coupons on the part of the issuer, and also the high likelihood of a regular income stream even when this is not necessarily selected for – i.e. value does not have to be sacrificed to ensure regular income.

Therefore, for income seeking investors bond portfolios are a superior solution compared to equities, as well as paying a far higher risk-adjusted return than bank deposits (the other traditional income investment).