The CPI release yesterday was more or less at expectations

It was the lowest annual reading since 1999 at 1.0%pa, or if you strip out globally influenced food and petrol prices, the lowest since 2009 at 1.5%pa. Either way it is a long way below the RBA’s target range of 2 to 3%pa.

The RBA sets interest rates to maximise employment while keeping inflation within the target band. They don’t like low inflation as it hurts businesses that have typically made decisions assuming they can put up prices each year. Businesses like predictable inflation, and the RBA likes businesses to make investment decisions as that means jobs growth.

So when inflation persistently comes in below the target range, as it has recently, the RBA will have a greater “easing bias”; that is, rates are more likely to fall than would be the case if inflation was in the target range.

It is not however current inflation that drives their decisions; it is expected inflation. So the more accurate predictor of future interest rate movements is the trend implied by the current CPI data; that trend is downwards. In fact, inflation has become so weak across so many sectors of the economy, that cigarette price inflation is now responsible for 30% of total CPI for the past 12 months.

This extraordinary result is despite the fact that tobacco makes up a relatively small part of the “basket” of goods and services that are used to calculate overall CPI at around 2.3% weighting. Cigarette prices are up 53% in 4 years, so even at this low weighting in the basket, the contribution to overall CPI is still 0.30%, or 30% of the past 12 months’ increase.

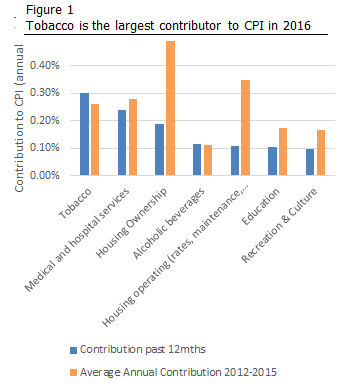

Almost all sectors have experienced falling inflation in recent years. Figure 1 shows the contribution of the major drivers of CPI over the past year (in blue) and the 2012 to 2015 three year period on average (in orange). Key points from this chart and the CPI data release are:

Almost all sectors have experienced falling inflation in recent years. Figure 1 shows the contribution of the major drivers of CPI over the past year (in blue) and the 2012 to 2015 three year period on average (in orange). Key points from this chart and the CPI data release are:

- Cigarettes contributed more to inflation overall than any of the major categories, despite its tiny (2.3%) weight in the basket

- Excise driven CPI in the Alcohol and Tobacco (4.8% of the basket) category made a bigger difference to overall CPI than medical and education services combined (8.5% of the basket), and were the only categories to show an increase in 2015/16

- Housing ownership, while still a major contributor to overall CPI due to its 15% weight, saw a dramatic fall in inflation from 3.36%pa to just 1.22%

- Housing maintenance, driven by utilities, had an even more dramatic fall from 5.02%pa to 1.56%, particularly driven by falling electricity prices. The combined “housing” category is therefore down by 67% in 2015/16 compared to the previous three years.

- Medical services are now the second largest contributor, but also seeing slowing inflation (from 5.25%pa to 4.50% in the past 12 months)

- Education is also slower, largely driven by lower university price increases

- Insurance costs have soared in the past year, up 6.3% compared to 2.7%pa

- Food costs were down dramatically too, falling from a 0.27%pa contribution to a -0.01%pa contribution, with only meat (particularly beef) increasing meaningfully.

- Recreation and culture made a much lower contribution to overall CPI, with the entire increase in prices in the past year explained by higher international travel costs (in turn driven by the lower AUD)

The only other major sectors to see a growing impact on total CPI were tobacco and beer (excise driven), insurance, childcare and meat.

Conclusion

The RBA is looking for sustainable inflation across the economy to give businesses the confidence to invest and thereby create jobs. Excise driven inflation does not provide such a stimulus. Other than tobacco, beer and a very limited range of sectors, all major categories are showing steeply declining inflation.

While the market accepted the low inflation figure yesterday as “meeting expectations”, once again it is important to look beneath the headlines and what is really going on. Both the demand for labour and inflation are weak, which will lead to a stronger easing bias than the market anticipates.

That said, there is an even chance that the RBA will leave rates on hold next week. The sluggishness facing the domestic economy will not respond to a quick fix. The RBA has a limited number of cuts it can make and so it will not want to waste them. With the Fed increasingly likely to raise rates in September, and a likely fall in the AUD:USD rate as markets start to price in that increase, the RBA could choose to wait until later in the year to see if the AUD falls and creates the stimulus needed without them needing to cut.

As always, we counsel that whether the RBA cuts this month or later in the year, the long term investor should not care much. Combined with a far more positive outlook given in the US Federal Reserve’s comments last night, the weakness in Australian inflation and labour demand means a weaker longer term outlook for the Australian dollar relative to the US dollar in my view. Let the institutional traders worry about which month they cut; for the rest of us the implications are:

- Lower long term yields in Australian bond markets and lower cash rates

- Weaker outlook for AUD:USD exchange rate