FY16 was challenging for PMP with higher than normal levels of retail customer disruption and continued strong competitive pricing levels

However, solid free cashflow has led to a near net debt free position. Yet PMP has a stated intention to continue industry consolidation and credit metrics may deteriorate as cash is used to fund a purchase. PMP’s 17 September 2019 bond therefore appears to offer fair value

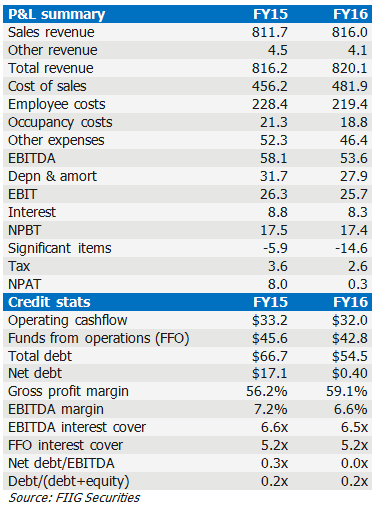

Total revenue improved 0.48% to $820.1m

Total revenue improved 0.48% to $820.1m- EBITDA reduced by 7.66% to $53.6m which was slightly under full year guidance, due to lower than expected volumes from key heat set print customers and higher than anticipated operational costs at Griffin Press due to continued increase in demand for short run on demand printing

- Significant items in FY16 were $14.6m (pre tax). This included $8.4m of redundancy and restructuring costs, $2.3m of costs relating to capital amendment and a $3.9m bad debt charge for Dick Smith

- NPAT reduced from $8.0m to $0.3m mainly due to the higher significant items

- The group is nearly net debt free. Net debt reduced from $17.1m in FY15 to $0.4m FY16. Leverage (Net debt/EBITDA) reduced from 0.3x to 0.007x

- EBITDA interest cover remain solid at 6.5x

- Free cashflow improved 5.7% to $37.5m as better working capital outcomes, lower interest expense and reduced CAPEX offset lower EBITDA

- Capital expenditure of $4.2m was slightly down given the useful life of its heatset press fleet and should remain low for the foreseeable future

- PMP continued industry consolidation with the Gordon & Gotch/Bauer Media contract. PMP states it will continue to look for further opportunities in existing markets for further consolidation or cost reduction

- The company will provide a trading update for FY17 at the Annual General Meeting in November 2016

Relative value

The following chart details the trading margins of various high yield general corporates.

The group is fundamentally net debt free and producing strong free cashflow. However PMP has a stated intention to continue industry consolidation and credit metrics may deteriorate as cash is used to fund a purchase. PMP therefore appears to offer fair value.

PMP’s 17 September 2019 fixed rate note is indicatively available at a yield to worst* of 6.00% and is available to wholesale investors.

PMP’s full investor announcements can be found here.

*In this instance, the yield to worst represents the yield to maturity.