BHP has provided its half-year operational review and reaffirmed its commitment to protecting its balance sheet. Bond prices have declined in recent weeks following the commodity price weakness and the current yield looks attractive given the credit quality of the issuer and its commitment to protecting the balance sheet

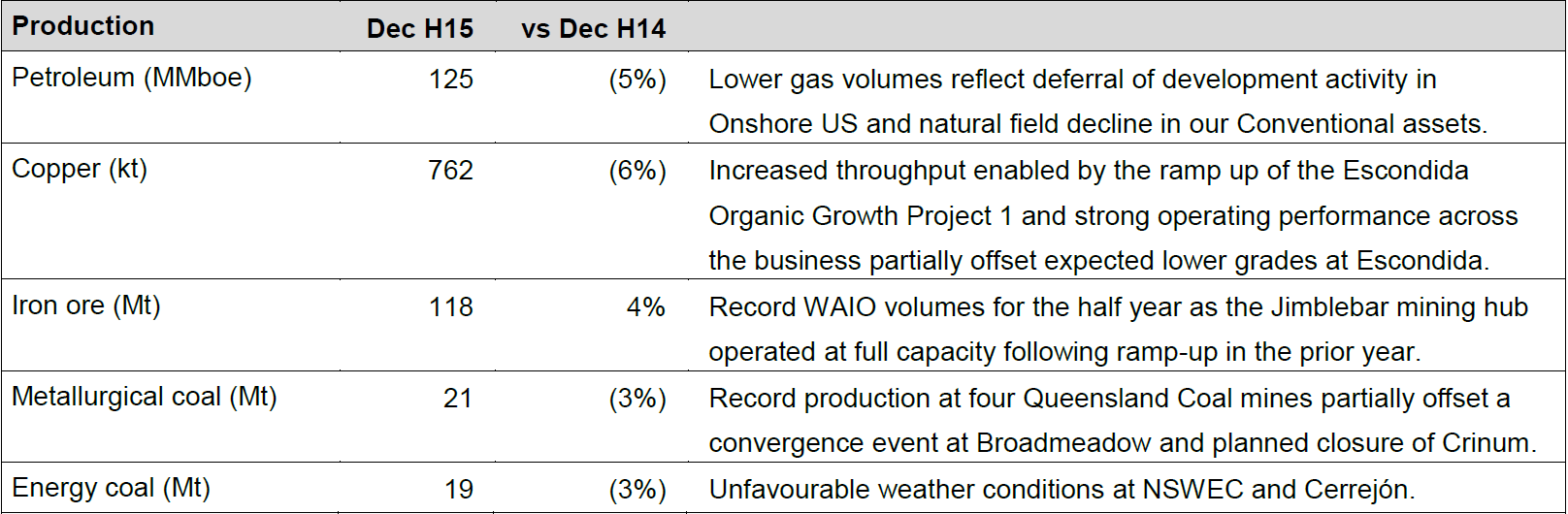

BHP Billiton has released its half yearly operational review. While production volumes were generally down on the prior corresponding half year period, full year production guidance has been maintained for petroleum, copper and coal. The table below summarises the company’s production levels by commodity for 1H16:

Source: BHP

Source: BHP

BHP also provided a recap and update on key events occurring in recent months:

On 5 November 2015, the Samarco iron ore operation in Brazil experienced a breach of its tailings dam and water dam. Samarco is continuing to work on quantifying the estimated costs related to the tragedy and, therefore, it is too early to provide an estimate of the financial impact on BHP On the 15 January 2016, BHP announced a non-cash writedown of US$4.9bn post tax against the carrying value of its onshore US shale oil assets. This is reflective of the significant falls in oil prices which have more than offset productivity improvements In the wake of continued commodity price weakness, as well as the uncertainty caused by the Samarco mine dam disaster, the prices on the BHP subordinated bonds have been relatively volatile and are currently trading at levels below par. We believe current bond price levels look attractive given the ‘A-rated’ credit quality of the issuer, as well the company’s commitment to protecting the strength of its balance sheet. The company is expected to either significantly reduce or suspend dividends at the forthcoming half yearly results announcement in February which would be positive for bondholders. The bonds are currently indicatively offered at the following levels (price and yield to call):

| Bond | Price | Yield to call |

| US dollar non-call 5 year | $94.75 | 7.59% |

| US dollar non-call 10 year | $93.80 | 7.66% |

| GBP non-call 7 year | $96.00 | 7.26% |

| Euro non-call 9 year | $93.50 | 6.62% |

Source: FIIG Securities. Prices and yields are indicative and subject to change.

The yield on the US dollar non-call 5 is currently yielding at around the non-call 10 year level and looks particularly attractive. Please note that the yield comparison is provided on a ‘yield to call’ basis on the expectation that the bonds will be called at the first call date.

While further price weakness is possible given the ongoing weakness in commodity markets, we expect prices on the BHP subordinated bonds will recover over time given the strong credit quality of the issuer. It is highly likely that BHP will need to either significantly reduce or suspend its dividend at the forthcoming half year result announcement in February which would be credit positive.

Please contact your FIIG representative for further information on the BHP subordinated bonds. Available to wholesale investors only.