The second half of the calendar year gave our investors 19 different new issues to participate in, amongst many others which we deemed unattractive, generally either due to excessive risk, too low yields, such as from government or very highly rated issuers, or issues where the minimum parcel size precluded us from offering them in small parcels, such as offshore bank offerings subject to a minimum $500,000 parcel due to banking legislation.

Participation in USD primary issuance is inherently a lot more challenging because it is common for transactions to be announced and priced within a 24 to 48-hour window (and commonly within the same trading day).

Of these 19 issues, we split them into FIIG High Yield AUD, Market Investment Grade and Market High Yield segments, and look at the performance of each of these segments separately given their differing characteristics.

FIIG AUD High Yield

FIIG originated 6 transactions in the second half of 2019, totalling $247m of face value:

| WorkPacTrust-BBSY+5.20%-19Jul22 | ElanorWildLife-7.20%-29Nov24 |

| WA Stockwell-7.00%-26Aug26 | VisionFund-5.00%-21Nov24 |

| Sunland-6.20%-31Oct24 | IMF Bentham-5.65%-08Jan26 |

The Workpac, VisionFund and Elanor WildLife Park Fund bonds were first time issuers, although the Elanor name will be familiar to many clients, with the parent company having issued a bond in late 2017.

WA Stockwell, Sunland and IMF Bentham are well known existing issuers who successfully refinanced their outstanding bonds with the issue of new bonds.

As the chart shows, all bonds have slightly increased in price1 since issue, and in addition to the strong coupon income on offer, the bonds have in the short time since issue produced excellent risk-adjusted returns.

Market AUD Investment Grade

We participated in 11 Investment Grade (IG) AUD issuances in the second half of 2019

Most offered a decent new issue concession – an enticement to buy the new bond over existing bonds already in the market – in the form of coupons that we thought were higher than the credits actually deserved.

In particular we thought the Pacific National 2029 bond looked very cheap, and so it proved, with the bond rallying almost $3 immediately after issue and maintaining the price despite rising rates in the last quarter.

The big outlier in the group was the Dexus 2029 bond issued on the 17th of October. We thought it represented fair value at issue, but pricing of the bond happened to coincide with the low in AUD 10 year rates, which between pricing and settlement rose by approximately 0.20%. As a result it has traded below par since issue, and at current levels it looks like good value compared to the rest of the cohort.

Latterly towards Christmas the effect of base interest rates can be seen with all bonds reacting in a similar fashion, as credit spreads remained relatively stable through this period.

Four investment grade floating rate notes (FRNs) were issued in the half, and the more muted reactions to rate movements versus fixed rate bonds which carry a much higher duration (price sensitivity to yield movements) can be seen, with the upper range of price being capped around 101.5 compared to 104 for the fixed rate cohort.

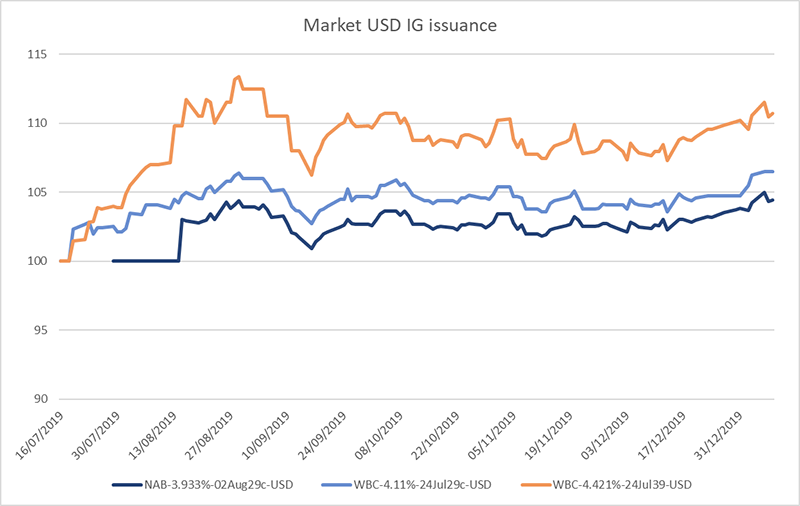

Market USD Investment Grade

Australian banks were large issuers in the USD market in 2019, particularly in response to the APRA (Australian Prudential Regulatory Authority) determination that they increase their regulatory capital in the Tier 2 banding, raising significant capital in very oversubscribed deals.

The huge demand for these deals can be seen in the price performance, with yields declining under heavy demand. A further notable impact of the large depth of the US market compared to our own was the ability to issue long dated bonds, evidenced by the Westpac 20 year bullet (i.e. with no calls) with a 2039 maturity.

Given the high duration of this bond, it also performed the strongest, showing a price increase of over $10 by the end of December.

Market High Yield

The high yield market showed its usual idiosyncrasies in terms of the new issuance, as it does in the price performance of individual bonds, reacting far more to the performance of individual issuers rather than broader market conditions.

The FMG 2027 bond has a loose correlation to iron ore prices, but with the much higher than expected levels seen through 2019, the talk around this credit is around its journey to an investment grade rating (long though it might be) rather than around its creditworthiness.

Virgin showed what can happen when you surprise the market, unexpectedly upsizing its 8% ASX-listed simple corporate bond from $150m to $325m, with the extra supply stretching investor appetite, driving down prices on the existing lines including the recently issued 8.125% 2024 USD bond shown above. As this extra supply is digested, we think the price should recover.

David Jones and Seek showed that high yield FRNs still reflect the floating nature of their coupons, as while the Seek bond was hugely oversubscribed, the price is still under 101 despite them being hard to source in the market presently. Had they issued a fixed coupon bond we may well have seen the price driven higher than current levels.

Conclusion

With low interest rates likely to persist for an extended period, we expect further high levels of issuance to come to market.

Market Investment Grade issuance in particular closes at short notice, especially if the deal is oversubscribed, and so clients need to be ready to move quickly on bonds that appeal.

Taking advantage of new issuance and their favourable pricing concessions is likely to be one of the main ways to generate good performance in 2020 given the low outright level of interest rates.

Investing in bonds at primary issuance has been a rapidly growing part of our client offering through 2019 and we would encourage interested prospective clients to ensure they have accounts open and are ready to invest given the large demand and short timeframes available to participate.