CML posted solid results and reaffirmed FY17 EBITDA guidance of greater than $10.6m (100% increase from FY16). Credit metrics are likely to improve as the company benefits from a full year’s contribution and synergies from acquisitions. Furthermore, the negative carry from fully drawn but unutilised debt will also abate and support profitability

In our opinion, given the possibility of an early call at a premium to current trading levels, CML’s bonds appear attractive. However there is no certainty of this and investors should also consider the yield to worst.

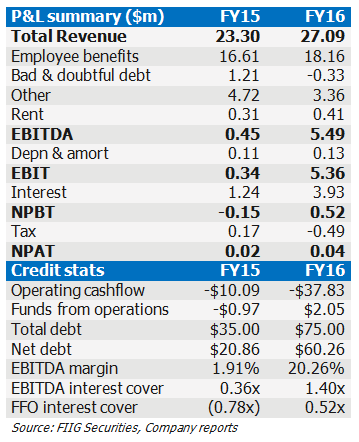

Revenue increased 16% to $27.1m and EBITDA increased to $5.5m from $0.45m; beating our forecast of $5.0m

Revenue increased 16% to $27.1m and EBITDA increased to $5.5m from $0.45m; beating our forecast of $5.0m - The loan book grew from $21.5m in FY15 to $69.9m. While the majority of the growth is attributed to acquisition, organic growth of 63% contributed ~$14.5m to the expansion of the Loan Book. This was the result of various sales and marketing activities. Most significantly, CML built an experienced sales team of 12 with a strong network of referral partners

- There were no one off costs associated with bad debts during FY16, reflecting sound risk management

- CML’s client attrition declined in FY16 and average client tenure continues to lengthen

- The group reconfirmed its FY17 EBITDA Guidance of $10.6m+

- Bondholders are primarily protected by the structural features of the transaction. EBITDA Interest coverage was 1.40x. Credit metrics are likely to improve as the company benefits from a full year’s contribution and synergies from acquisitions. The negative carry from fully drawn but unutilised debt will also abate

- CML also has an improving credit position given the increased size and diversity of the loan book: at first bond issue CML had a $20m loan book with maximum client exposure of $1.5m. It now has a $70m book with a maximum client exposure of $2m

- The business has limited fixed assets and will continue to benefit from economies of scale as the receivables book grown

- CML stated that it will over time seek to “transition from its current funding arrangements to institutional bank funding”. Given its improved size and market position, we believe that CML may be able to get cheaper bank funding compared to its bonds

Relative value

The following chart details the trading margins on a yield to worst basis of peer high yield finance companies.

CML has stated its long-term intention to refinance its bonds in order to lower its costs of funding, however the exact timing is uncertain. Furthermore, bank financing would also be attractive given the bond’s terms restrict dividend payments greater than 50% of NPAT. We also note that CML has structured its bonds with coinciding call dates suggesting consideration of the potential for early redemption.

CML can call its issues at first opportunity in May 2018 at 104%. Alternatively, given the above we believe it may seek to refinance earlier.

In our opinion, given the strong possibility of an early call at a premium to the current trading price, CML bonds appear attractive. The fixed rate note for example would yield 6.75% to the first call date in May 2018. However there is no certainty of this and therefore the above chart and the below pricing are on a yield to worst basis.

The notes are indicatively available at a yield to worst*:

- 2021 fixed rate bond: 6.75% (wholesale only)

- 2020 floating rate bond: 6.13% (wholesale and retail)

*In this instance, the yield to worst represents the yield to maturity.

Note: Prices accurate as of 26 August 2016 but subject to change.

CML’s full results can be found here.