Significant free cashflow generation has funded Dicker Data’s (DDR) CAPEX and reduced debt, leading to improved interest coverage and reduced leverage

Overall the results were solid. In our opinion, DDR’s bonds appear to be trading relatively tight compared to other similar bonds, however we do note that the DDR’s current cashflow generation may lead to further deleverage.

Revenue for 1H16 was $590.3m (1H15: $531.5m). 13 new vendors contributed an increase of $24.4m to revenues, while existing vendor revenue grew 6.7% on a year on year basis

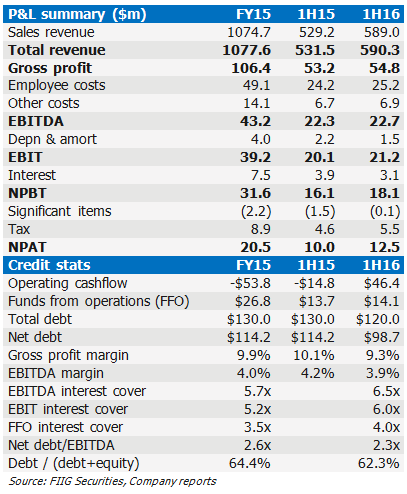

Revenue for 1H16 was $590.3m (1H15: $531.5m). 13 new vendors contributed an increase of $24.4m to revenues, while existing vendor revenue grew 6.7% on a year on year basis- EBITDA rose 2% to $22.7m as margins normalised

- Gross profit margin reduced to 9.3% from 10.1% in the corresponding period. This was expected as the unusually high margins achieved in FY15 reverted to more historical levels

- Integration and restructuring costs after the acquisition of Express Data in 2014 are now complete

- A decreased investment in working capital driven by an increase in accounts payable days as well as improved inventory days on hand has benefited cashflow. Further the slowing growth rate also benefited operating cashflow. Generally there is a negative working capital impact particularly for fast growing high turnover, low margin businesses

- Cashflow from operations was positive $46.42m, compared to negative $14.79m in 1H15

- Free cashflow was utilised to purchase an $18.4m adjoining property (for expansion), reduce current borrowings by $10m, pay net dividends of $11m and retain $5.5m in cash. Cash on balance sheet therefore increased to $21.3m (FY15: $15.8m)

- Financing costs fell by $0.8m, reflecting the falling interest rate environment and the company’s reduction in average debt requirements

- As a result, credit metrics have improved with LTM EBITDA interest expense improving to 6.5x (FY15: 5.7x) and leverage reducing to 2.3x (FY15: 2.6x)

- Dicker Data expects to achieve its previous guidance of $35.0m in pre-tax operating profit for FY2016. The below chart details its run rate vs projections and the prior year.

Dicker Data has a history of accurately forecasting its performance. This is a function of its large, entrenched market position, the relative stability of its margins and the understanding of its clients’ volume requirements.

Relative value

The following chart details the trading margins of various high yield general corporates.

In our opinion, DDR’s floating rate note appears to be trading relatively tight compared to other similar bonds. However we do note that the current cashflow generation may lead to further deleverage.

Dicker Data’s 26 March 2020 floating rate note is indicatively available at a yield to worst* of 5.73% and is available to wholesale and retail investors.

The group’s full results can be found here.

*In this instance, the yield to worst represents the yield to maturity.